- Canada

- /

- Metals and Mining

- /

- TSXV:SUP

Discover C-Com Satellite Systems And Two Other TSX Penny Stocks

Reviewed by Simply Wall St

As we navigate the early days of 2025, the Canadian market has been characterized by fluctuating bond yields and a complex economic landscape, with recent U.S. inflation data providing some relief to both stocks and bonds. In this context, investors are reminded of the importance of earnings in driving stock-market direction amid interest rate pressures. While penny stocks may seem like an outdated term, they continue to represent opportunities for those interested in smaller or newer companies that might offer growth potential alongside strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Silvercorp Metals (TSX:SVM) | CA$4.32 | CA$985.56M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.43 | CA$388.78M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.48 | CA$14.32M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.44 | CA$123.54M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.71 | CA$669.36M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.29 | CA$229.35M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.05 | CA$29.82M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.17M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.85 | CA$179.61M | ★★★★★☆ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.01 | CA$137.56M | ★★★★★☆ |

Click here to see the full list of 936 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

C-Com Satellite Systems (TSXV:CMI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: C-Com Satellite Systems Inc. develops and deploys mobile auto-deploying satellite-based technology for high-speed Internet, VoIP, and video services in various regions globally and has a market cap of CA$46.06 million.

Operations: The company generates revenue of CA$10.34 million from the design and manufacture of auto-deploying mobile satellite antennas.

Market Cap: CA$46.06M

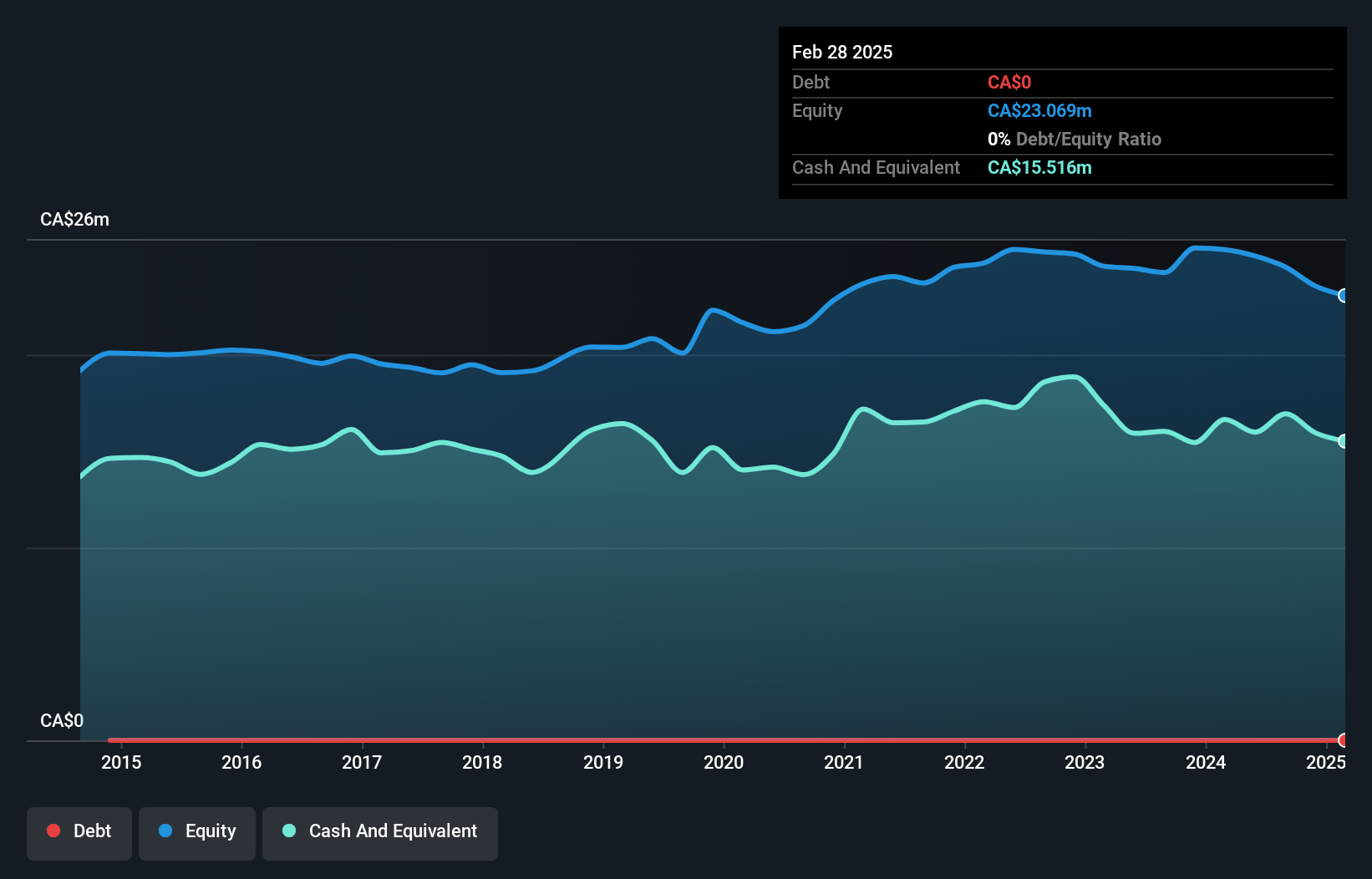

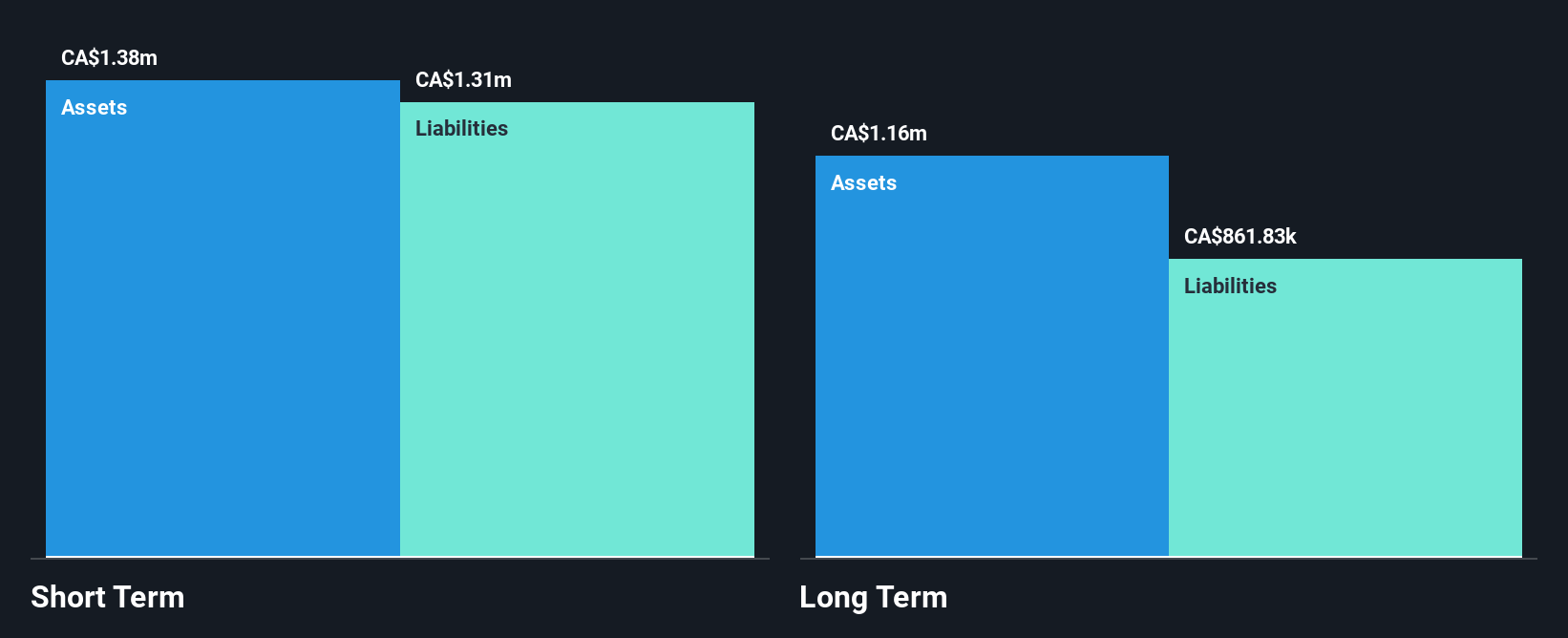

C-Com Satellite Systems Inc., with a market cap of CA$46.06 million, recently became profitable, marking a significant shift in its financial trajectory. Despite this progress, the company's Return on Equity remains low at 8.1%, and it has suspended its dividend to focus on strategic projects like the Ka-band Electronically Steered Antenna (ESA). The company maintains strong liquidity with short-term assets of CA$25.6 million exceeding both short- and long-term liabilities, while remaining debt-free for five years. However, earnings have declined by 7% annually over the past five years despite recent profitability improvements.

- Get an in-depth perspective on C-Com Satellite Systems' performance by reading our balance sheet health report here.

- Understand C-Com Satellite Systems' track record by examining our performance history report.

Forum Energy Metals (TSXV:FMC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Forum Energy Metals Corp. is involved in the evaluation, acquisition, exploration, and development of natural resource properties in Canada and the United States with a market cap of CA$21.20 million.

Operations: Currently, Forum Energy Metals Corp. does not report any revenue segments.

Market Cap: CA$21.2M

Forum Energy Metals Corp., with a market cap of CA$21.20 million, is pre-revenue and unprofitable, facing significant earnings declines over the past five years. The company has a volatile share price but remains debt-free and recently bolstered its cash position through private placements, raising CA$518,000. Forum's exploration efforts at its Aberdeen property in Nunavut have shown promising results with potential new uranium zones identified. Despite these developments, the company's short-term assets cover its liabilities comfortably for now. The board is experienced, yet there's insufficient data on management tenure to assess leadership stability fully.

- Navigate through the intricacies of Forum Energy Metals with our comprehensive balance sheet health report here.

- Explore historical data to track Forum Energy Metals' performance over time in our past results report.

Northern Superior Resources (TSXV:SUP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Northern Superior Resources Inc. is a junior mining company focused on exploring and developing gold properties in Ontario and Québec, Canada, with a market cap of CA$77.62 million.

Operations: Northern Superior Resources Inc. does not currently report any revenue segments.

Market Cap: CA$77.62M

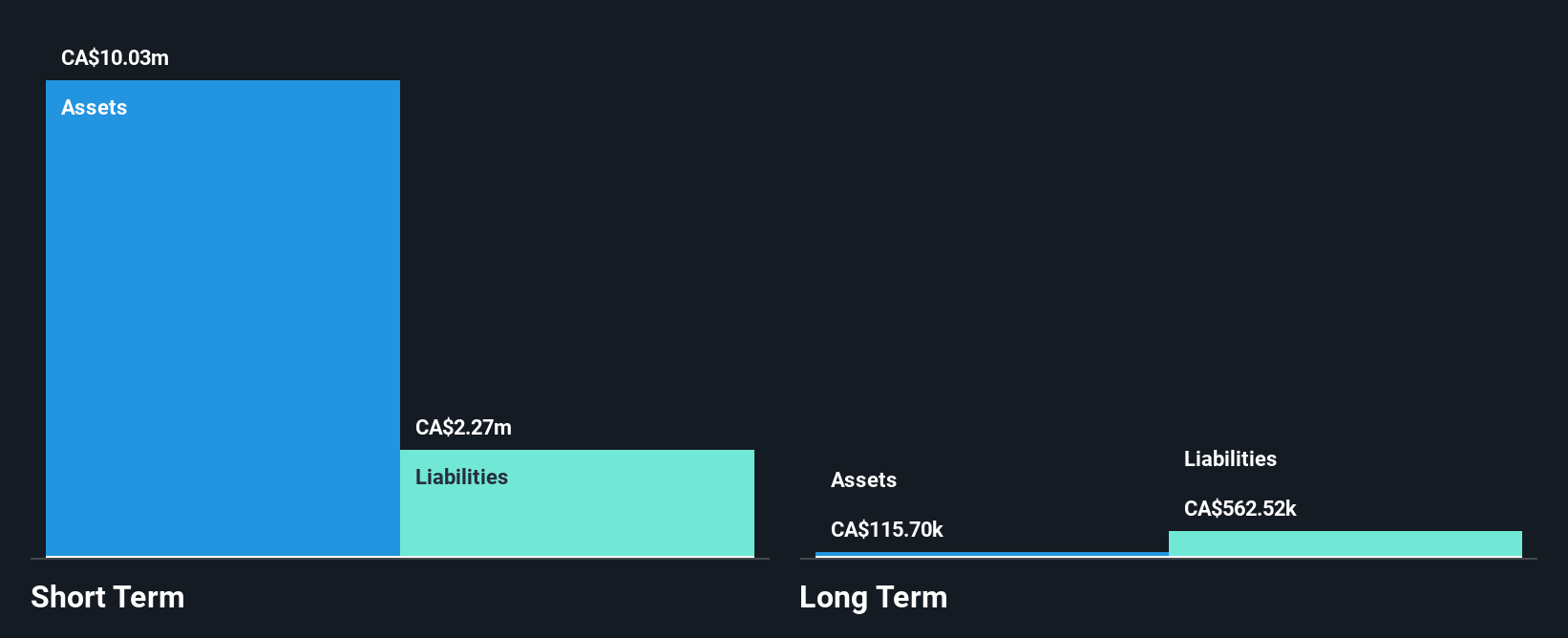

Northern Superior Resources Inc., with a market cap of CA$77.62 million, is a pre-revenue junior mining company focused on gold exploration in Ontario and Québec. The company recently reported increased losses for the third quarter of 2024 but maintains a strong cash position, covering both short and long-term liabilities comfortably. Recent drilling results at its Philibert Project have shown promising mineralized intersections, suggesting potential resource expansion in the Chibougamau Gold District. Despite being unprofitable with declining earnings over the past five years, Northern Superior remains debt-free and has sufficient cash runway for continued exploration efforts.

- Unlock comprehensive insights into our analysis of Northern Superior Resources stock in this financial health report.

- Assess Northern Superior Resources' previous results with our detailed historical performance reports.

Taking Advantage

- Discover the full array of 936 TSX Penny Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northern Superior Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SUP

Northern Superior Resources

An exploration stage junior mining company, engages in the identification, acquisition, evaluation, and exploration of gold properties in Ontario and Québec, Canada.

Flawless balance sheet very low.

Market Insights

Community Narratives