Investors Still Aren't Entirely Convinced By Tantalus Systems Holding Inc.'s (TSE:GRID) Revenues Despite 26% Price Jump

Despite an already strong run, Tantalus Systems Holding Inc. (TSE:GRID) shares have been powering on, with a gain of 26% in the last thirty days. The annual gain comes to 114% following the latest surge, making investors sit up and take notice.

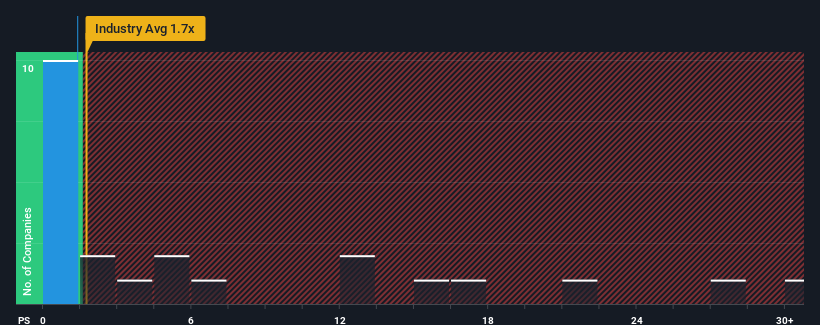

Even after such a large jump in price, Tantalus Systems Holding's price-to-sales (or "P/S") ratio of 1.4x might still make it look like a buy right now compared to the Electronic industry in Canada, where around half of the companies have P/S ratios above 3.2x and even P/S above 15x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Tantalus Systems Holding

What Does Tantalus Systems Holding's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Tantalus Systems Holding has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Tantalus Systems Holding will help you uncover what's on the horizon.How Is Tantalus Systems Holding's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Tantalus Systems Holding's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.4% last year. The solid recent performance means it was also able to grow revenue by 28% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Turning to the outlook, the next three years should generate growth of 19% each year as estimated by the five analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 8.8% each year, which is noticeably less attractive.

In light of this, it's peculiar that Tantalus Systems Holding's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

Despite Tantalus Systems Holding's share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A look at Tantalus Systems Holding's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Tantalus Systems Holding that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Tantalus Systems Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:GRID

Tantalus Systems Holding

A technology company, provides smart grid solutions in Canada and the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion