TELUS (TSX:T) Announces US$1.5 Billion Debt Offering & TransUnion Partnership

Reviewed by Simply Wall St

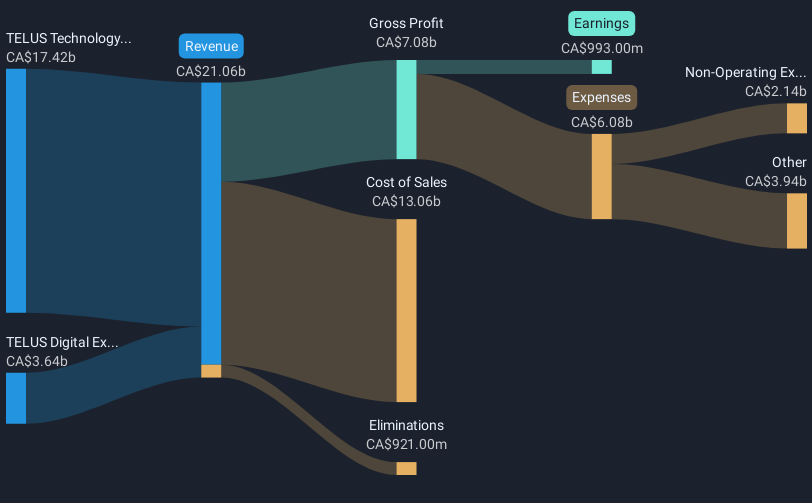

TELUS (TSX:T) recently announced a $1.5 billion debt financing initiative and a partnership with TransUnion for enhanced call display solutions, both events aimed at strengthening its financial position and customer experience. Over the last quarter, TELUS's share price increased by 8%, in line with broader market gains. The market saw a 12% rise over the past year. These moves by TELUS may have supported the company's performance during this period, adding weight to its stock appreciation as it aligns with the overall market's positive trajectory.

The recent developments at TELUS, specifically the $1.5 billion debt financing and collaboration with TransUnion, are likely to enhance its financial resilience and customer engagement strategy. These initiatives align with the company's broader efforts to support revenue growth, which could favorably impact future earnings forecasts as the firm strengthens its market position through diversification and cost efficiencies.

Over a longer five-year timeframe, TELUS has delivered a total shareholder return of 27.23%, combining both share price appreciation and dividends. This performance underscores the company's steady growth trajectory, although recent numbers reveal TELUS's one-year share return fell short of the broader Canadian Market, which posted a return of 19.6% over the past year.

In terms of revenue and earnings forecasts, the financial maneuvers and partnerships aim to bolster TELUS's growth prospects. With the analyst price target set at CA$23.22, the current share price of CA$20.99 suggests a modest discount of 5.64%, indicating potential upside if the company successfully executes its growth strategies. Investors may want to consider how TELUS's strategic moves could impact its ability to close the gap with the analyst consensus.

Jump into the full analysis health report here for a deeper understanding of TELUS.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TELUS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:T

TELUS

Provides a range of telecommunications and information technology products and services in Canada.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives