- Canada

- /

- Telecom Services and Carriers

- /

- TSX:QBR.A

TSX Dividend Stocks To Consider For Income Stability

Reviewed by Simply Wall St

As the Canadian market navigates through complex trade developments and anticipates potential central bank rate cuts, investors face a landscape marked by both resilience and bouts of volatility. In such an environment, dividend stocks can offer income stability, providing a reliable stream of returns even amid economic uncertainties.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Sun Life Financial (TSX:SLF) | 3.98% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 3.94% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.51% | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | 9.28% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.71% | ★★★★★☆ |

| Olympia Financial Group (TSX:OLY) | 6.28% | ★★★★★☆ |

| National Bank of Canada (TSX:NA) | 3.50% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 5.14% | ★★★★★☆ |

| Atrium Mortgage Investment (TSX:AI) | 9.58% | ★★★★★☆ |

| Acadian Timber (TSX:ADN) | 6.50% | ★★★★★☆ |

Click here to see the full list of 28 stocks from our Top TSX Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

IGM Financial (TSX:IGM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: IGM Financial Inc. operates in the asset management sector in Canada with a market capitalization of approximately CA$10.22 billion.

Operations: IGM Financial Inc. generates revenue through its primary segments: Asset Management, contributing CA$1.28 billion, and Wealth Management, contributing CA$2.50 billion.

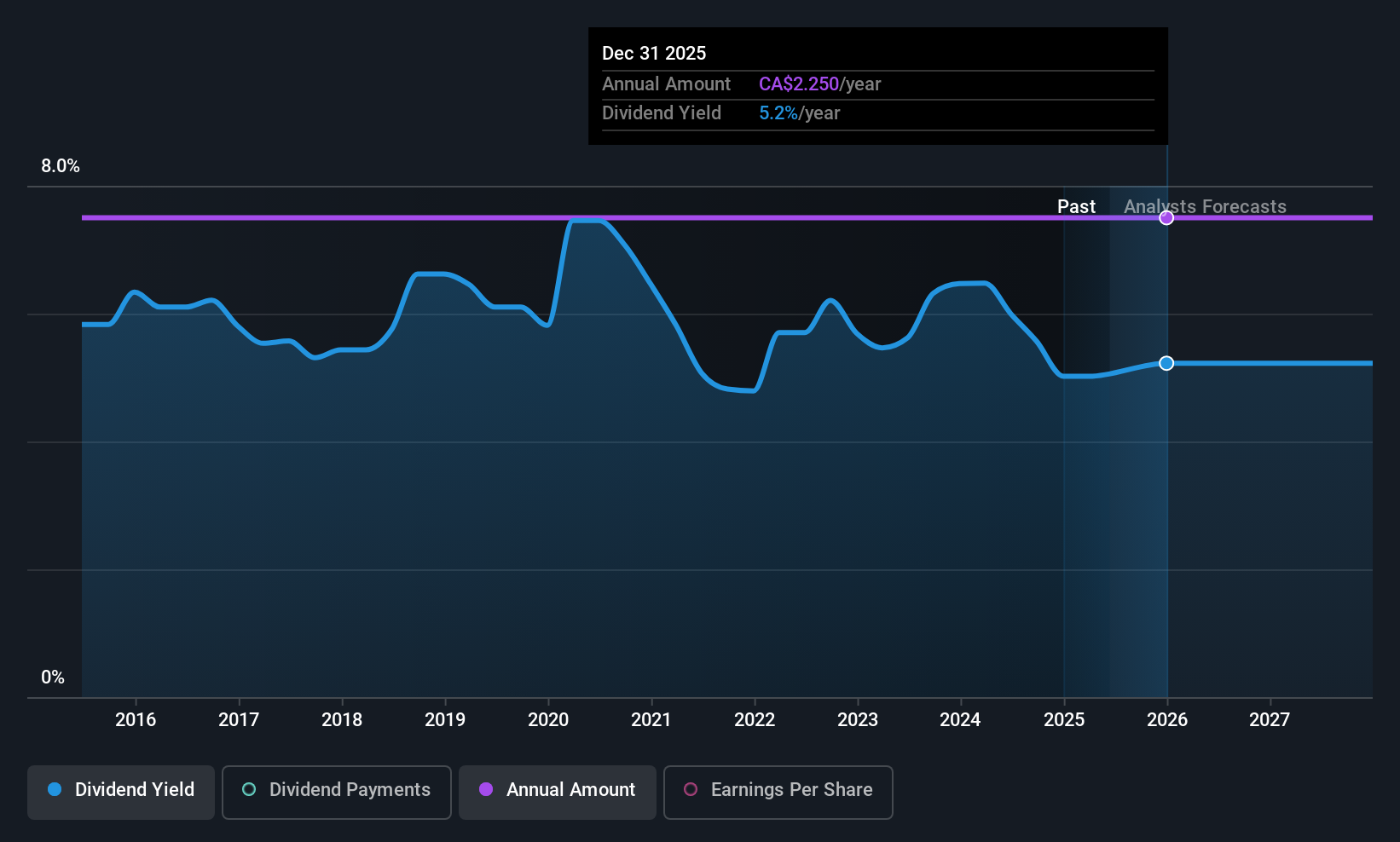

Dividend Yield: 5.1%

IGM Financial maintains a reliable dividend, currently yielding 5.14%, though below Canada's top-tier payers. The dividend is well-supported by earnings and cash flows, with payout ratios of 56.5% and 54.8%, respectively. Recent Q1 results showed revenue growth to C$875.8 million and net income improvement to C$233.78 million, reinforcing its financial stability for dividends. Additionally, IGM has completed a share buyback worth C$82.87 million, further enhancing shareholder value amidst board changes.

- Click here to discover the nuances of IGM Financial with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that IGM Financial is trading behind its estimated value.

North West (TSX:NWC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The North West Company Inc. operates as a retailer of food and everyday products and services in northern Canada, rural Alaska, the South Pacific, and the Caribbean with a market cap of CA$2.48 billion.

Operations: The North West Company Inc.'s revenue segments include retail operations in northern Canada, rural Alaska, the South Pacific, and the Caribbean.

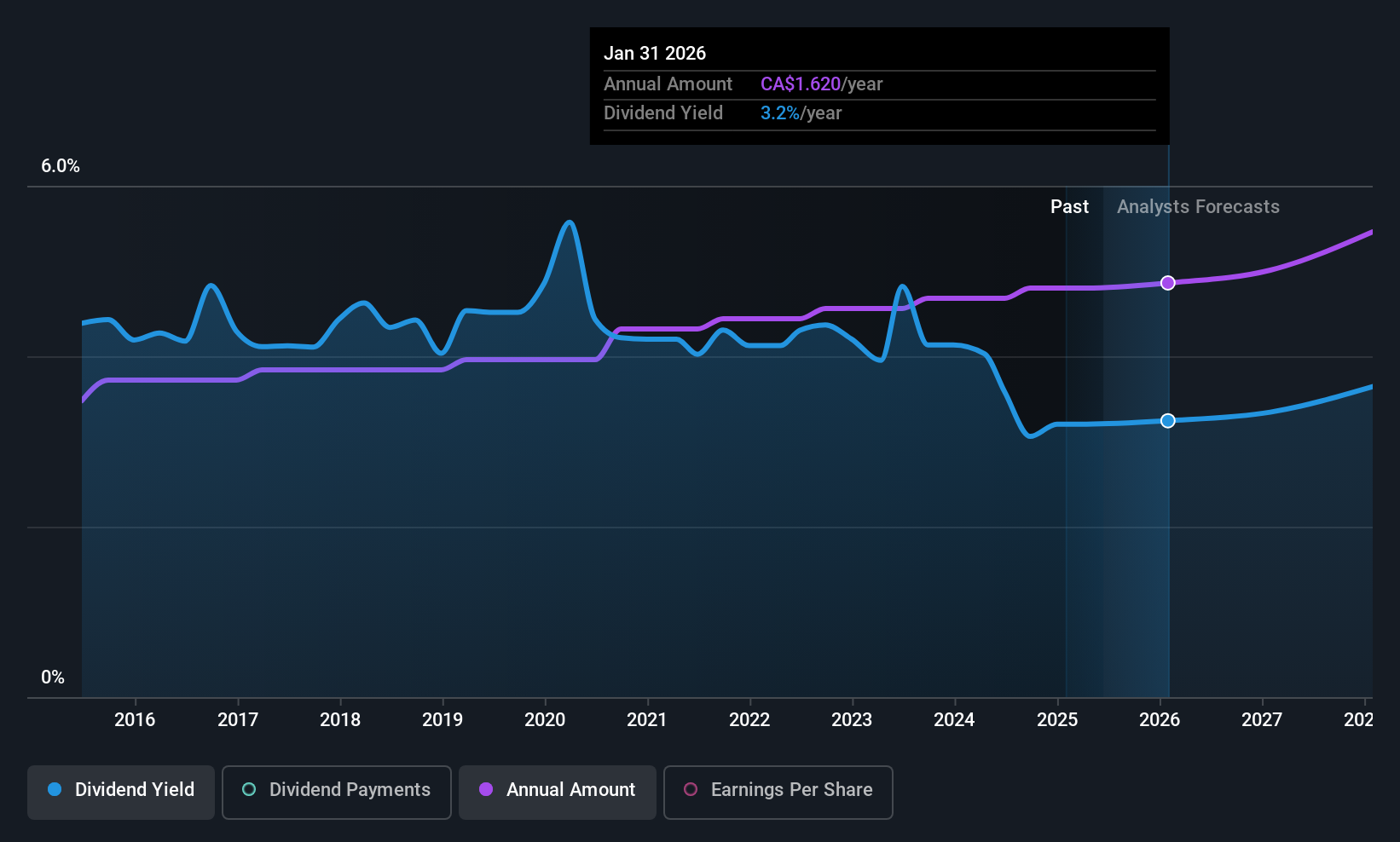

Dividend Yield: 3.2%

North West Company offers a stable dividend yield of 3.18%, supported by solid earnings and cash flows with payout ratios of 54.9% and 64.7%, respectively. Recent earnings show modest growth, with Q1 sales at C$641.37 million and net income at C$25.84 million, reflecting financial stability for continued dividend payments. The board recently affirmed a quarterly dividend of C$0.40 per share, maintaining its reliable decade-long dividend history despite being below Canada's top-tier payers.

- Click to explore a detailed breakdown of our findings in North West's dividend report.

- Our comprehensive valuation report raises the possibility that North West is priced lower than what may be justified by its financials.

Quebecor (TSX:QBR.A)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Quebecor Inc. operates in the telecommunications, media, and sports and entertainment sectors in Canada with a market cap of CA$9.04 billion.

Operations: Quebecor Inc.'s revenue is primarily derived from its telecommunications segment at CA$4.82 billion, followed by media at CA$698.80 million, and sports and entertainment at CA$228.30 million.

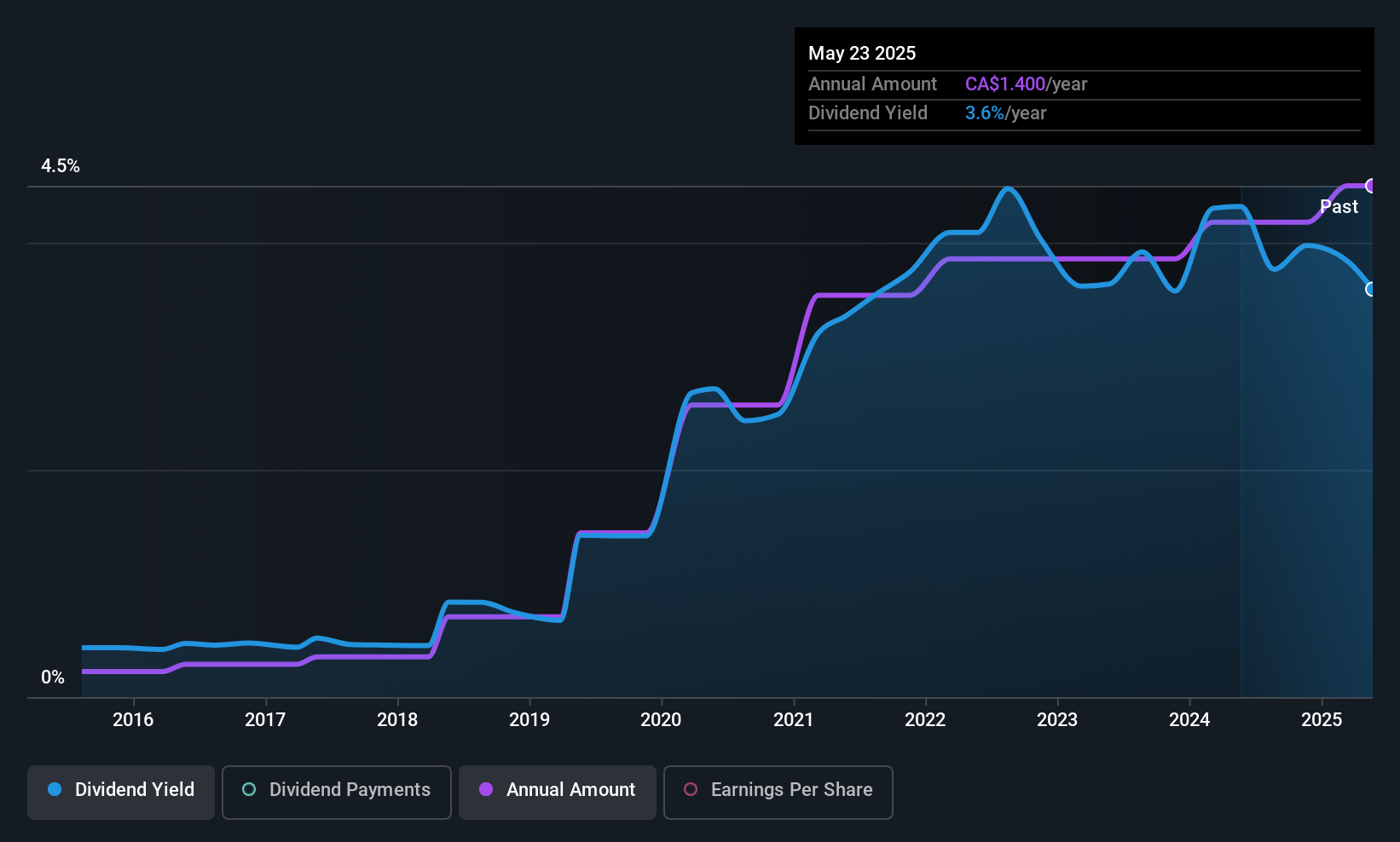

Dividend Yield: 3.5%

Quebecor's dividend yield of 3.5% is lower than Canada's top 25% payers but remains stable and reliable over the past decade, with consistent growth. Its dividends are well-covered by earnings and cash flows, with payout ratios of 40.1% and 35.9%, respectively. Recent Q1 results show net income rising to C$190.7 million from C$173.2 million last year, supporting its sustainable dividend policy amidst strategic share buybacks totaling C$106.7 million since August 2024.

- Click here and access our complete dividend analysis report to understand the dynamics of Quebecor.

- Our expertly prepared valuation report Quebecor implies its share price may be lower than expected.

Taking Advantage

- Navigate through the entire inventory of 28 Top TSX Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quebecor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:QBR.A

Quebecor

Operates in the telecommunications, media, and sports and entertainment businesses in Canada.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives