Transatlantic Expansion via Liege Could Be a Game Changer for Cargojet (TSX:CJT)

Reviewed by Sasha Jovanovic

- Cargojet Inc. recently began a scheduled direct air cargo service linking Canada with Europe via Liege Airport, starting November 1, 2025, and integrated this route into its established domestic overnight network for improved transcontinental freight connectivity.

- This expansion further positions Cargojet within a key European logistics hub and expands its global network reach for freight forwarders and shippers across both regions.

- We'll examine how this European route launch could shape Cargojet's international growth narrative and network diversification.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Cargojet Investment Narrative Recap

To be a shareholder in Cargojet, one needs to believe in the company’s ability to leverage its dominant Canadian overnight network while expanding international routes and deepening partnerships with major clients like Amazon and DHL. The launch of direct service into Europe's Liege Airport could help address soft demand in international lanes, but near-term catalysts still depend heavily on stable volumes from contracted partners; overreliance on a few key customers remains the most important risk, and this latest expansion does not materially reduce that exposure.

Among recent announcements, the August renewal of Cargojet’s long-term agreement with DHL stands out, as it supports revenue visibility and directly links to international network growth like the new European route. The strengthened DHL relationship offers stability amid ongoing global uncertainties that continue to impact international block hours and freight demand.

However, for investors it's essential to remember that while new routes bring promise, the business remains especially vulnerable to sudden changes in long-term contracts with...

Read the full narrative on Cargojet (it's free!)

Cargojet's outlook projects CA$1.1 billion in revenue and CA$111.6 million in earnings by 2028. This assumes a 3.7% annual revenue growth rate but a decrease in earnings of CA$34.1 million from the current CA$145.7 million.

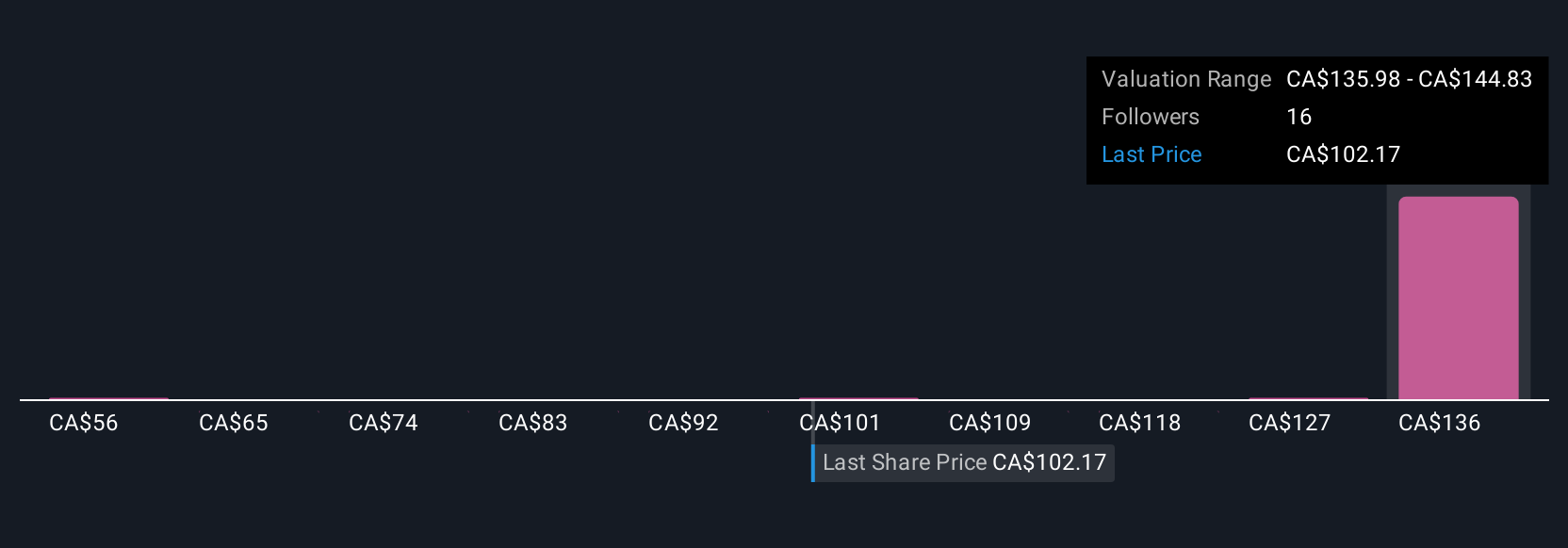

Uncover how Cargojet's forecasts yield a CA$144.83 fair value, a 77% upside to its current price.

Exploring Other Perspectives

Five Simply Wall St Community fair value estimates span a wide range from CA$56.31 to CA$144.83 per share. Many users see opportunity, but with block hour declines and trade volatility, the spectrum of outcomes invites more exploration of potential scenarios.

Explore 5 other fair value estimates on Cargojet - why the stock might be worth as much as 77% more than the current price!

Build Your Own Cargojet Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cargojet research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Cargojet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cargojet's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CJT

Cargojet

Provides time-sensitive overnight air cargo services and carries in Canada.

Undervalued average dividend payer.

Market Insights

Community Narratives