- Canada

- /

- Transportation

- /

- TSX:CNR

Will CN Rail’s 30 Years on TSX Reveal New Clues About Its Resilience and Future Potential? (TSX:CNR)

Reviewed by Sasha Jovanovic

- Canadian National Railway recently marked its 30th anniversary of being listed on the Toronto Stock Exchange, celebrating three decades at the forefront of North America's rail industry.

- This milestone highlights CN's ongoing role in powering the economy by safely moving over 300 million tons of goods annually across the continent.

- Given the company's long-term market presence, we'll explore how this anniversary might influence perceptions of Canadian National Railway's resilience and future potential.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Canadian National Railway Investment Narrative Recap

For many shareholders, the core thesis behind Canadian National Railway rests on its ability to generate sustained, long-term value from its extensive rail network, cost discipline, and pricing power, even amid economic uncertainty. While the recent 30th listing anniversary underscores a legacy of resilience, it does not materially change the short-term catalysts or the principal risk: persistent macro and trade uncertainty remain central challenges for CN’s revenue growth, especially with muted industrial demand weighing on volumes.

One recent announcement that stands out is the affirmation of CN’s fourth-quarter dividend at CA$0.8875 per share, reinforcing its commitment to shareholder returns. This steady capital distribution aligns with CN’s emphasis on operational stability, even as broader volume pressures and supply chain shifts continue to shape short-term results.

Yet, despite CN’s history of reliability, investors should also weigh how currency and fuel volatility could ...

Read the full narrative on Canadian National Railway (it's free!)

Canadian National Railway's outlook anticipates CA$19.6 billion in revenue and CA$5.6 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 4.6% and a CA$1.0 billion earnings increase from current earnings of CA$4.6 billion.

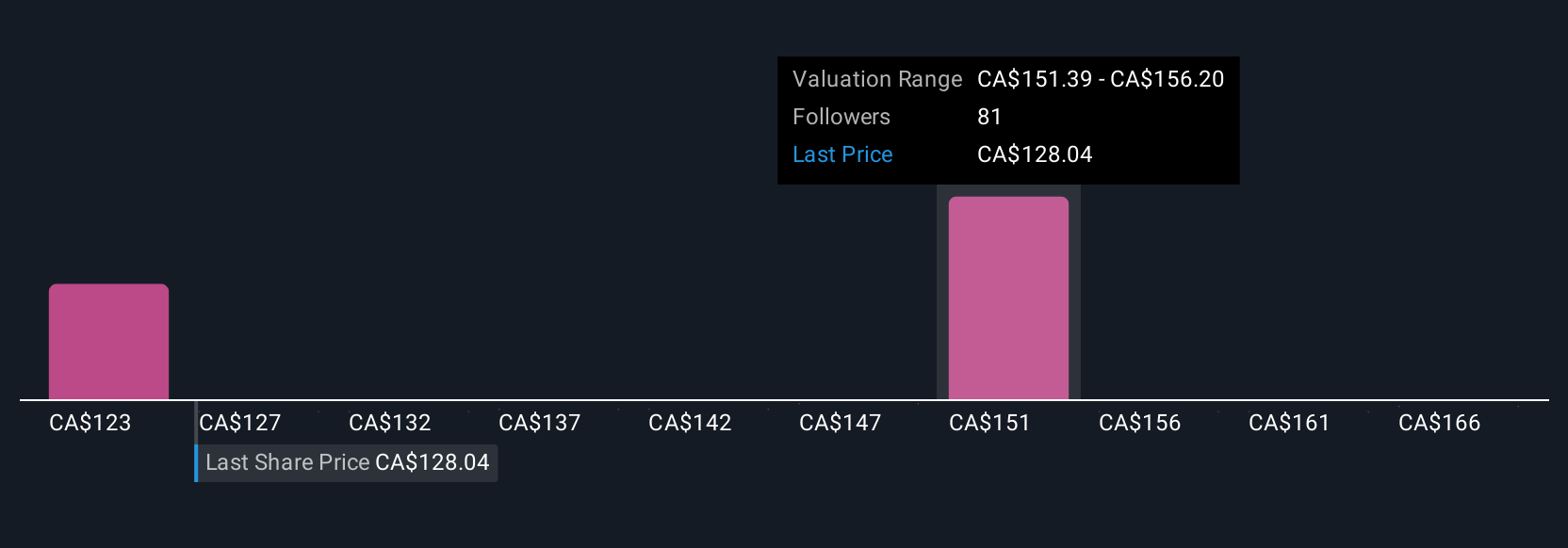

Uncover how Canadian National Railway's forecasts yield a CA$150.57 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members published 14 fair value estimates for CN stock, ranging from CA$116.67 to CA$156.78. Many highlight flat volume growth as a concern, prompting varied outlooks on future earnings potential.

Explore 14 other fair value estimates on Canadian National Railway - why the stock might be worth as much as 21% more than the current price!

Build Your Own Canadian National Railway Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Canadian National Railway research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Canadian National Railway research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Canadian National Railway's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CNR

Canadian National Railway

Engages in the rail, intermodal, trucking, and related transportation businesses in Canada and the United States.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives