As the U.S. government shutdown creates uncertainty south of the border, Canadian markets remain resilient, buoyed by robust consumer spending and significant investments in artificial intelligence. In this context, penny stocks—often misunderstood as relics of past trading days—still hold potential for those seeking growth opportunities in smaller or newer companies. By focusing on strong financial health, investors can uncover hidden value and explore promising prospects within this niche segment of the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$3.08 | CA$77.86M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$22.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.55 | CA$4.59M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.365 | CA$54.82M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.37 | CA$911.46M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.16 | CA$22.99M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.76 | CA$445.72M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.51 | CA$178.15M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.19 | CA$207.9M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.80 | CA$9.96M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 418 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

NanoXplore (TSX:GRA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: NanoXplore Inc. is a graphene company that manufactures and supplies graphene powder for transportation and industrial markets in Australia, with a market cap of CA$496.47 million.

Operations: The company generates revenue from two primary segments: Battery Cells and Materials, which contributed CA$0.67 million, and Advanced Materials, Plastics and Composite Products, which brought in CA$128.24 million.

Market Cap: CA$496.47M

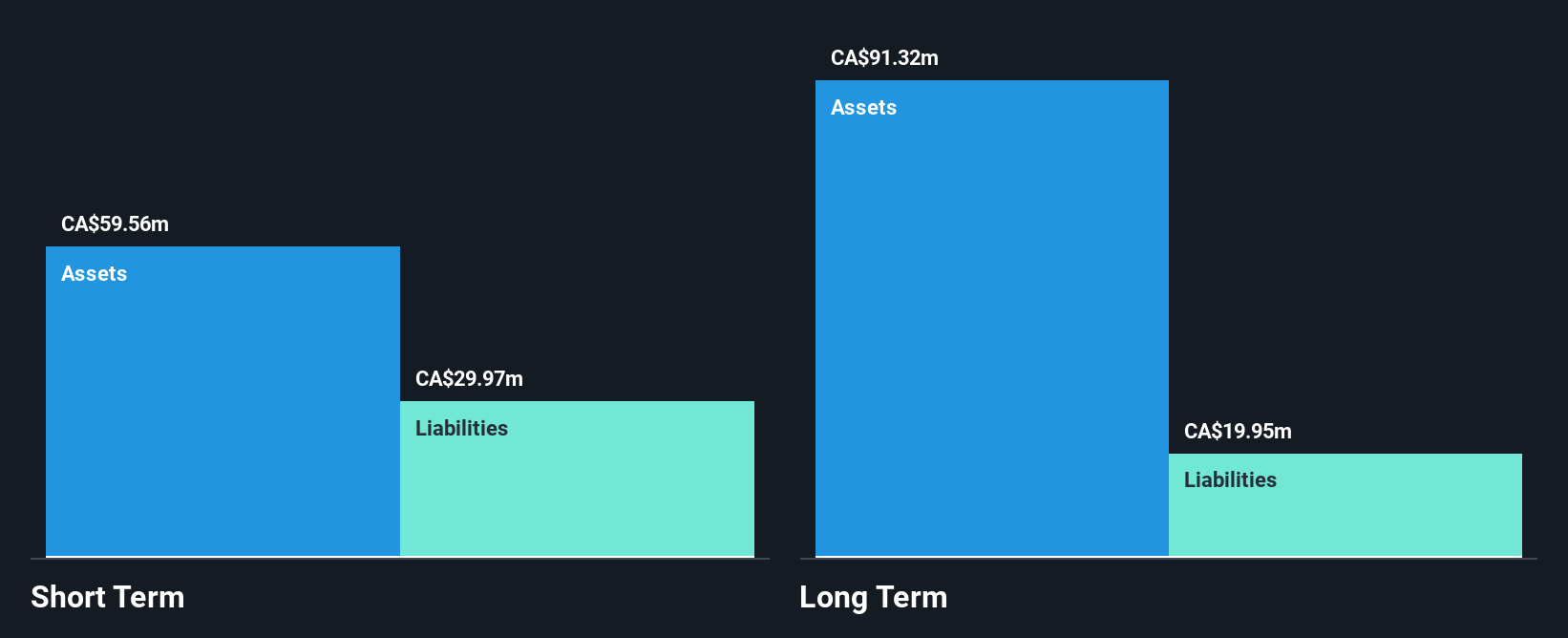

NanoXplore Inc., with a market cap of CA$496.47 million, is navigating its unprofitable status by leveraging strategic partnerships and operational improvements. The company recently secured a multi-year supply agreement with Chevron Phillips Chemical to provide Tribograf™, enhancing its commercial prospects in the oil and gas sector. Despite reporting a net loss of CA$9.66 million for the year ended June 2025, NanoXplore's financial stability is supported by short-term assets exceeding liabilities and reduced debt levels over five years. Leadership changes are underway, with COO Rocco Marinaccio set to become CEO, potentially driving further operational efficiencies.

- Click to explore a detailed breakdown of our findings in NanoXplore's financial health report.

- Learn about NanoXplore's future growth trajectory here.

Tantalus Systems Holding (TSX:GRID)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tantalus Systems Holding Inc. is a technology company that offers smart grid solutions in Canada and the United States, with a market cap of CA$200.08 million.

Operations: The company's revenue is primarily derived from its Connected Devices and Infrastructure segment, which generated $31.51 million, and its Utility Software Applications and Services segment, contributing $17.66 million.

Market Cap: CA$200.08M

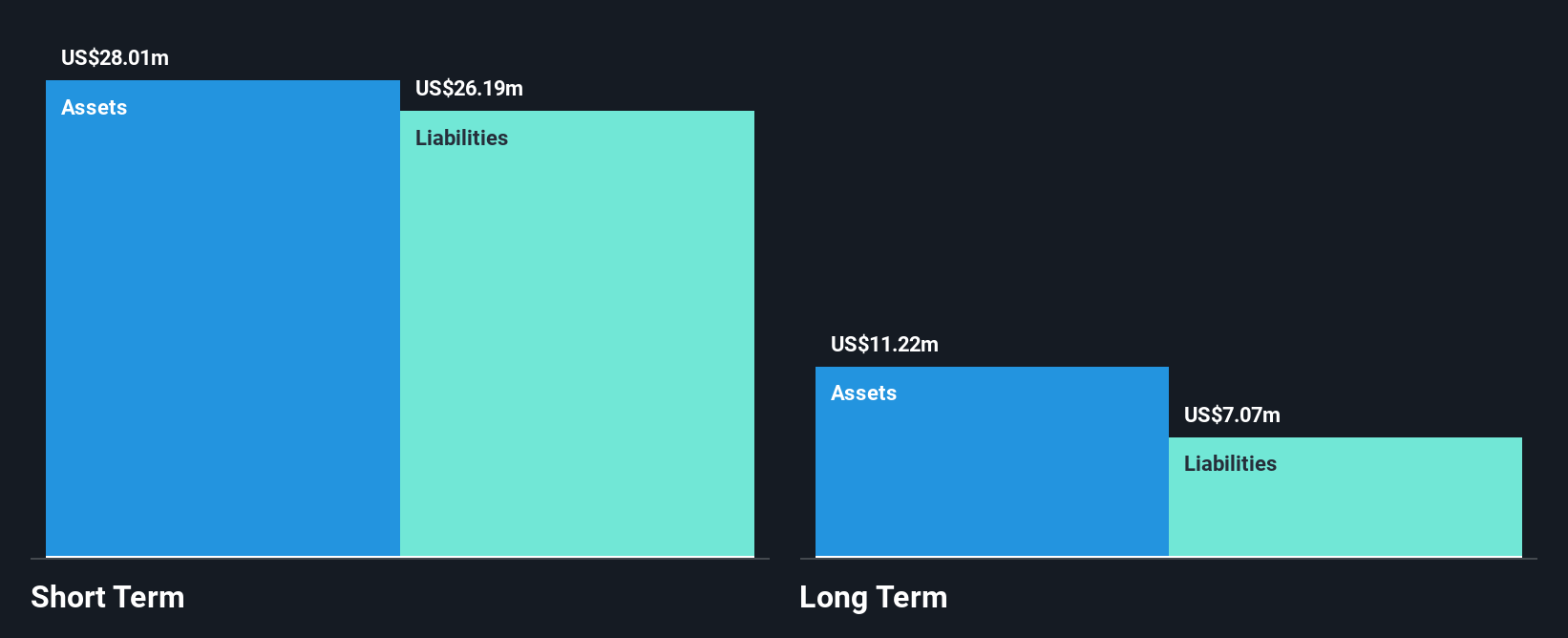

Tantalus Systems Holding Inc., with a market cap of CA$200.08 million, is showing signs of resilience in the penny stock arena despite its unprofitability. Recent earnings reveal a reduction in net loss to US$0.903 million for Q2 2025, alongside revenue growth to US$13.09 million from the previous year. The company's strategic expansion with EPB in Chattanooga illustrates its capability to secure significant contracts and enhance grid modernization efforts through TRUSense Ethernet Gateways deployment. Tantalus benefits from experienced leadership and maintains financial stability with short-term assets exceeding liabilities, supported by a positive cash runway exceeding three years.

- Navigate through the intricacies of Tantalus Systems Holding with our comprehensive balance sheet health report here.

- Examine Tantalus Systems Holding's earnings growth report to understand how analysts expect it to perform.

Sintana Energy (TSXV:SEI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sintana Energy Inc. is involved in the exploration and development of crude oil and natural gas, with a market cap of CA$246.27 million.

Operations: Sintana Energy Inc. does not report any revenue segments.

Market Cap: CA$246.27M

Sintana Energy Inc., with a market cap of CA$246.27 million, remains pre-revenue and unprofitable, reflecting the challenges in its sector. Despite this, the company has no debt and maintains financial stability with short-term assets of CA$16.3 million surpassing liabilities. Recent developments include a 12-month extension for its exploration license in Namibia's Orange Basin, potentially enhancing future prospects through strategic partnerships and promising geological data. The seasoned management team provides experienced oversight as Sintana navigates these early stages of development without shareholder dilution over the past year.

- Dive into the specifics of Sintana Energy here with our thorough balance sheet health report.

- Understand Sintana Energy's track record by examining our performance history report.

Seize The Opportunity

- Discover the full array of 418 TSX Penny Stocks right here.

- Want To Explore Some Alternatives? Rare earth metals are the new gold rush. Find out which 33 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NanoXplore might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GRA

NanoXplore

A graphene company, manufactures and supplies graphene powder for use in transportation and industrial markets in Australia.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives