How Air Canada’s Share Buyback Plan and Earnings Drop Will Impact TSX:AC Investors

Reviewed by Sasha Jovanovic

- On November 4, 2025, Air Canada reported third quarter results showing revenue of CA$5.77 billion and net income of CA$264 million, both declining from the prior year, and announced a share buyback program to repurchase up to 29.56 million shares by November 2026.

- This combination of weaker quarterly earnings and an aggressive capital return initiative highlights the company's efforts to address profitability challenges while pursuing shareholder value.

- We'll explore how Air Canada's share buyback plan shapes its investment narrative amid recent earnings pressure and shifting industry conditions.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Air Canada Investment Narrative Recap

To be a shareholder in Air Canada, you need confidence that the airline can overcome current earnings pressure and margin headwinds through ongoing international demand, network expansion, and cost efficiency. The recent quarterly results do little to alter the central near-term challenge: persistent labor cost inflation coupled with competitive yield pressures, which remain the biggest headwind to margin recovery. At this point, the Q3 update is broadly in line with prior expectations and does not materially shift the main risk or short-term catalyst facing the business.

Among recent announcements, the launch of a new share buyback program stands out for its immediate relevance. Air Canada plans to repurchase nearly 10% of its shares by late 2026, showcasing a push to support shareholder value during a period of softer earnings. While this could provide additional support for the stock, the effectiveness of such capital allocation will ultimately depend on easing margin pressures.

But while buybacks might offer upside, investors should pay close attention to the mounting labor cost issue that could...

Read the full narrative on Air Canada (it's free!)

Air Canada's outlook anticipates CA$26.3 billion in revenue and CA$869.3 million in earnings by 2028. This scenario assumes annual revenue growth of 5.6% but a decrease in earnings of CA$630 million from the current CA$1.5 billion.

Uncover how Air Canada's forecasts yield a CA$24.36 fair value, a 28% upside to its current price.

Exploring Other Perspectives

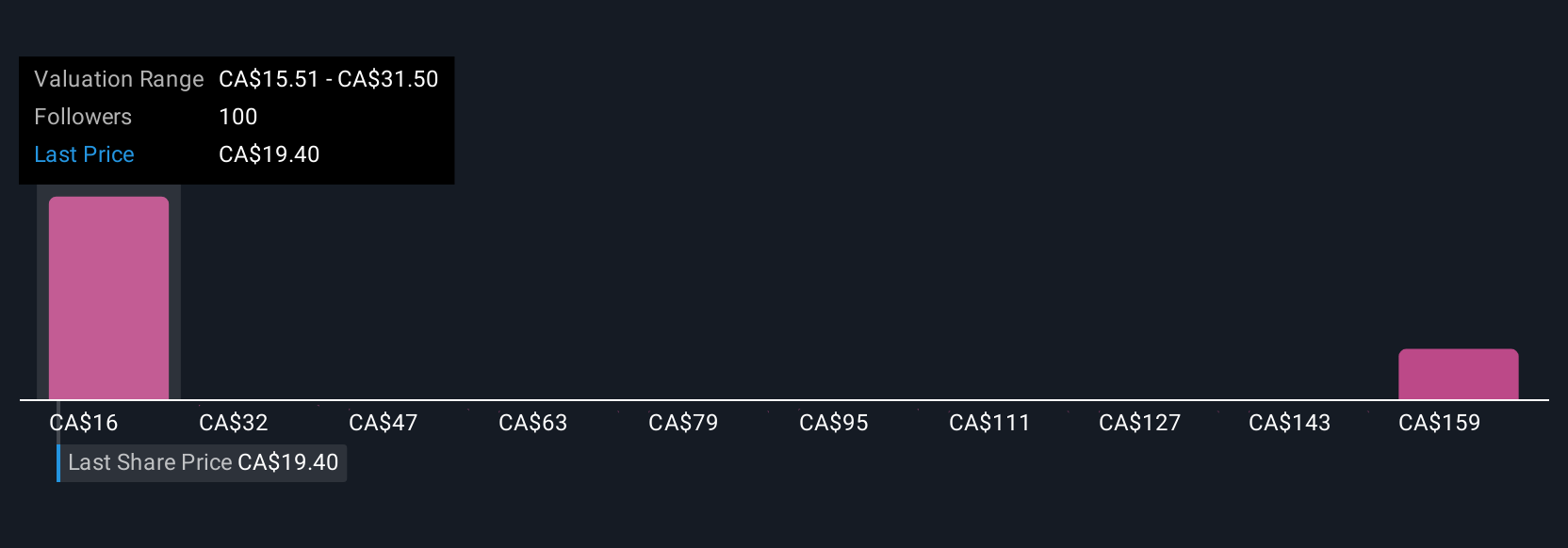

Simply Wall St Community members calculated fair values from CA$19.00 to CA$48.79, reflecting eight significantly different perspectives. With labor costs still rising, the range highlights how market participants weigh ongoing cost risks against Air Canada's recovery potential.

Explore 8 other fair value estimates on Air Canada - why the stock might be worth over 2x more than the current price!

Build Your Own Air Canada Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Air Canada research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Air Canada research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Air Canada's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AC

Air Canada

Provides domestic, U.S. transborder, and international airline services.

Very undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives