TELUS (TSE:T) Is Paying Out A Larger Dividend Than Last Year

TELUS Corporation's (TSE:T) dividend will be increasing to CA$0.34 on 4th of July. The announced payment will take the dividend yield to 4.1%, which is in line with the average for the industry.

View our latest analysis for TELUS

TELUS Doesn't Earn Enough To Cover Its Payments

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. Before this announcement, TELUS was paying out 103% of what it was earning, and not generating any free cash flows either. Paying out such a large dividend compared to earnings while also not generating free cash flows is a major warning sign for the sustainability of the dividend as these levels are certainly a bit high.

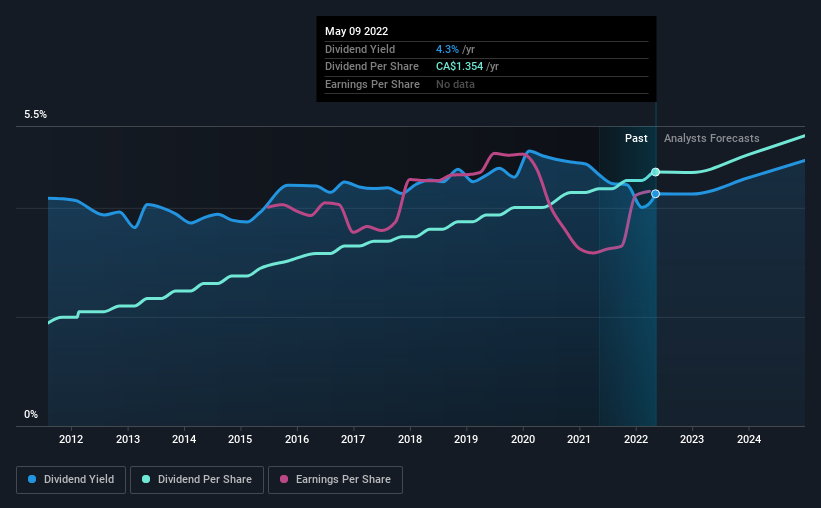

Over the next year, EPS is forecast to fall by 4.8%. If the dividend continues along the path it has been on recently, the payout ratio in 12 months could be 119%, which is definitely a bit high to be sustainable going forward.

TELUS Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. Since 2012, the first annual payment was CA$0.55, compared to the most recent full-year payment of CA$1.35. This implies that the company grew its distributions at a yearly rate of about 9.4% over that duration. The dividend has been growing very nicely for a number of years, and has given its shareholders some nice income in their portfolios.

The Dividend's Growth Prospects Are Limited

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Earnings has been rising at 3.1% per annum over the last five years, which admittedly is a bit slow. The earnings growth is anaemic, and the company is paying out 103% of its profit. As they say in finance, 'past performance is not indicative of future performance', but we are not confident a company with limited earnings growth and a high payout ratio will be a star dividend-payer over the next decade.

The Dividend Could Prove To Be Unreliable

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. We can't deny that the payments have been very stable, but we are a little bit worried about the very high payout ratio. We would be a touch cautious of relying on this stock primarily for the dividend income.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. To that end, TELUS has 3 warning signs (and 1 which shouldn't be ignored) we think you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if TELUS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:T

TELUS

Provides a range of telecommunications and information technology products and services in Canada.

Average dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion