- Canada

- /

- Transportation

- /

- TSX:CNR

CN (TSX:CNR) Margin Miss Reinforces Cautious Narrative Despite Attractive Valuation and Dividend

Reviewed by Simply Wall St

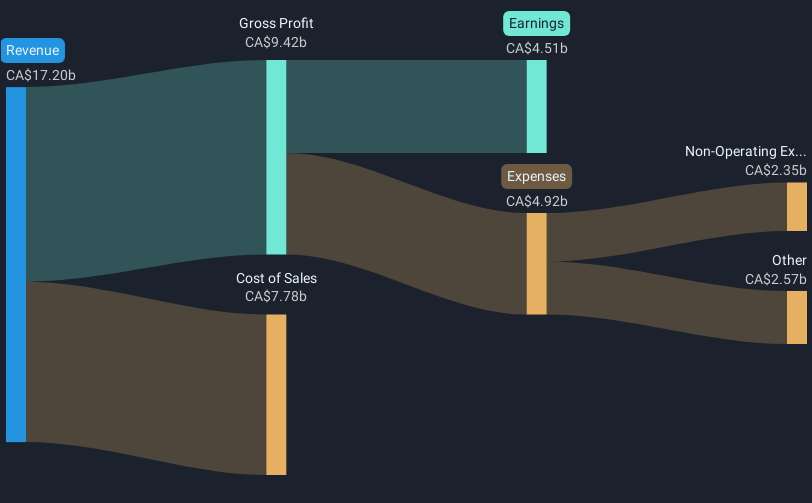

Canadian National Railway (TSX:CNR) posted a net profit margin of 26.9% compared to 31.7% last year, with earnings contracting over the past year even as five-year annual growth still clocks in at 4.7%. Looking ahead, both earnings and revenue growth are forecast at 6.6% and 4.5% per year, trailing the broader Canadian market averages. For investors, the current numbers highlight solid long-term profitability and relative value anchored by an attractive price-to-earnings ratio and dividend, but tempered by softer margins and a near-term pace that lags the overall market.

See our full analysis for Canadian National Railway.Next, we’ll see how these results stack up against the key narratives investors are watching. This will help you spot which themes are holding up and which might need a rethink.

See what the community is saying about Canadian National Railway

PE Ratio Discount Narrows Gap with Peers

- Canadian National Railway is trading at a price-to-earnings ratio of 17.9x, which is meaningfully below peers at 22.1x and the North American transportation industry at 23.1x.

- According to the analysts' consensus view, this valuation advantage is offset by the current share price of CA$134.49, which is trading at a premium to its estimated DCF fair value of CA$123.28,

- Consensus notes this discount to industry multiples is attractive, but for significant upside the company would need earnings to rise to CA$5.6 billion and justify an even higher future PE of 20.6x within three years.

- Even with the current growth outlook, the 12.7% gap to the consensus analyst price target of CA$151.95 presents modest room for upside if assumptions hold.

- To see how this valuation story fits into the bigger strategic picture, check out the full consensus narrative on how analysts are weighing CNR's pipeline of growth and risk factors. 📊 Read the full Canadian National Railway Consensus Narrative.

Margin Expansion Expected Despite Recent Dip

- Net profit margin is currently at 26.9%, below last year's 31.7%, but consensus forecasts call for margins to improve to 28.6% in three years.

- Consensus narrative highlights how margin expansion is built on anticipated efficiency gains and cost discipline,

- Forecasts rest on the company's ability to drive higher volumes and keep costs in check, with a focus on flexible workforce management and automation to lift operating ratio and net margins as growth rebounds.

- However, if macro headwinds or flat volumes persist, consensus warns margin improvement may be slower than projected, which could challenge the outlook for accelerated earnings growth.

Unique Network Drives Long-Term Revenue Upside

- Analysts estimate annual revenue growth of 4.6% over the next three years, reflecting the strategic value of CN’s tri-coastal network and Western export capacity.

- Consensus analysis argues the company’s network advantages fuel sustainable market share gains and free cash flow growth,

- However, critics note that continued trade and currency risks, along with flat volumes in recent years despite heavy capital investment, raise doubts about the extent of possible long-term revenue and market share expansion.

- Consensus captures this tension by framing upside as dependent on both steady demand recovery and the effectiveness of CN’s ongoing investments in supply chain resiliency.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Canadian National Railway on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

View the data through your own lens. Share your perspective and craft a narrative that reflects your outlook in just a few minutes. Do it your way

A great starting point for your Canadian National Railway research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While Canadian National Railway boasts long-term profitability, its forecast earnings and revenue growth trail peers, and recent margins have dipped below industry averages.

If you want to focus on consistent financial performers, start with stable growth stocks screener (2087 results) to discover companies that deliver reliable growth even when others slow down.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CNR

Canadian National Railway

Engages in the rail, intermodal, trucking, and related transportation businesses in Canada and the United States.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives