- Canada

- /

- Communications

- /

- TSX:VCM

Vecima Networks (TSX:VCM) Faces Earnings With 11.5% Revenue Growth and Strong Valuation Context

Reviewed by Simply Wall St

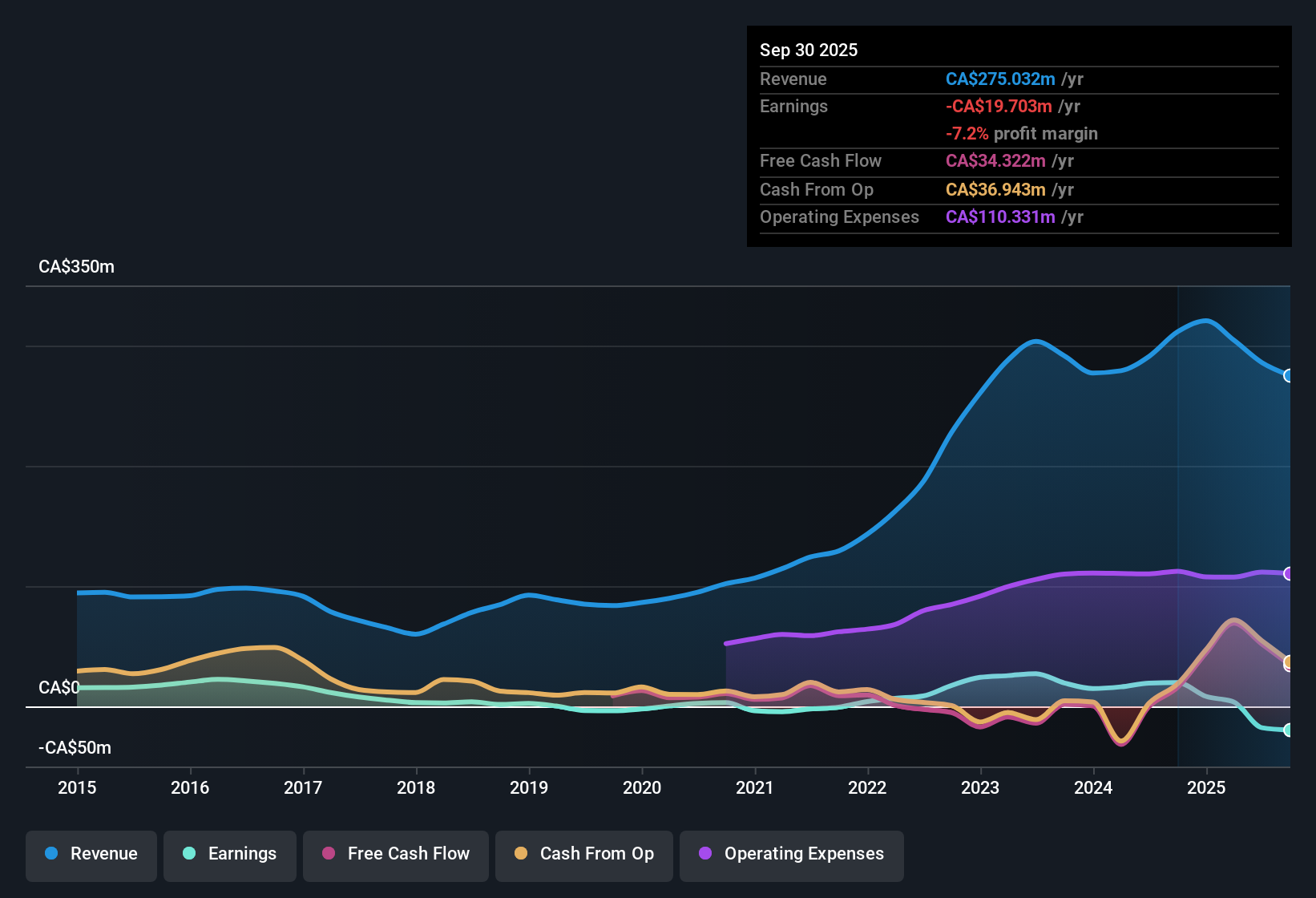

Vecima Networks (TSX:VCM) is set to outpace its market, with revenue forecast to grow 11.5% per year, well ahead of the broader Canadian market's expected 4.1% annual growth. Even with robust growth prospects and shares trading at CA$10.37, notably under the estimated fair value of CA$17, the company remains unprofitable and recent earnings growth figures are not directly comparable to historical averages. Investors are focusing on several reward signals, including strong value indications and sustained revenue momentum, though close watch is warranted on the company’s journey to profitability.

See our full analysis for Vecima Networks.Next, we’ll see how these performance figures look in context by comparing them to the narratives widely tracked by the market and the Simply Wall St community.

Curious how numbers become stories that shape markets? Explore Community Narratives

Price-to-Sales Lags Industry Average

- Vecima’s Price-to-Sales Ratio sits at 0.9x, which undercuts both its peer group at 1.0x and the North American Communications industry norm of 1.9x. This points to a material valuation discount against the broader sector.

- Heavily supporting those looking for relative value, investors point out Vecima now trades below both the industry average and recent analyst targets.

- The CA$10.37 share price is not only at a significant discount to the industry but also below the most recent analyst target of CA$16.00.

- This sharp gap between the current price and multiples seen elsewhere may attract bargain hunters who believe the sector’s momentum will eventually lift Vecima’s valuation up toward peers.

Unprofitable Yet Outpacing on Revenue

- The company remains unprofitable, as there is no evidence of positive net income in the most recent filings. However, its revenue is projected to grow 11.5% per year, vastly exceeding the Canadian market’s 4.1% average.

- Those watching the prevailing market view highlight a tension here: despite rapid top-line growth, the ongoing lack of profitability continues to be a sticking point for some, while others believe that robust sector trends will eventually allow revenue expansion to feed through to the bottom line.

- On one hand, rapid revenue growth (11.5% vs 4.1% market average) heavily supports hopeful narratives about future scale and earnings potential.

- On the other hand, with no profit yet on the books, the debate centers on timing. Will operational leverage eventually deliver the earnings investors anticipate, or will the profitability gap linger?

Dividend Sustainability in Focus

- The main risk flagged is ongoing concern about whether current dividends are sustainable, rather than headline payout ratios rising or falling. Sustainability remains the key issue, not a cut or increase.

- Those analyzing the prevailing view point out there are only minor risks flagged outside dividend questions, and the focus is firmly on whether cash flows from projected growth can reliably support future payouts.

- With no reported changes to dividend payouts in recent data, bears are not highlighting a cut, but challenge whether future payments are built on a firm foundation with the company still in the red.

- Rewards so far cluster around growth and value, but dividend-focused investors might remain cautious until clear evidence emerges that growing revenues are making dividends safer over time.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Vecima Networks's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.See What Else Is Out There

Vecima’s ongoing lack of profitability and questions about dividend sustainability may give some investors pause. This is despite the company’s revenue growth and attractive valuation.

If you want more reliable income, check out dividend stocks with yields > 3% to spot companies delivering consistent dividends with the fundamentals to support future payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:VCM

Vecima Networks

Engages in the development of integrated hardware and software solutions for broadband access, content delivery, and telematics.

Very undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success