How TELUS’s Expansion Into AI, Fibre, and Rentals Will Impact TSX:T Investors

Reviewed by Sasha Jovanovic

- In recent developments, TELUS celebrated breaking ground on a sustainable, mixed-use rental project in Vancouver, began installation of a crucial 125 km submarine fibre optic cable in Quebec, partnered with Railtown AI Technologies to expand secure AI infrastructure, and reported higher third-quarter earnings, revenue growth, and a dividend increase.

- This series of announcements shows TELUS leveraging both technological innovation and real estate assets to support community needs and diversify its business operations beyond traditional telecommunications.

- We’ll now explore how TELUS’s expansion of fibre optic infrastructure shapes its investment narrative and future growth outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

TELUS Investment Narrative Recap

To be a TELUS shareholder, you need confidence in the company’s ability to generate steady growth from its core telecom services while managing heavy investment demands in advanced fiber, 5G, and digital segments. The latest news around network expansion, sustainable real estate projects, and healthy earnings may provide support to near-term investor sentiment, but does not materially offset the most immediate risk: persistent pressure on profit margins from competition and regulatory changes.

The announcement of a 125 km submarine fiber optic cable in Quebec directly supports the investment case for broadband infrastructure as a long-term growth catalyst. This project enhances TELUS’s network reliability and capacity, reinforcing its competitive position at a time when customer experience and service uptime are crucial.

But against these positive signals, it’s important for investors to recognize the risk of ongoing margin pressure as competitive and regulatory dynamics shift...

Read the full narrative on TELUS (it's free!)

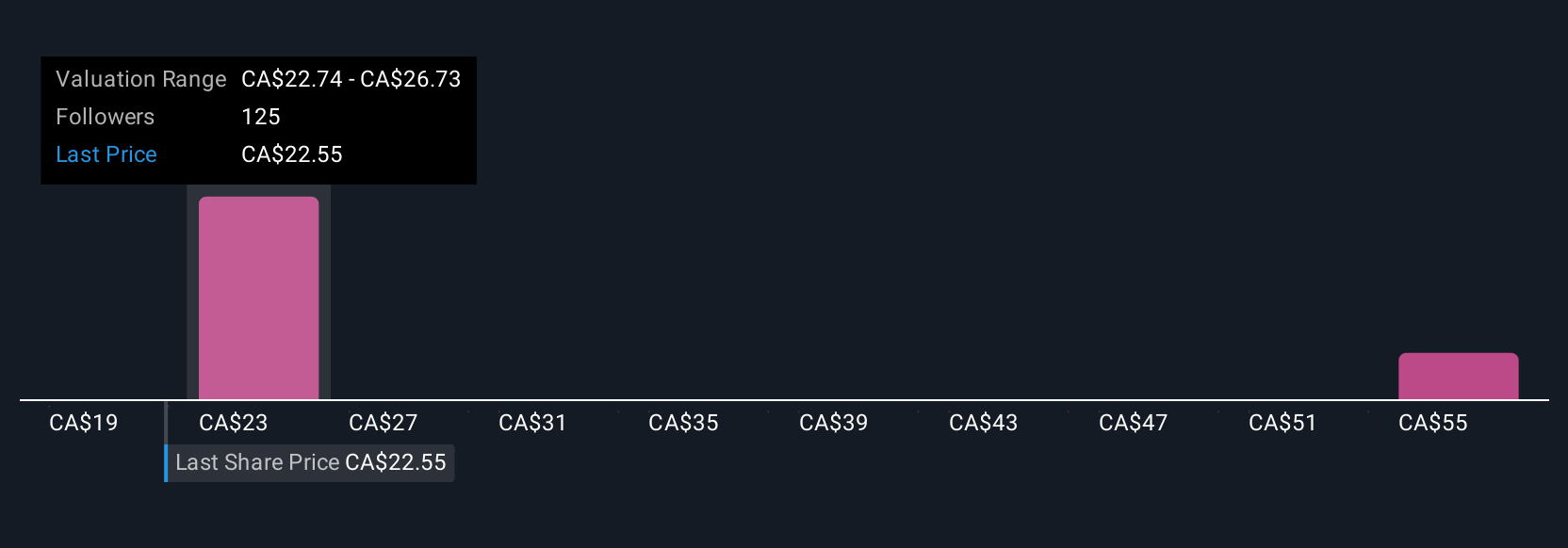

TELUS' narrative projects CA$22.7 billion in revenue and CA$1.5 billion in earnings by 2028. This requires 3.6% yearly revenue growth and a CA$534 million earnings increase from the current CA$966.0 million.

Uncover how TELUS' forecasts yield a CA$23.38 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Fair value estimates from nine members of the Simply Wall St Community range from CA$17.70 to CA$48.69 per share. While broadband investment remains a key catalyst, your peers show just how much expectations about future performance can vary, consider reviewing multiple viewpoints as you form your outlook.

Explore 9 other fair value estimates on TELUS - why the stock might be worth over 2x more than the current price!

Build Your Own TELUS Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TELUS research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free TELUS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TELUS' overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TELUS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:T

TELUS

Provides a range of telecommunications and information technology products and services in Canada.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives