- Canada

- /

- Metals and Mining

- /

- TSXV:SLI

Exploring Undiscovered Gems in Canada December 2024

Reviewed by Simply Wall St

As Canadian markets navigate the evolving landscape of bond yields and interest rate adjustments, investors are increasingly looking beyond traditional cash holdings to explore opportunities in other asset classes. In this environment, identifying promising small-cap stocks can be particularly rewarding, as these companies often offer unique growth potential and resilience amidst shifting economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Reconnaissance Energy Africa | NA | 9.16% | 15.11% | ★★★★★★ |

| Lithium Chile | NA | nan | 42.01% | ★★★★★★ |

| Minsud Resources | NA | nan | -29.01% | ★★★★★★ |

| Amerigo Resources | 14.04% | 7.04% | 11.73% | ★★★★★☆ |

| Maxim Power | 25.01% | 12.79% | 17.14% | ★★★★★☆ |

| Mako Mining | 10.21% | 38.44% | 58.78% | ★★★★★☆ |

| Grown Rogue International | 24.92% | 43.35% | 67.95% | ★★★★★☆ |

| Corby Spirit and Wine | 65.79% | 7.46% | -5.76% | ★★★★☆☆ |

| Petrus Resources | 19.44% | 17.20% | 46.03% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Evertz Technologies (TSX:ET)

Simply Wall St Value Rating: ★★★★★★

Overview: Evertz Technologies Limited designs, manufactures, and distributes video and audio infrastructure solutions for production, post-production, broadcast, and telecommunications markets globally, with a market cap of approximately CA$948.45 million.

Operations: Revenue primarily stems from the Television Broadcast Equipment Market, amounting to CA$494.95 million.

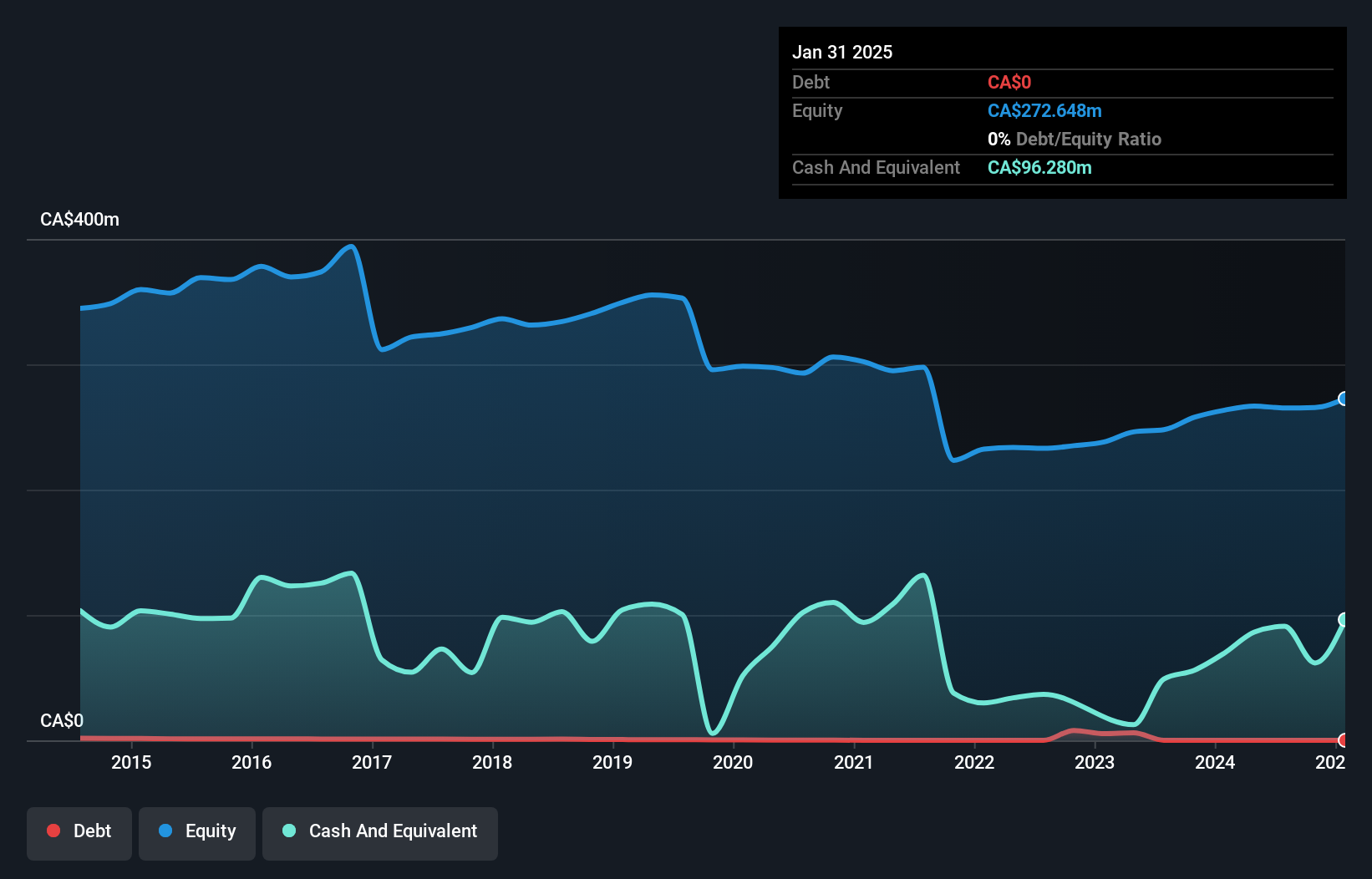

Evertz Technologies, a Canadian player in the communications sector, showcases a compelling mix of financial stability and strategic moves. Despite facing a 14.8% earnings drop over the past year, it's trading at 10.1% below its estimated fair value, suggesting potential upside compared to industry peers. The company remains debt-free, enhancing its financial flexibility and reducing risk exposure. Recent activities include repurchasing 202,684 shares for CAD 2.56 million and declaring a quarterly dividend of CAD 0.20 per share. With positive free cash flow and no debt concerns, Evertz appears poised for steady future growth within its market segment.

- Navigate through the intricacies of Evertz Technologies with our comprehensive health report here.

Gain insights into Evertz Technologies' past trends and performance with our Past report.

Kraken Robotics (TSXV:PNG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Kraken Robotics Inc. is a marine technology company that designs, manufactures, and sells sonar and optical sensors, batteries, and underwater robotic equipment for unmanned underwater vehicles used in military and commercial applications globally, with a market cap of CA$708.89 million.

Operations: Kraken Robotics generates revenue primarily from product sales amounting to CA$67.40 million and service offerings totaling CA$23.79 million.

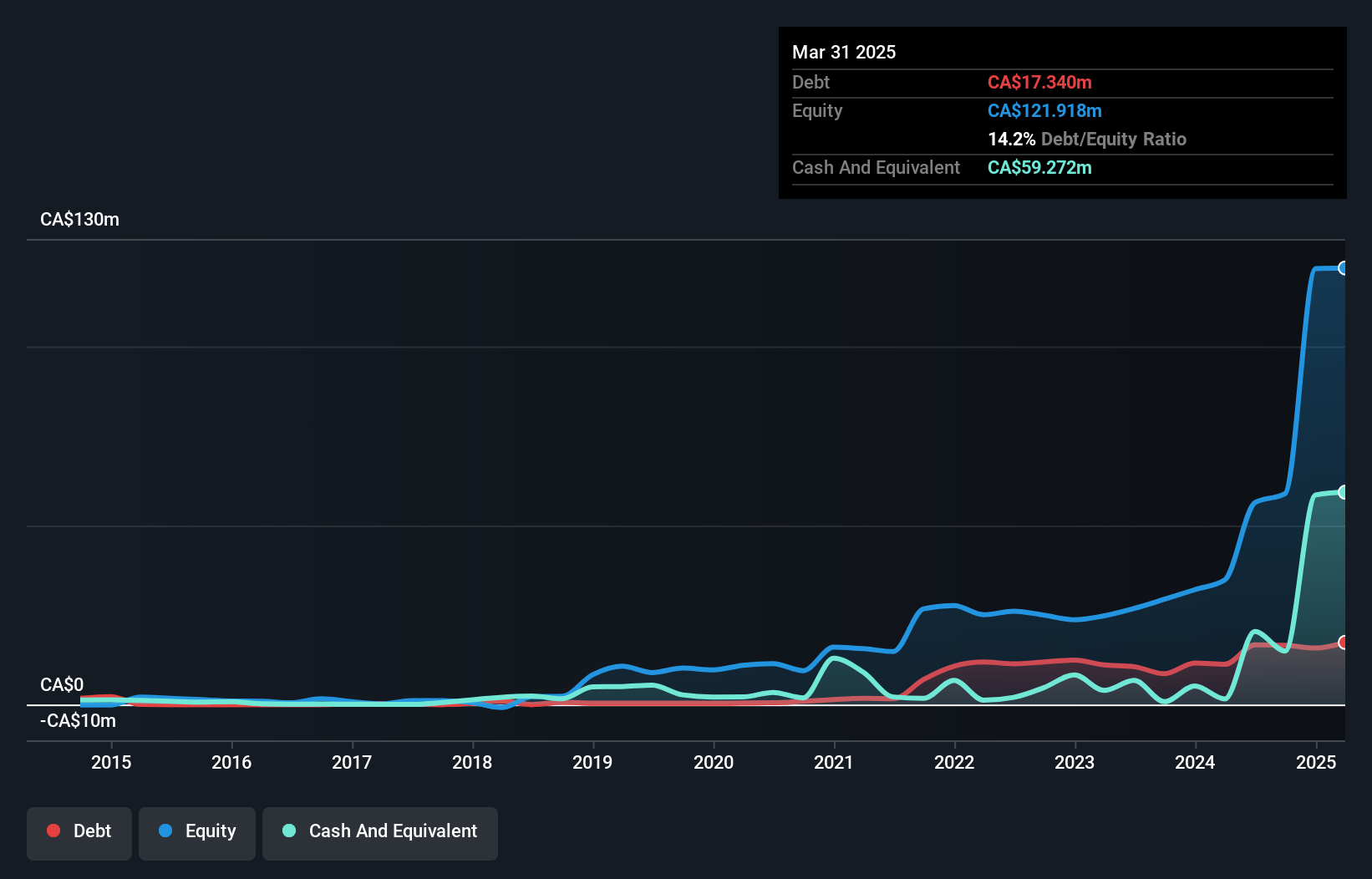

Kraken Robotics, a nimble player in the tech space, showcased robust earnings growth of 431.9% over the past year, outpacing its industry peers. The company's net debt to equity ratio stands at a satisfactory 2.7%, reflecting prudent financial management despite an increase in debt to equity from 3.5% to 28% over five years. Recent developments include a CAD 45 million follow-on equity offering and successful demonstrations of their ALARS system for naval clients, indicating strong market interest and potential for future revenue streams. Their third-quarter net income was CAD 1.63 million with stable earnings per share at CAD 0.01.

- Delve into the full analysis health report here for a deeper understanding of Kraken Robotics.

Understand Kraken Robotics' track record by examining our Past report.

Standard Lithium (TSXV:SLI)

Simply Wall St Value Rating: ★★★★★★

Overview: Standard Lithium Ltd. is engaged in the exploration, development, and processing of lithium brine properties in the United States with a market capitalization of CA$391.81 million.

Operations: Standard Lithium Ltd. does not currently report any revenue segments, indicating that it may still be in the development stage without significant revenue generation from its lithium brine properties.

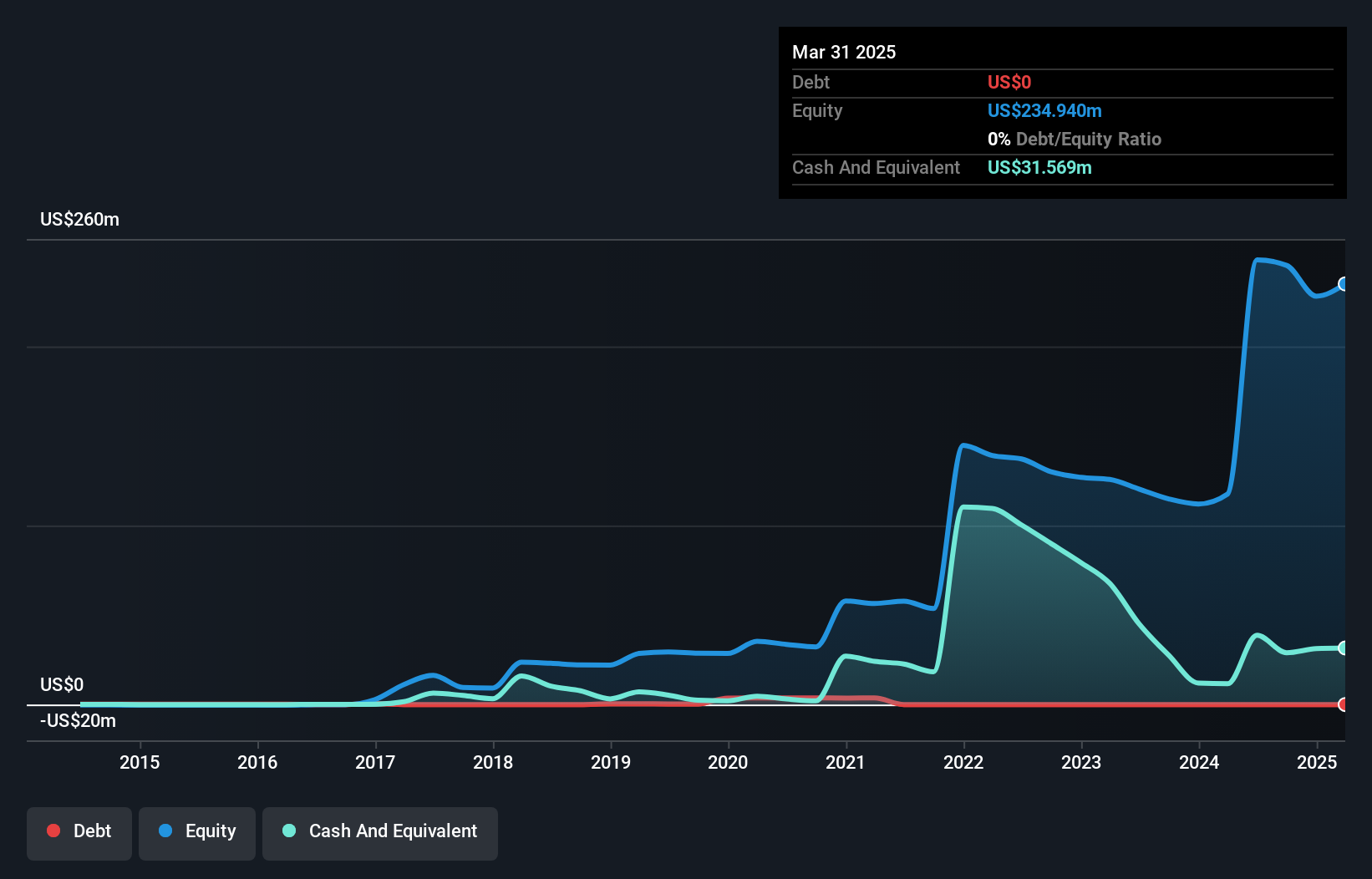

Standard Lithium, a nimble player in the lithium space, has shown promise with its recent profitability, despite significant insider selling over the past quarter. The company reported a net loss of US$4.83 million for Q1 2025, an improvement from last year's US$7.26 million loss. With no debt on its books now compared to a debt-to-equity ratio of 1.1 five years ago, SLI appears financially sound but remains highly volatile in share price movements recently. Its P/E ratio stands at 2.4x—substantially lower than the Canadian market average of 14.1x—suggesting potential undervaluation amidst industry peers.

- Click here to discover the nuances of Standard Lithium with our detailed analytical health report.

Explore historical data to track Standard Lithium's performance over time in our Past section.

Taking Advantage

- Explore the 45 names from our TSX Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SLI

Standard Lithium

Explores for, develops, and processes lithium brine properties in the United States.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)