Tantalus Systems Holding Inc. (TSE:GRID) Stock Catapults 26% Though Its Price And Business Still Lag The Industry

Tantalus Systems Holding Inc. (TSE:GRID) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. The last month tops off a massive increase of 125% in the last year.

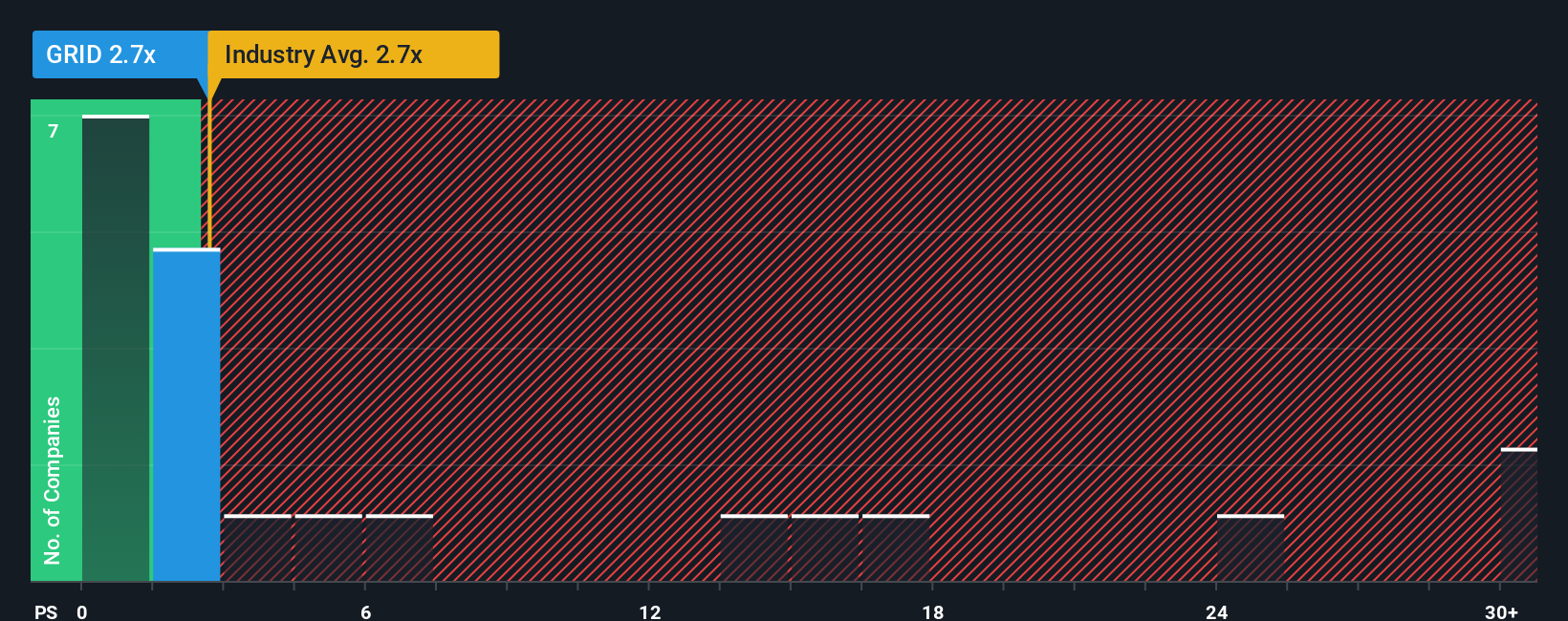

Although its price has surged higher, Tantalus Systems Holding's price-to-sales (or "P/S") ratio of 2.7x might still make it look like a buy right now compared to the Electronic industry in Canada, where around half of the companies have P/S ratios above 4.2x and even P/S above 18x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Tantalus Systems Holding

What Does Tantalus Systems Holding's Recent Performance Look Like?

There hasn't been much to differentiate Tantalus Systems Holding's and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. Those who are bullish on Tantalus Systems Holding will be hoping that this isn't the case.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Tantalus Systems Holding.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Tantalus Systems Holding would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 21% last year. The strong recent performance means it was also able to grow revenue by 42% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 16% during the coming year according to the six analysts following the company. That's shaping up to be materially lower than the 21% growth forecast for the broader industry.

With this in consideration, its clear as to why Tantalus Systems Holding's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

The latest share price surge wasn't enough to lift Tantalus Systems Holding's P/S close to the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Tantalus Systems Holding maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Tantalus Systems Holding that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Tantalus Systems Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:GRID

Tantalus Systems Holding

A technology company, provides smart grid solutions in Canada and the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026