As the Canadian market navigates a complex landscape marked by trade developments and economic adjustments, the TSX has shown resilience, bolstered by strong performances in sectors like materials. In this context, investors might find value in exploring penny stocks—smaller or newer companies that can offer unique opportunities despite their somewhat outdated label. By focusing on those with robust financials and clear growth potential, these stocks may present compelling prospects for those willing to look beyond traditional investments.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.73 | CA$73.84M | ✅ 4 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$1.73 | CA$68.55M | ✅ 4 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.61 | CA$419.14M | ✅ 3 ⚠️ 2 View Analysis > |

| Silvercorp Metals (TSX:SVM) | CA$4.90 | CA$1.12B | ✅ 5 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.08 | CA$580.58M | ✅ 4 ⚠️ 2 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.70 | CA$283.88M | ✅ 2 ⚠️ 2 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.56 | CA$539.85M | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.62 | CA$126.48M | ✅ 1 ⚠️ 2 View Analysis > |

| McCoy Global (TSX:MCB) | CA$3.35 | CA$91.2M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.49 | CA$12.89M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 928 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Haivision Systems (TSX:HAI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Haivision Systems Inc. offers mission-critical, real-time video networking and visual collaboration solutions across Canada, the United States, and internationally with a market cap of CA$114.28 million.

Operations: The company generates CA$123.12 million in revenue from its Internet Telephone segment.

Market Cap: CA$114.28M

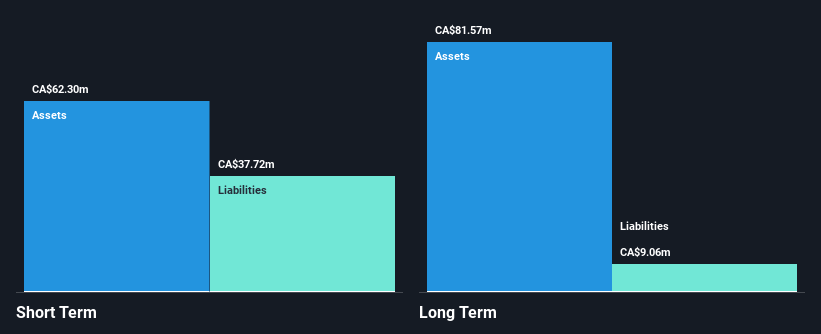

Haivision Systems Inc., with a market cap of CA$114.28 million, has demonstrated significant earnings growth over the past year at 63.5%, outpacing the Communications industry average. Despite this, recent earnings results for Q1 2025 showed a decline in sales to CA$28.16 million and a net loss of CA$1.08 million compared to last year's profit. The company's debt is well covered by operating cash flow, and its short-term assets exceed both short- and long-term liabilities, indicating solid financial management despite low return on equity at 2.4%. Haivision trades significantly below estimated fair value, suggesting potential undervaluation in the market.

- Click to explore a detailed breakdown of our findings in Haivision Systems' financial health report.

- Learn about Haivision Systems' future growth trajectory here.

NervGen Pharma (TSXV:NGEN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: NervGen Pharma Corp. is a clinical-stage biotech company focused on developing pharmaceutical treatments for nervous system damage, with a market cap of CA$212.25 million.

Operations: NervGen Pharma Corp. currently does not report any revenue segments.

Market Cap: CA$212.25M

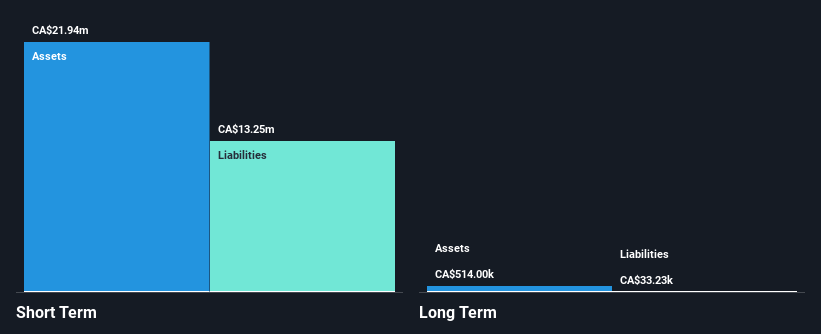

NervGen Pharma Corp., with a market cap of CA$212.25 million, is pre-revenue and focused on developing NVG-291 for spinal cord injuries. The company recently initiated an expanded access policy for NVG-291 following FDA approval, allowing treatment use outside clinical trials. Despite a net loss of CA$24.01 million in 2024, NervGen remains debt-free with short-term assets covering liabilities and has not diluted shareholders recently. However, the cash runway is limited to less than a year if current cash flow trends continue. Analysts expect the stock price to rise significantly based on consensus estimates.

- Click here to discover the nuances of NervGen Pharma with our detailed analytical financial health report.

- Review our growth performance report to gain insights into NervGen Pharma's future.

QYOU Media (TSXV:QYOU)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: QYOU Media Inc. is a company that curates, produces, and distributes content from social media stars and digital creators in the United States and India, with a market cap of CA$15.93 million.

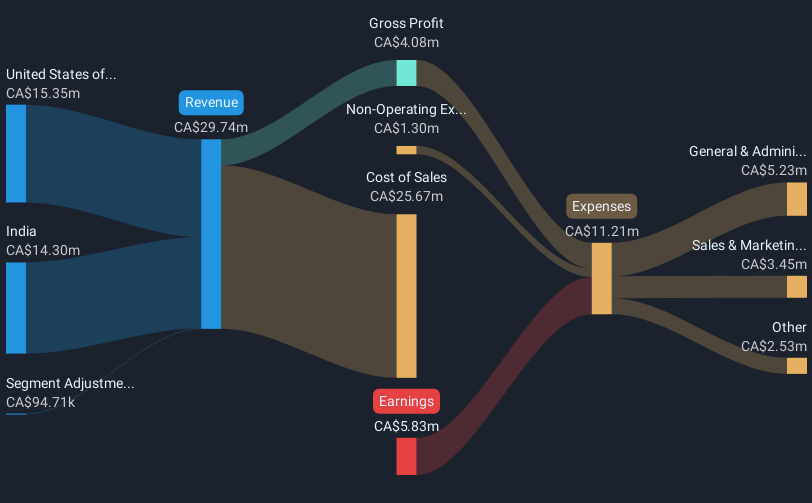

Operations: The company generates revenue of CA$29.74 million from distributing curated media content.

Market Cap: CA$15.93M

QYOU Media Inc., with a market cap of CA$15.93 million, is navigating financial challenges despite generating CA$29.74 million in revenue from curated media content. The company remains unprofitable with a negative return on equity and increased debt levels over the past five years. Recent efforts to bolster finances include a private placement offering aimed at raising up to CA$2.3 million, which may extend its limited cash runway beyond the current two months based on free cash flow estimates. While short-term liabilities exceed assets, long-term obligations are covered, and management demonstrates seasoned experience amidst high share price volatility.

- Unlock comprehensive insights into our analysis of QYOU Media stock in this financial health report.

- Evaluate QYOU Media's historical performance by accessing our past performance report.

Where To Now?

- Reveal the 928 hidden gems among our TSX Penny Stocks screener with a single click here.

- Seeking Other Investments? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QYOU Media might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:QYOU

QYOU Media

Through its subsidiaries, curates, produces, and distributes content created by social media stars and digital content creators in the United States, Canada, and India.

Slight risk with imperfect balance sheet.

Market Insights

Community Narratives