Increases to CEO Compensation Might Be Put On Hold For Now at Kraken Robotics Inc. (CVE:PNG)

Despite strong share price growth of 225% for Kraken Robotics Inc. (CVE:PNG) over the last few years, earnings growth has been disappointing, which suggests something is amiss. Some of these issues will occupy shareholders' minds as the AGM rolls around on 24 June 2021. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. From the data that we gathered, we think that shareholders should hold off on a raise on CEO compensation until performance starts to show some improvement.

View our latest analysis for Kraken Robotics

Comparing Kraken Robotics Inc.'s CEO Compensation With the industry

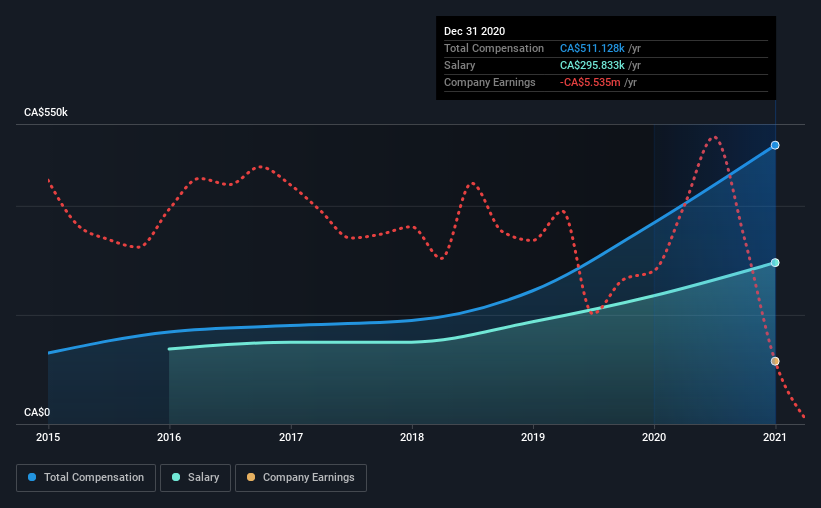

Our data indicates that Kraken Robotics Inc. has a market capitalization of CA$110m, and total annual CEO compensation was reported as CA$511k for the year to December 2020. That's a notable increase of 39% on last year. Notably, the salary which is CA$295.8k, represents a considerable chunk of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations under CA$243m, the reported median total CEO compensation was CA$224k. This suggests that Karl Kenny is paid more than the median for the industry. What's more, Karl Kenny holds CA$16m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$296k | CA$235k | 58% |

| Other | CA$215k | CA$133k | 42% |

| Total Compensation | CA$511k | CA$369k | 100% |

Talking in terms of the industry, salary represented approximately 78% of total compensation out of all the companies we analyzed, while other remuneration made up 22% of the pie. Kraken Robotics pays a modest slice of remuneration through salary, as compared to the broader industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Kraken Robotics Inc.'s Growth

Over the last three years, Kraken Robotics Inc. has shrunk its earnings per share by 4.7% per year. Its revenue is down 53% over the previous year.

Overall this is not a very positive result for shareholders. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Kraken Robotics Inc. Been A Good Investment?

Most shareholders would probably be pleased with Kraken Robotics Inc. for providing a total return of 225% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Although shareholders would be quite happy with the returns they have earned on their initial investment, earnings have failed to grow and this could mean returns may be hard to keep up. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 2 warning signs for Kraken Robotics that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kraken Robotics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:PNG

Kraken Robotics

A marine technology company, engages in the design, manufacture, and sale of sonar and optical sensors, batteries, and underwater robotic equipment for unmanned underwater vehicles used in military and commercial applications in Canada, the Asia Pacific, Europe, the Middle East, Africa, North America, and internationally.

Reasonable growth potential with adequate balance sheet.