- Canada

- /

- Infrastructure

- /

- TSX:WTE

Undiscovered Gems in Canada to Explore June 2025

Reviewed by Simply Wall St

As the Canadian market navigates through a landscape marked by trade developments and anticipated central bank actions, investors are closely monitoring the potential for volatility amidst these economic shifts. Despite these challenges, solid fundamentals continue to support a bullish outlook, creating an intriguing environment for discovering under-the-radar opportunities in small-cap stocks. In this context, identifying promising stocks involves looking for companies with resilient business models and strong growth potential that can thrive even in uncertain economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pulse Seismic | NA | 11.60% | 32.30% | ★★★★★★ |

| Mako Mining | 6.32% | 19.64% | 64.11% | ★★★★★★ |

| TWC Enterprises | 4.02% | 13.46% | 16.81% | ★★★★★★ |

| Majestic Gold | 9.90% | 11.70% | 9.35% | ★★★★★★ |

| Pinetree Capital | 0.20% | 63.68% | 65.79% | ★★★★★★ |

| Itafos | 25.35% | 11.11% | 49.69% | ★★★★★★ |

| BMTC Group | NA | -4.13% | -8.71% | ★★★★★☆ |

| Corby Spirit and Wine | 57.06% | 9.84% | -5.44% | ★★★★☆☆ |

| Genesis Land Development | 48.16% | 31.08% | 55.45% | ★★★★☆☆ |

| Dundee | 2.02% | -35.84% | 57.23% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Evertz Technologies (TSX:ET)

Simply Wall St Value Rating: ★★★★★★

Overview: Evertz Technologies Limited designs, manufactures, and distributes video and audio infrastructure solutions for production, post-production, broadcast, and telecommunications markets globally with a market cap of CA$914.60 million.

Operations: Evertz Technologies generates revenue primarily from its Television Broadcast Equipment Market segment, which reported CA$496.59 million. The company's financial performance is influenced by its cost structure and market dynamics, with a focus on optimizing operational efficiencies to enhance profitability.

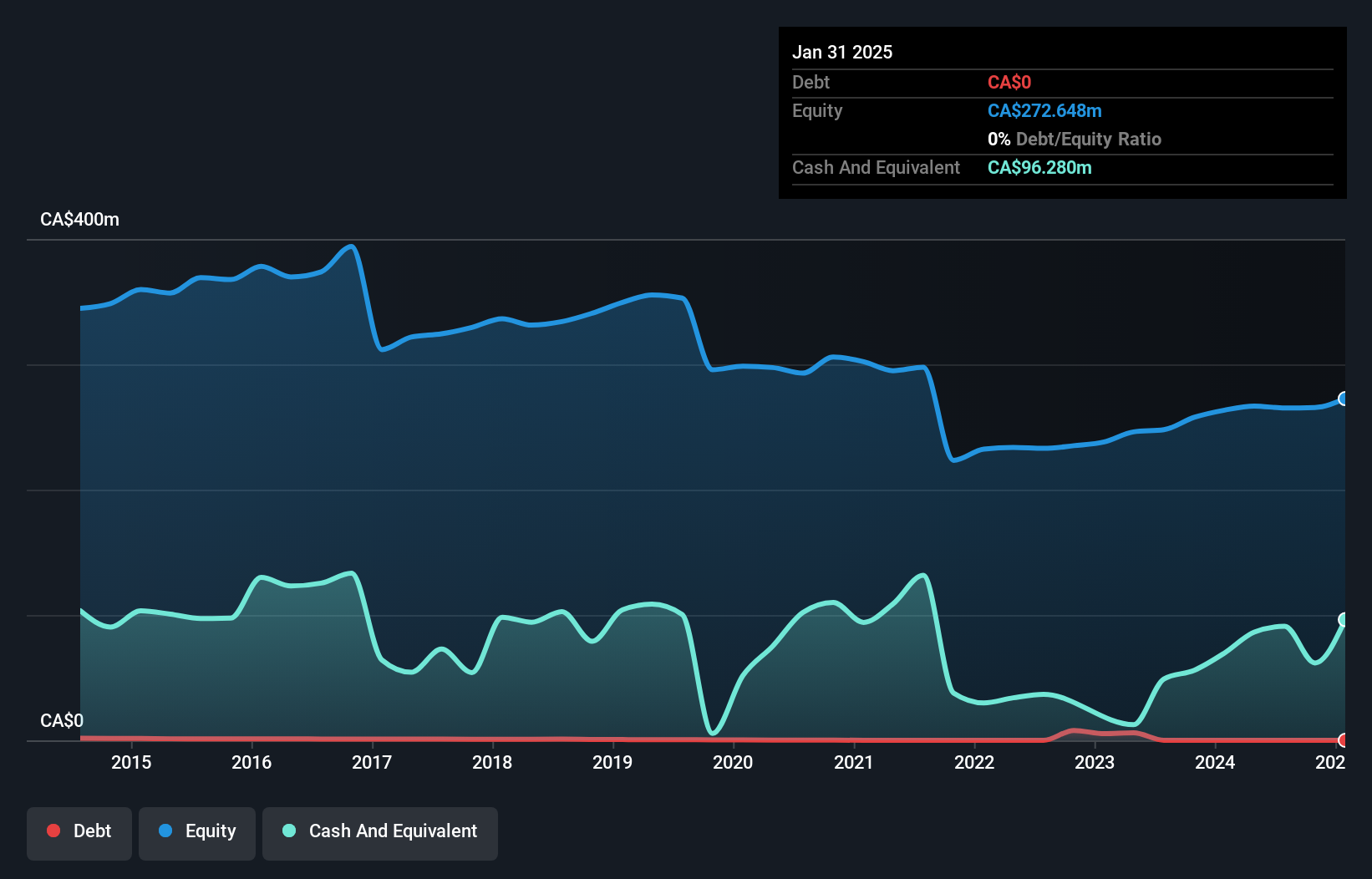

Evertz Technologies, a notable player in the communications sector, is navigating a complex landscape with both opportunities and challenges. The company, which boasts high-quality earnings and no debt, is capitalizing on the rising demand for IP-based and cloud solutions. Despite facing a 19.6% negative earnings growth last year against an industry average of 35.8%, Evertz remains attractive with its price-to-earnings ratio of 15.2x below the Canadian market's 15.4x. A significant purchase order backlog over CA$269 million underscores future demand potential, though rising R&D costs may pressure profit margins from 12.1% to an anticipated 10.5%.

BMTC Group (TSX:GBT)

Simply Wall St Value Rating: ★★★★★☆

Overview: BMTC Group Inc. operates a retail network in Canada, focusing on furniture, household appliances, and electronic products, with a market cap of CA$421.23 million.

Operations: BMTC Group generates revenue primarily from its retail network, with a significant segment adjustment of CA$612.43 million. The company also derives a smaller portion of its revenue from real estate activities amounting to CA$3.25 million.

BMTC Group, a Canadian retail player, showcases an intriguing mix of financial dynamics. Despite reporting a net loss of CA$12.93 million in Q1 2025 compared to a net income of CA$1.46 million the previous year, its earnings have grown by 171.5% over the past year, outpacing the industry average of 6.7%. The company is debt-free now, contrasting with a debt-to-equity ratio of 1.7 five years ago and has recently completed share repurchases totaling CA$4.72 million for 357,050 shares under its buyback program announced in April 2024.

- Unlock comprehensive insights into our analysis of BMTC Group stock in this health report.

Explore historical data to track BMTC Group's performance over time in our Past section.

Westshore Terminals Investment (TSX:WTE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Westshore Terminals Investment Corporation operates a coal storage and unloading/loading terminal at Roberts Bank, British Columbia, with a market cap of CA$1.68 billion.

Operations: Westshore generates revenue primarily from its transportation infrastructure segment, amounting to CA$402.78 million. The company's net profit margin is a key financial indicator to consider when assessing its profitability.

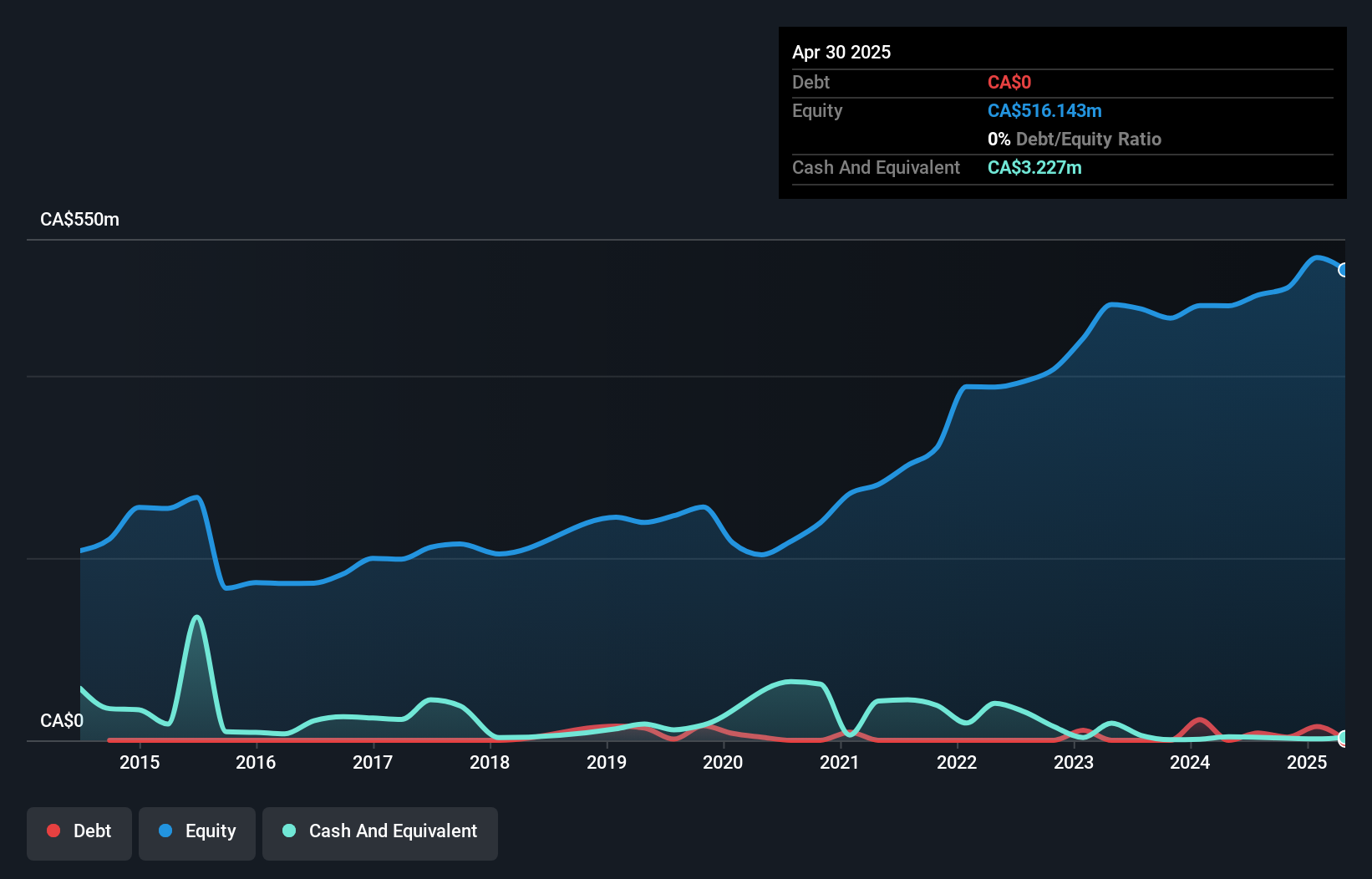

Westshore Terminals, a notable player in Canada's infrastructure sector, has shown impressive earnings growth of 12.7% over the past year, outpacing the industry average of 10.1%. The company is debt-free and trades at 31.7% below its estimated fair value, highlighting potential investment appeal. Recent executive changes include Glenn Dudar stepping up as CEO, succeeding William Stinson who retired after a long tenure since 2007. Despite a slight dip in Q1 revenue to CAD 82.81 million from CAD 84.76 million last year, Westshore continues to offer dividends at $0.375 per share and plans to repurchase up to 807,118 shares under its buyback program.

- Dive into the specifics of Westshore Terminals Investment here with our thorough health report.

Learn about Westshore Terminals Investment's historical performance.

Summing It All Up

- Access the full spectrum of 44 TSX Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Westshore Terminals Investment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WTE

Westshore Terminals Investment

Operates a coal storage and unloading/loading terminal at Roberts Bank, British Columbia.

Adequate balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion