- Canada

- /

- Interactive Media and Services

- /

- TSX:ILLM

TSX Penny Stocks To Watch: illumin Holdings And Two More Hidden Opportunities

Reviewed by Simply Wall St

As we head into the second half of 2025, the Canadian market is navigating a complex landscape shaped by ongoing trade negotiations and potential tariff changes, which could influence economic growth and inflation. In such an environment, identifying stocks with strong fundamentals becomes crucial for investors looking to capitalize on market opportunities. While "penny stocks" may seem like an outdated term, they still represent smaller or less-established companies that can offer significant value when supported by robust financials. Here are three penny stocks that stand out for their balance sheet strength and potential for growth in today's evolving market landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| PetroTal (TSX:TAL) | CA$0.69 | CA$631.17M | ✅ 3 ⚠️ 4 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.34 | CA$743.85M | ✅ 4 ⚠️ 2 View Analysis > |

| Dynacor Group (TSX:DNG) | CA$4.53 | CA$190.97M | ✅ 4 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.44 | CA$12.6M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.76 | CA$538.89M | ✅ 3 ⚠️ 2 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.18 | CA$94.36M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.14 | CA$121.23M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.95 | CA$152.77M | ✅ 1 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.90 | CA$186.9M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.88 | CA$5.42M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 883 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

illumin Holdings (TSX:ILLM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: illumin Holdings Inc. is a technology company offering digital media solutions across the United States, Canada, Europe, Latin America, and other international markets with a market cap of CA$92.36 million.

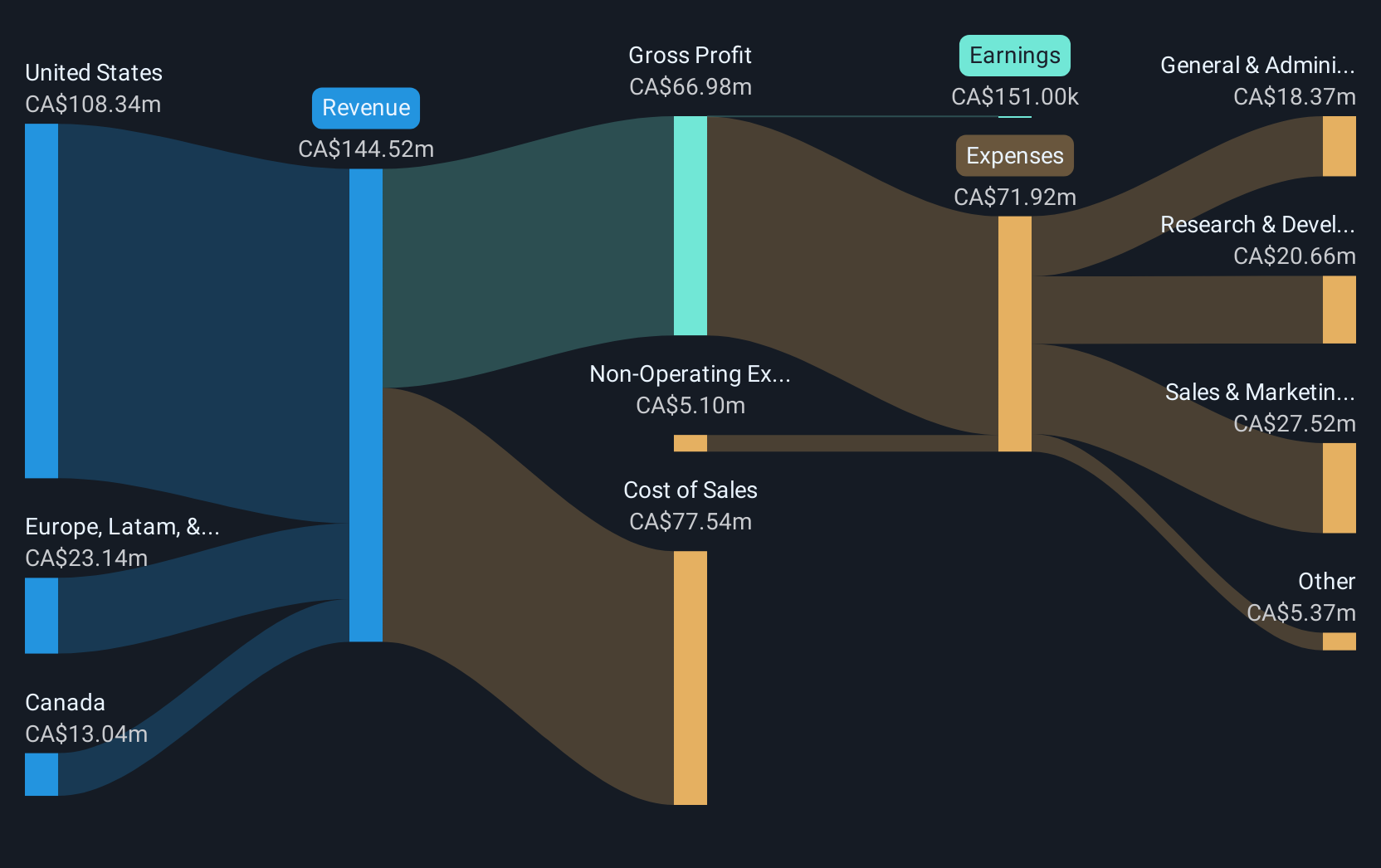

Operations: The company generates CA$144.52 million in revenue from its Internet Information Providers segment.

Market Cap: CA$92.36M

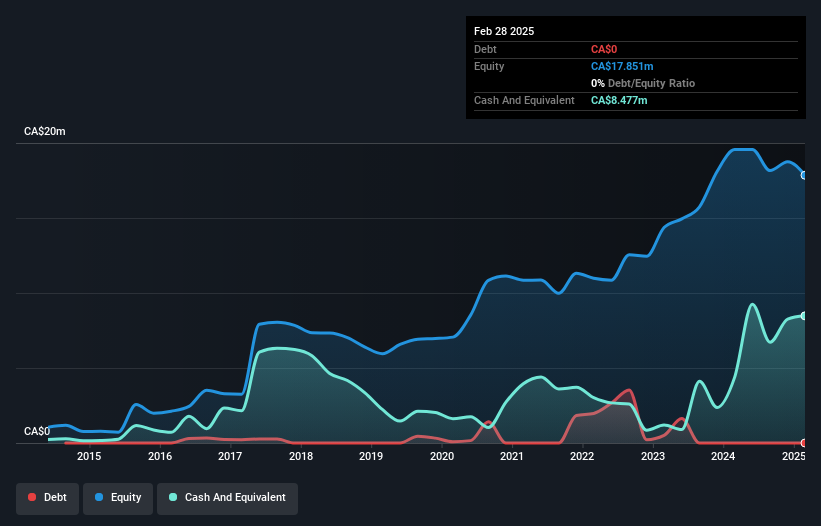

illumin Holdings Inc., with a market cap of CA$92.36 million, has shown promising growth in its digital media solutions segment, reporting CA$29.08 million in sales for Q1 2025, up from the previous year. The company has transitioned to profitability recently and boasts a seasoned management team with an average tenure of 5.7 years. Its financial health is robust, with more cash than total debt and short-term assets exceeding liabilities significantly. Despite low return on equity at 0.2%, analysts agree that the stock price could rise substantially, trading well below estimated fair value by 84.7%.

- Unlock comprehensive insights into our analysis of illumin Holdings stock in this financial health report.

- Gain insights into illumin Holdings' outlook and expected performance with our report on the company's earnings estimates.

Orbit Garant Drilling (TSX:OGD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Orbit Garant Drilling Inc. offers mineral drilling services across Canada, the United States, Central and South America, and West Africa with a market cap of CA$55.06 million.

Operations: The company generates revenue through its Drilling International segment, which contributes CA$52.1 million, and its Drilling Canada segment, encompassing Surface Drilling, Underground Drilling, and Manufacturing Canada, which accounts for CA$135.1 million.

Market Cap: CA$55.06M

Orbit Garant Drilling Inc., with a market cap of CA$55.06 million, has demonstrated financial resilience and growth potential. Recent earnings show an increase in sales to CA$50.06 million for Q3 2025, with net income rising to CA$2.65 million compared to the previous year. The company has achieved profitability, supported by high-quality earnings and strong interest coverage at 6.5 times EBIT. Although its management team is relatively new with limited tenure, the board is experienced with an average tenure of 3.6 years. Despite a high net debt-to-equity ratio of 46.5%, short-term assets comfortably cover liabilities.

- Click to explore a detailed breakdown of our findings in Orbit Garant Drilling's financial health report.

- Examine Orbit Garant Drilling's earnings growth report to understand how analysts expect it to perform.

Gatekeeper Systems (TSXV:GSI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Gatekeeper Systems Inc. designs, manufactures, markets, and sells video security solutions for mobile and transportation environments focused on children, passengers, and public safety in Canada and the United States with a market cap of CA$74.23 million.

Operations: The company generates revenue primarily from its Electronic Security Devices segment, which accounted for CA$31.33 million.

Market Cap: CA$74.23M

Gatekeeper Systems Inc., with a market cap of CA$74.23 million, operates in the video security solutions sector and remains unprofitable despite reducing losses over the past five years. The company has no debt, and its short-term assets exceed both short- and long-term liabilities, indicating financial stability. Recent contracts with transit agencies and school districts across North America highlight revenue opportunities through equipment sales and recurring subscription services for AI-assisted video management solutions. However, recent earnings show a decline in sales to CA$5.92 million for Q2 2025, compared to CA$9.86 million a year ago, reflecting ongoing challenges in achieving profitability.

- Dive into the specifics of Gatekeeper Systems here with our thorough balance sheet health report.

- Explore historical data to track Gatekeeper Systems' performance over time in our past results report.

Turning Ideas Into Actions

- Embark on your investment journey to our 883 TSX Penny Stocks selection here.

- Contemplating Other Strategies? We've found 20 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if illumin Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ILLM

illumin Holdings

A technology company, provides digital media solutions in the United States, Canada, Europe, Latin America, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives