- Canada

- /

- Transportation

- /

- TSX:CNR

Does CNR’s Recent 2.4% Rebound Signal Fair Value Amid Industry Uncertainty?

Reviewed by Bailey Pemberton

- Wondering if Canadian National Railway shares are trading at a bargain, or if they are expensive for what you get? Let's dig into where things stand right now.

- In the last week, the stock is up 2.4%, but after a soft performance this year it is still down 8.8% year-to-date and 10.7% over the past year.

- Recent headlines highlight Canada's rail sector navigating industry-wide challenges, especially related to supply chain disruptions and shifting commodity prices. These factors have spurred both cautious optimism and some unease among investors, reflected in the stock’s recent ups and downs.

- Right now, Canadian National Railway scores 3 out of 6 on our valuation checks, signaling some areas of potential value. We are about to break down the numbers from several different angles, saving the most revealing perspective for last.

Approach 1: Canadian National Railway Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today’s dollars. For Canadian National Railway, this approach helps investors gauge whether the stock’s current price reflects its financial fundamentals.

Canadian National Railway’s latest reported Free Cash Flow stands at CA$3.43 billion. Analysts forecast steady cash flow growth and project CA$4.45 billion in annual free cash flow by 2029. While analyst forecasts only extend to the next five years, long-term numbers beyond this are extrapolated from industry trends by Simply Wall St, which offers a fuller picture of cash generation potential.

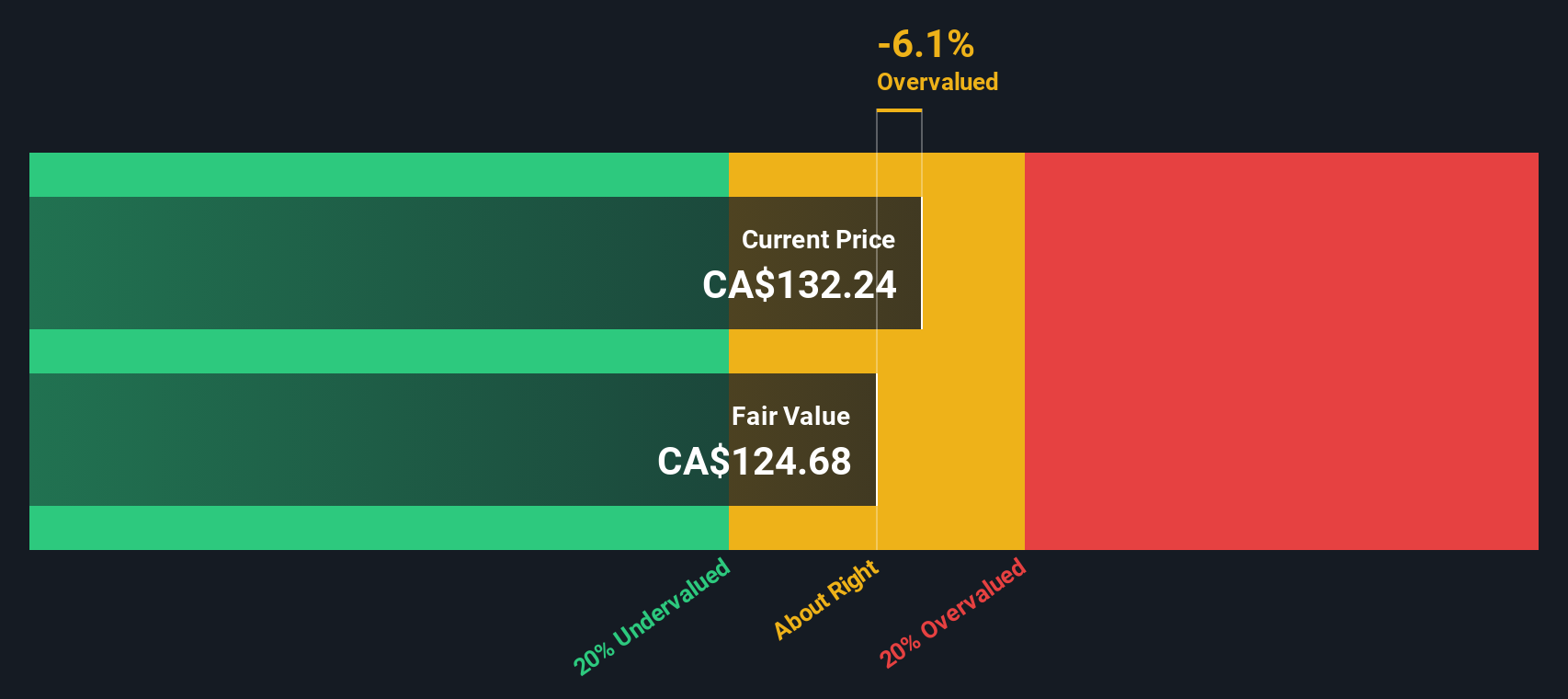

Based on the DCF methodology, the estimated intrinsic value for the company is CA$133.18 per share. This is just 0.5% above the current trading price, signaling that the stock is slightly overvalued but very close to fair value.

Result: ABOUT RIGHT

Canadian National Railway is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Canadian National Railway Price vs Earnings

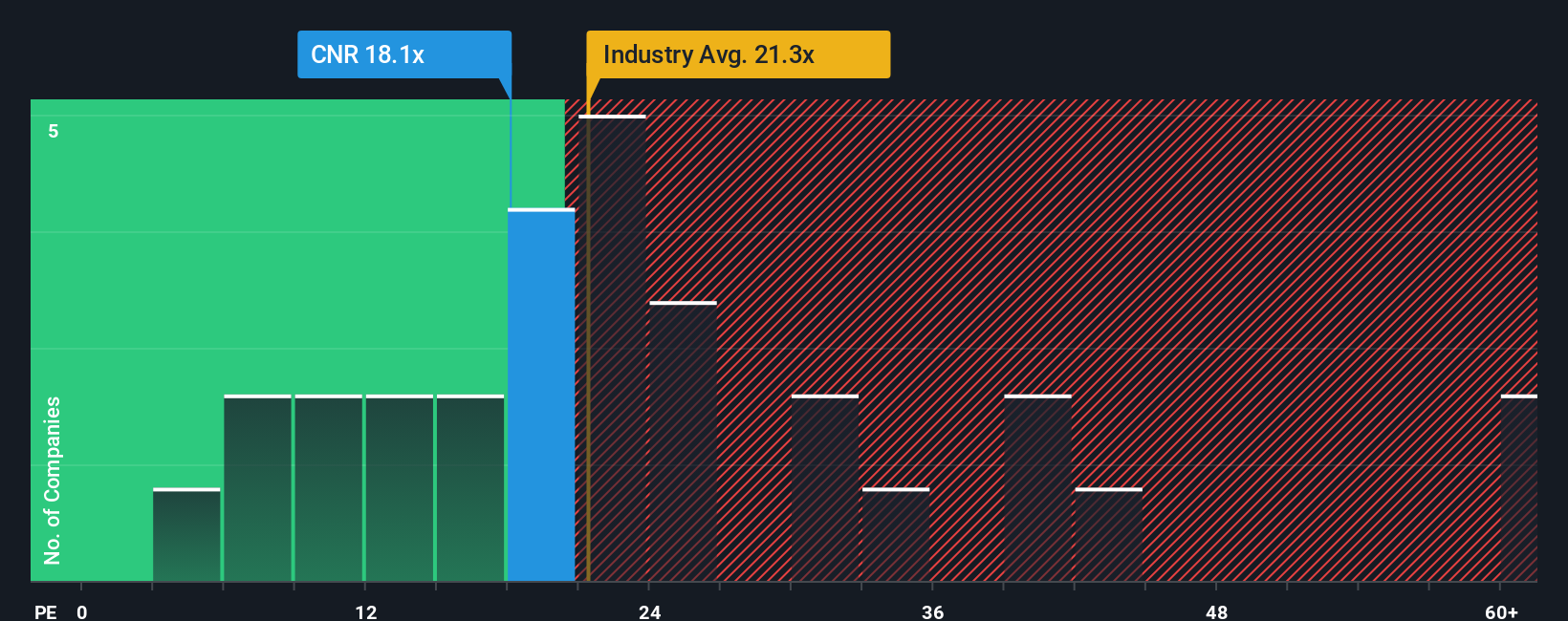

The Price-to-Earnings (PE) ratio is a preferred yardstick for valuing profitable, established companies like Canadian National Railway. This multiple provides a quick sense of how much investors are willing to pay for every dollar of earnings, making it a widely used benchmark for companies with consistent profitability.

What counts as a "normal" or "fair" PE ratio varies by sector and company. Generally, higher growth prospects or lower risk levels can justify a higher PE, while slower-growing or riskier businesses usually trade at lower multiples. It can be helpful to compare Canadian National Railway’s PE with a few different benchmarks to provide context.

Currently, Canadian National Railway trades at 17.8x earnings. This is above the broader Transportation industry average of 15.1x, but below the average for its main peers at 22.0x. In addition, Simply Wall St’s proprietary Fair Ratio for CN is 21.7x. This benchmark reflects not just industry standards and peer performance, but also important company-specific factors such as profitability, earnings growth, market cap, and risk profile.

Comparing to the Fair Ratio offers a more nuanced perspective than simply looking at peers or the sector, as it factors in the precise characteristics that matter most for a business like Canadian National Railway. With a current PE almost identical to the Fair Ratio, the shares appear fairly valued on this measure.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Canadian National Railway Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, yet powerful way to express your unique outlook on a company. It connects your story about where the business is heading with your assumptions for its future revenue, earnings, and margins, and ultimately the fair value you believe is justified. Narratives let you move beyond passive number crunching by linking the company’s real-world story to your own financial forecast. This makes investing more about your perspective instead of just industry averages or analyst estimates.

Narratives are built right into the Simply Wall St Community page, so they are easy to use and accessible for any investor. By comparing your calculated Fair Value to the current share price, Narratives help you evaluate opportunities. They are updated automatically whenever new news or earnings results are released.

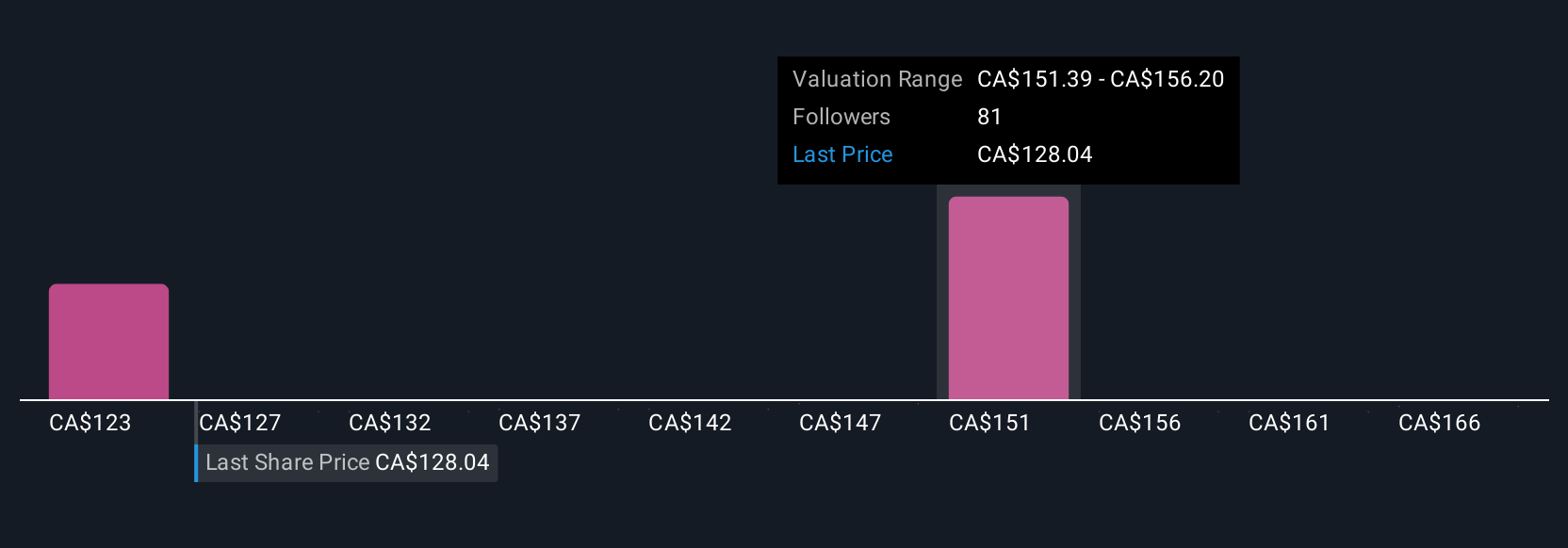

For example, one investor may model a bullish scenario where Canadian National Railway rides the North American "reshoring" trend to a fair value of CA$284.80, while another sees modest growth and assigns a fair value as low as CA$133.00. With Narratives, you can put your own view front and center, quickly spot differences in outlook among investors, and respond confidently as fresh data comes in.

For Canadian National Railway, we’ll make it really easy for you with previews of two leading Canadian National Railway Narratives:

- 🐂 Canadian National Railway Bull Case

Fair Value: CA$150.57

Undervalued by: 11.2%

Revenue Growth Rate: 4.38%

- Strategic investments and cost efficiency are positioning CN for margin expansion and stronger earnings, supporting improved free cash flow.

- Unique network advantages and pricing power support sustainable long-term growth, particularly as supply chains are re-optimized across North America.

- Analysts' consensus price target indicates notable upside from today’s share price if revenue and margin assumptions are met. However, headwinds such as trade risk and muted industry demand remain.

- 🐻 Canadian National Railway Bear Case

Fair Value: CA$132.87

Overvalued by: 0.7%

Revenue Growth Rate: 3.5%

- CN’s unique tri-coastal network is a major competitive strength, but the current share price reflects only modest near-term upside with significant macro and operational risks present.

- The central bull thesis centers on North American reshoring trends, but in the base and low cases, results could lag expectations if economic conditions or catalysts materialize slowly.

- Even if upside from a “reshoring” tailwind emerges, conservative scenarios caution that EPS and returns may still trail the market, supported by CN’s defensive qualities but limited by slow growth.

Do you think there's more to the story for Canadian National Railway? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CNR

Canadian National Railway

Engages in the rail, intermodal, trucking, and related transportation businesses in Canada and the United States.

Established dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026