Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In contrast to all that, I prefer to spend time on companies like Total Telcom (CVE:TTZ), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Total Telcom

Total Telcom's Improving Profits

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So EPS growth can certainly encourage an investor to take note of a stock. Like a falcon taking flight, Total Telcom's EPS soared from CA$0.014 to CA$0.021, over the last year. That's a impressive gain of 46%.

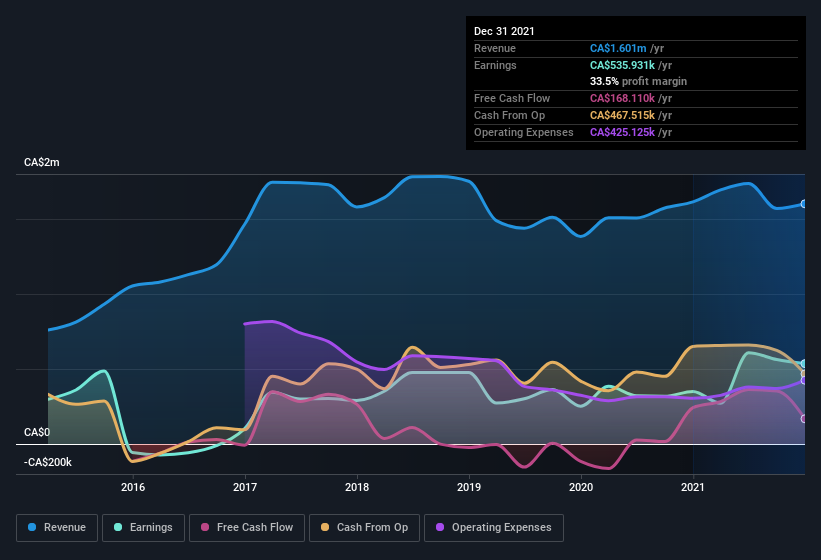

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Total Telcom's EBIT margins have fallen over the last twelve months, but the flat revenue sends a message of stability. Does that sound particularly bullish? No, it does not.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Total Telcom isn't a huge company, given its market capitalization of CA$3.5m. That makes it extra important to check on its balance sheet strength.

Are Total Telcom Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We haven't seen any insiders selling Total Telcom shares, in the last year. So it's definitely nice that Chairman Neil Magrath bought CA$55k worth of shares at an average price of around CA$0.10.

I do like that insiders have been buying shares in Total Telcom, but there is more evidence of shareholder friendly management. I refer to the very reasonable level of CEO pay. For companies with market capitalizations under CA$256m, like Total Telcom, the median CEO pay is around CA$200k.

Total Telcom offered total compensation worth CA$130k to its CEO in the year to . That comes in below the average for similar sized companies, and seems pretty reasonable to me. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. I'd also argue reasonable pay levels attest to good decision making more generally.

Does Total Telcom Deserve A Spot On Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Total Telcom's strong EPS growth. But wait, it gets better. We have seen insider buying and the executive pay seems on the modest side of things. On balance the message seems to be that this stock is worth looking at, at least for a while. Still, you should learn about the 4 warning signs we've spotted with Total Telcom (including 2 which are concerning) .

As a growth investor I do like to see insider buying. But Total Telcom isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Total Telcom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:TTZ

Total Telcom

Through its subsidiary, ROM Communications Inc., develops and provides remote asset monitoring and tracking products and services in the United States and Canada.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)