- Canada

- /

- Telecom Services and Carriers

- /

- TSX:CCA

How Cogeco’s Dividend Hike and Québec Internet Expansion Could Influence the TSX:CCA Investment Story

Reviewed by Sasha Jovanovic

- Cogeco Communications recently reported its fiscal 2025 results, announced a 7% increase to its quarterly dividend, released its fiscal 2026 guidance forecasting a 1% to 3% revenue decline, and unveiled a major Internet expansion across Québec aimed at increasing competition with larger telecom providers.

- This combination of modestly lower earnings expectations alongside both shareholder returns and growth initiatives highlights the company’s efforts to balance profitability pressures with expansion into new markets.

- We will examine how Cogeco’s expanded Internet presence in Québec shapes the company’s broader investment narrative and competitive outlook.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Cogeco Communications Investment Narrative Recap

For shareholders in Cogeco Communications, the key belief is that the company's broadband expansion and operational efficiencies can eventually outweigh near-term pressure from declining traditional services and intensified competition. Recent fiscal 2026 guidance for a 1% to 3% revenue decline affirms that competitive risks remain the most important short-term catalyst, or threat, with the latest announcements unlikely to fundamentally shift this balance in the short run. One recent announcement that stands out is the major Internet expansion across Québec. This effort directly addresses competitive headwinds by aiming to win market share from dominant telecom operators, highlighting Cogeco’s commitment to growth even as it acknowledges revenue pressures tied to shifting subscriber trends. However, what investors should also be aware of is that, even as new markets open up, the risk remains if customer gains do not offset increased costs and pricing pressure...

Read the full narrative on Cogeco Communications (it's free!)

Cogeco Communications is projected to have CA$2.8 billion in revenue and CA$325.6 million in earnings by 2028. This outlook assumes a 1.6% annual decline in revenue and a decrease in earnings of CA$1.5 million from the current CA$327.1 million.

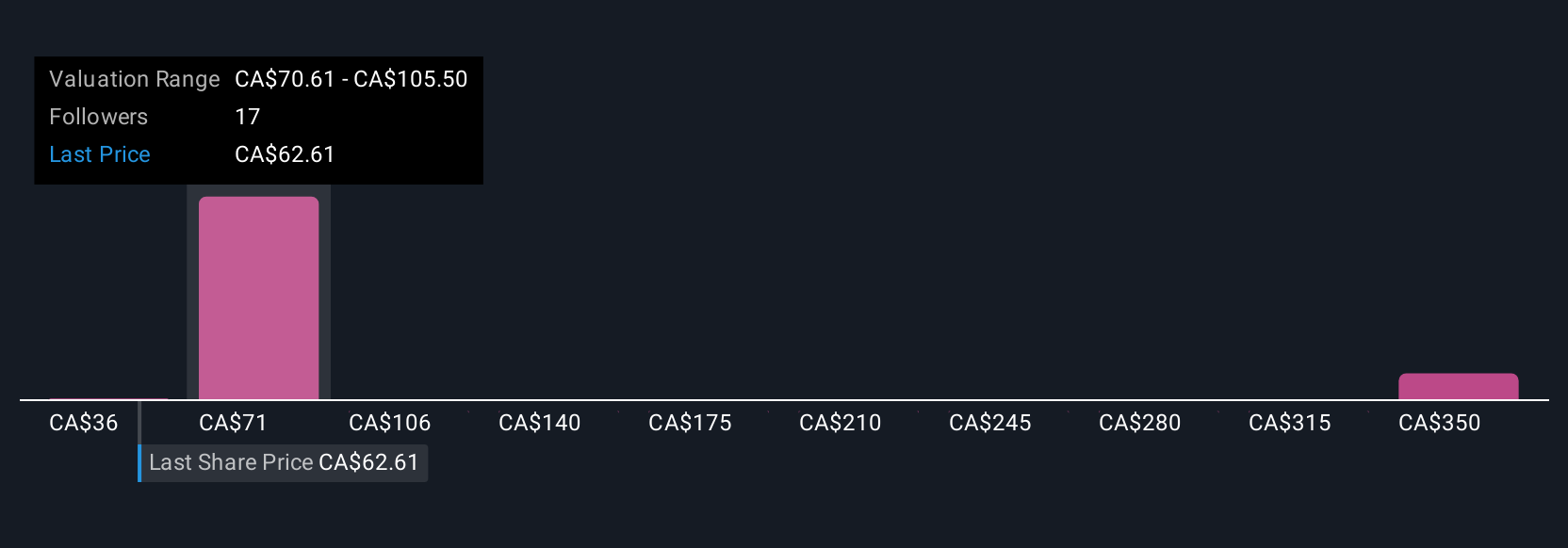

Uncover how Cogeco Communications' forecasts yield a CA$74.09 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Seven Simply Wall St Community members value Cogeco between CA$35.72 and CA$317.50 per share. Given ongoing revenue declines and competitive risk, you can see how investor opinions differ widely and are worth comparing for a broader view.

Explore 7 other fair value estimates on Cogeco Communications - why the stock might be worth 44% less than the current price!

Build Your Own Cogeco Communications Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cogeco Communications research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cogeco Communications research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cogeco Communications' overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CCA

Cogeco Communications

Operates as a telecommunications corporation in Canada and the United States.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives