What Did JEMTEC's (CVE:JTC) CEO Take Home Last Year?

Eric Caton is the CEO of JEMTEC Inc. (CVE:JTC), and in this article, we analyze the executive's compensation package with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for JEMTEC

Comparing JEMTEC Inc.'s CEO Compensation With the industry

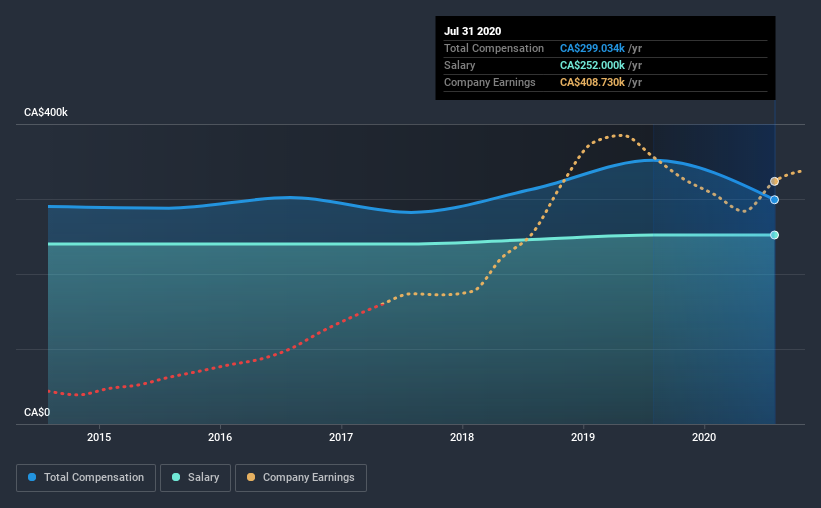

Our data indicates that JEMTEC Inc. has a market capitalization of CA$4.8m, and total annual CEO compensation was reported as CA$299k for the year to July 2020. That's a notable decrease of 15% on last year. In particular, the salary of CA$252.0k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the industry with market capitalizations below CA$254m, reported a median total CEO compensation of CA$334k. This suggests that JEMTEC remunerates its CEO largely in line with the industry average. Furthermore, Eric Caton directly owns CA$1.0m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$252k | CA$252k | 84% |

| Other | CA$47k | CA$100k | 16% |

| Total Compensation | CA$299k | CA$352k | 100% |

Speaking on an industry level, nearly 74% of total compensation represents salary, while the remainder of 26% is other remuneration. It's interesting to note that JEMTEC pays out a greater portion of remuneration through salary, compared to the industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

JEMTEC Inc.'s Growth

JEMTEC Inc.'s earnings per share (EPS) grew 138% per year over the last three years. It achieved revenue growth of 1.2% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's also good to see modest revenue growth, suggesting the underlying business is healthy. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has JEMTEC Inc. Been A Good Investment?

We think that the total shareholder return of 229%, over three years, would leave most JEMTEC Inc. shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

As we touched on above, JEMTEC Inc. is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. The company is growing EPS and total shareholder returns have been pleasing. So one could argue that CEO compensation is quite modest, if you consider company performance! Stockholders might even be okay with a bump in pay, seeing as how investor returns have been so strong.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 4 warning signs for JEMTEC (1 is significant!) that you should be aware of before investing here.

Important note: JEMTEC is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade JEMTEC, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:JTC

JEMTEC

Provides integrated technology systems for community-based corrections in Canada.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion