- Canada

- /

- Telecom Services and Carriers

- /

- TSX:TSAT

Investors Still Aren't Entirely Convinced By Telesat Corporation's (TSE:TSAT) Earnings Despite 25% Price Jump

Telesat Corporation (TSE:TSAT) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 45% over that time.

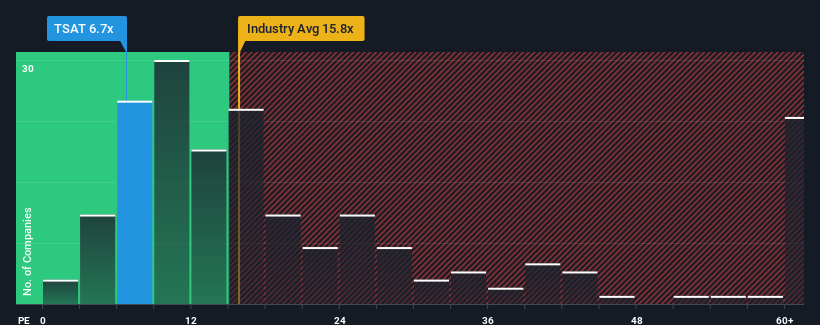

Although its price has surged higher, given about half the companies in Canada have price-to-earnings ratios (or "P/E's") above 16x, you may still consider Telesat as a highly attractive investment with its 6.7x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times haven't been advantageous for Telesat as its earnings have been falling quicker than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

View our latest analysis for Telesat

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as Telesat's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 75%. The last three years don't look nice either as the company has shrunk EPS by 44% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

What We Can Learn From Telesat's P/E?

Even after such a strong price move, Telesat's P/E still trails the rest of the market significantly. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Telesat (2 are significant) you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Telesat might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:TSAT

Telesat

A satellite operator, provides mission-critical communications solutions to support the requirements of satellite users in Canada, the United States, Asia, Australia, Latin America, the Caribbean, Europe, the Middle East, and Africa.

Slightly overvalued with limited growth.

Similar Companies

Market Insights

Community Narratives