- Canada

- /

- Communications

- /

- TSX:STC

Does Sangoma Technologies’ (TSX:STC) Share Buyback Reflect Renewed Confidence or Cautious Optimism?

Reviewed by Simply Wall St

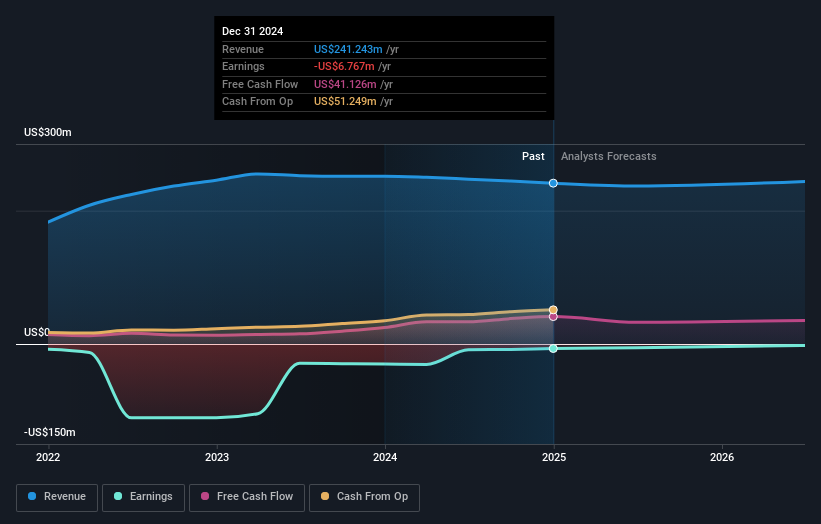

- Sangoma Technologies Corporation recently reported its financial results for the year ended June 30, 2025, with sales of US$236.69 million and a reduced net loss of US$5.01 million compared to the previous year.

- An interesting aspect is management’s completion of a share buyback, signaling confidence in the company even as guidance projects stable revenues excluding divested operations for fiscal 2026.

- We’ll explore how Sangoma’s narrowed net loss and updated guidance contribute to the broader investment narrative for the year ahead.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

What Is Sangoma Technologies' Investment Narrative?

For anyone considering Sangoma Technologies, you need to believe in the company's ability to refocus its core product and service segments after recent operational changes. While this year’s results showed revenue softening to US$236.69 million, management managed to narrow net losses and executed a meaningful share buyback, both of which may signal improving discipline and internal confidence. The guidance for fiscal 2026 pegs revenues at US$200–210 million, aligning with the current trajectory after excluding divested operations, but suggests limited near-term top-line growth. On the positive side, cost control and the buyback offer short-term support as the company transitions. However, with the revenue reset, the biggest risk shifts toward whether Sangoma can reignite sustainable growth in its core markets or if ongoing competitive pressures will keep weighing on financial performance. For now, the news both clarifies management’s priorities and reins in expectations for fast revenue recovery.

But, there’s a stark risk around execution that investors should not overlook. Despite retreating, Sangoma Technologies' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 3 other fair value estimates on Sangoma Technologies - why the stock might be worth just CA$11.28!

Build Your Own Sangoma Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sangoma Technologies research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Sangoma Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sangoma Technologies' overall financial health at a glance.

No Opportunity In Sangoma Technologies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:STC

Sangoma Technologies

Develops, manufactures, distributes, and supports voice and data connectivity components for software-based communication applications in the United States of America and internationally.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives