- Canada

- /

- Metals and Mining

- /

- TSXV:SOMA

August 2025's TSX Penny Stock Standouts

Reviewed by Simply Wall St

Amidst a backdrop of evolving economic conditions, the Canadian market is navigating challenges such as inflationary pressures and fluctuating employment rates. For investors exploring beyond well-known stocks, penny stocks—typically smaller or newer companies—remain intriguing, despite the term's outdated connotations. These stocks can offer unique opportunities for growth and value, particularly when backed by robust financials; this article will highlight three standout examples that demonstrate resilience and potential in today's market landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.61 | CA$68.78M | ✅ 3 ⚠️ 3 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.035 | CA$2.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.435 | CA$12.46M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.76 | CA$505.63M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.90 | CA$17.84M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$4.07 | CA$203.53M | ✅ 2 ⚠️ 1 View Analysis > |

| Avino Silver & Gold Mines (TSX:ASM) | CA$4.88 | CA$698.44M | ✅ 3 ⚠️ 1 View Analysis > |

| ACT Energy Technologies (TSX:ACX) | CA$4.70 | CA$157.8M | ✅ 4 ⚠️ 2 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.92 | CA$182.35M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.70 | CA$9.65M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 433 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Tantalus Systems Holding (TSX:GRID)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tantalus Systems Holding Inc. is a technology company that offers smart grid solutions in Canada and the United States, with a market cap of CA$156.30 million.

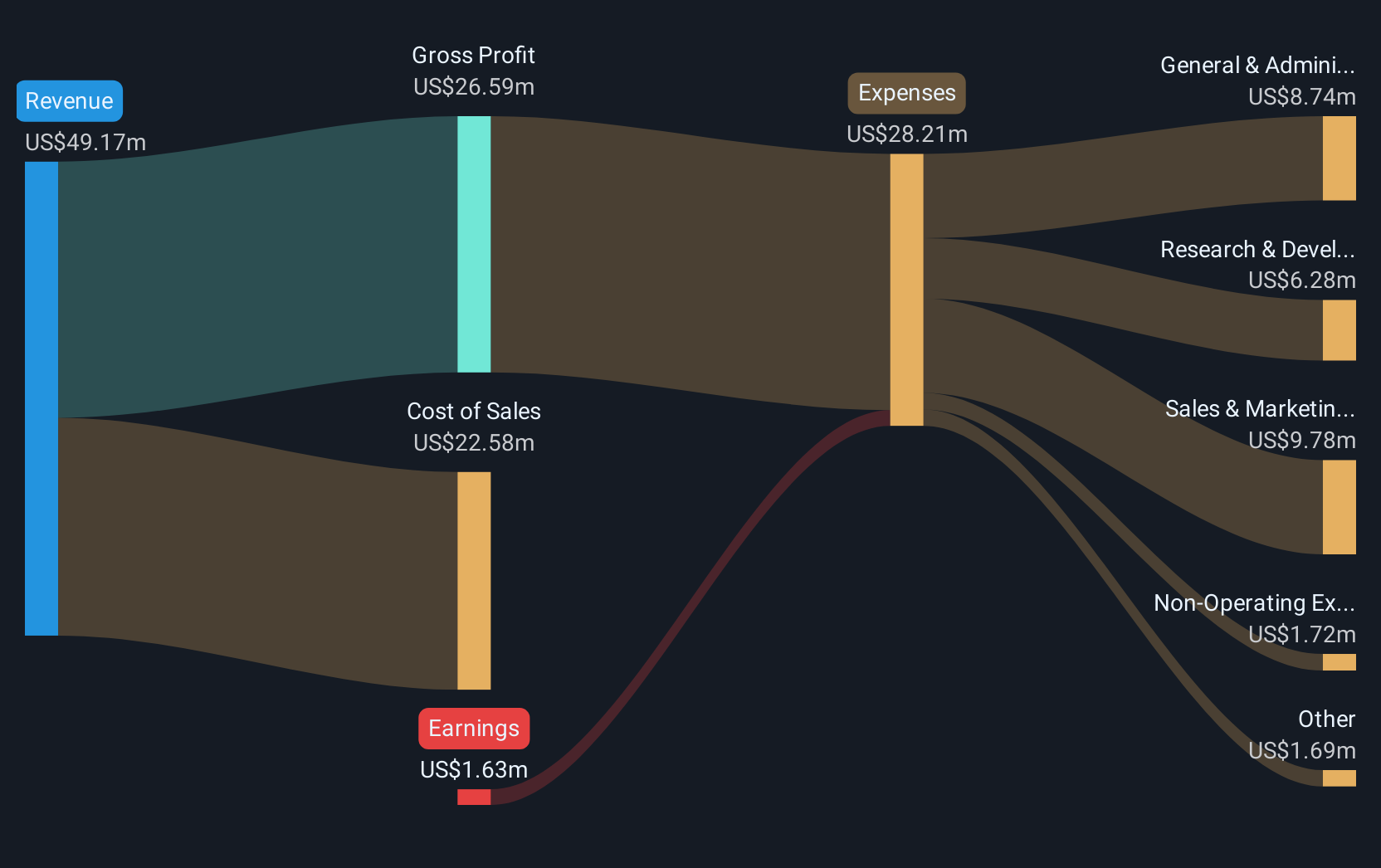

Operations: The company's revenue is derived from two main segments: Connected Devices and Infrastructure, generating $29.62 million, and Utility Software Applications and Services, contributing $17.20 million.

Market Cap: CA$156.3M

Tantalus Systems Holding Inc., a technology company with a market cap of CA$156.30 million, has shown revenue growth despite being currently unprofitable. Recent earnings reports indicated sales of US$13.09 million for Q2 2025, up from US$10.74 million the previous year, with a net loss reduction to US$0.903 million from US$1 million. The company has secured significant contracts, including expansions and deployments with EPB in Chattanooga and Indiana Municipal Power Agency, demonstrating its technological relevance in grid modernization efforts. Tantalus maintains more cash than debt and possesses a stable cash runway exceeding three years if current conditions persist.

- Navigate through the intricacies of Tantalus Systems Holding with our comprehensive balance sheet health report here.

- Learn about Tantalus Systems Holding's future growth trajectory here.

Soma Gold (TSXV:SOMA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Soma Gold Corp. is a natural resource company focused on the acquisition, exploration, and development of mineral properties in Colombia, with a market cap of CA$107.32 million.

Operations: The company generates revenue primarily from its operations in Colombia, amounting to CA$97.91 million.

Market Cap: CA$107.32M

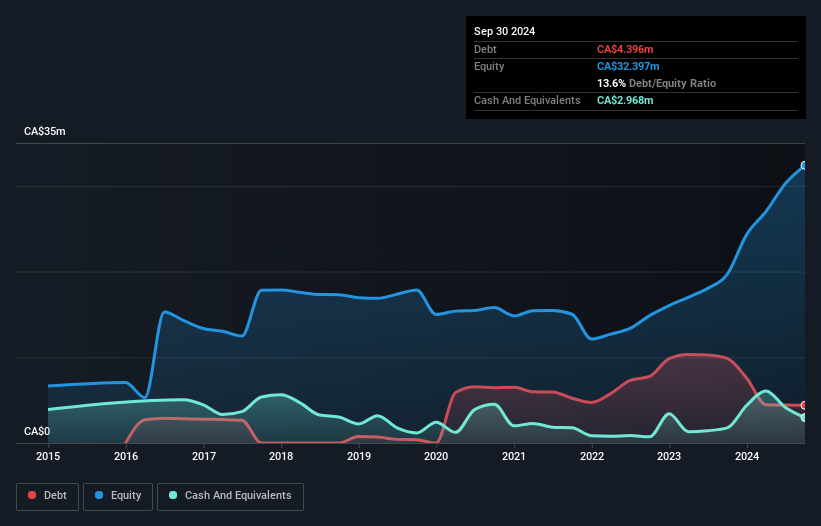

Soma Gold Corp., with a market cap of CA$107.32 million, has recently demonstrated significant growth, reporting earnings of CA$3.17 million for Q1 2025 compared to a loss last year. The company's revenue from Colombian operations reached CA$97.91 million, reflecting robust operational performance. Soma's recent private placement aims to raise up to CAD 17.25 million, signaling investor confidence and potential growth funding. However, the company faces challenges with high net debt-to-equity ratio (108%) and long-term liabilities exceeding short-term assets by CA$5.1M, indicating financial leverage concerns despite strong interest coverage and operating cash flow support.

- Click here to discover the nuances of Soma Gold with our detailed analytical financial health report.

- Examine Soma Gold's past performance report to understand how it has performed in prior years.

Tornado Infrastructure Equipment (TSXV:TGH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tornado Infrastructure Equipment Ltd. designs, fabricates, manufactures, and sells hydrovac trucks in North America with a market cap of CA$242.99 million.

Operations: The company generates revenue from the Canadian market, contributing CA$36.20 million, and the United States market, which accounts for CA$102.44 million.

Market Cap: CA$243M

Tornado Infrastructure Equipment Ltd., with a market cap of CA$242.99 million, is experiencing steady growth in earnings and revenue, driven by its strategic initiatives and strong market presence in North America. The company's recent Q1 2025 results showed an increase in sales to CA$35.65 million from the previous year, alongside improved net income of CA$2.85 million. With high return on equity at 27.1% and cash surpassing total debt, Tornado is well-positioned financially. Analysts expect continued growth due to infrastructure spending, strategic acquisitions like CustomVac, and enhanced production capabilities at its Red Deer facility set for completion soon.

- Click here and access our complete financial health analysis report to understand the dynamics of Tornado Infrastructure Equipment.

- Explore Tornado Infrastructure Equipment's analyst forecasts in our growth report.

Make It Happen

- Click through to start exploring the rest of the 430 TSX Penny Stocks now.

- Want To Explore Some Alternatives? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 25 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SOMA

Soma Gold

A natural resource company, engages in the acquisition, exploration, and development of mineral properties in Columbia.

Solid track record and good value.

Market Insights

Community Narratives