- Canada

- /

- Food and Staples Retail

- /

- TSX:NWC

Undiscovered Gems In Canada September 2025

Reviewed by Simply Wall St

As the Canadian market navigates a period of economic contraction, with GDP declining by 1.6% in the second quarter and modest growth anticipated, investor attention is shifting towards small-cap stocks that may benefit from potential monetary easing by the Bank of Canada. In this environment, identifying promising investments requires a focus on companies with strong fundamentals and resilience to economic fluctuations, particularly those poised to capitalize on broader market participation and potential interest rate adjustments.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pulse Seismic | NA | 13.84% | 33.31% | ★★★★★★ |

| Clairvest Group | NA | -8.94% | -11.82% | ★★★★★★ |

| TWC Enterprises | 3.89% | 13.21% | 11.52% | ★★★★★★ |

| Mako Mining | 5.45% | 22.24% | 62.70% | ★★★★★★ |

| Itafos | 23.13% | 10.69% | 44.01% | ★★★★★★ |

| BMTC Group | NA | -4.13% | -8.71% | ★★★★★☆ |

| Grown Rogue International | 26.48% | 33.74% | 4.14% | ★★★★★☆ |

| Corby Spirit and Wine | 58.35% | 10.79% | -4.77% | ★★★★☆☆ |

| Soma Gold | 142.85% | 31.11% | 38.09% | ★★★★☆☆ |

| Dundee | 1.89% | -35.40% | 52.34% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Birchcliff Energy (TSX:BIR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Birchcliff Energy Ltd. is an intermediate oil and natural gas company involved in the exploration, development, and production of natural gas, light oil, condensate, and other natural gas liquids in Western Canada with a market cap of approximately CA$1.72 billion.

Operations: The company generates revenue primarily from its oil and gas exploration and production segment, amounting to CA$648.22 million.

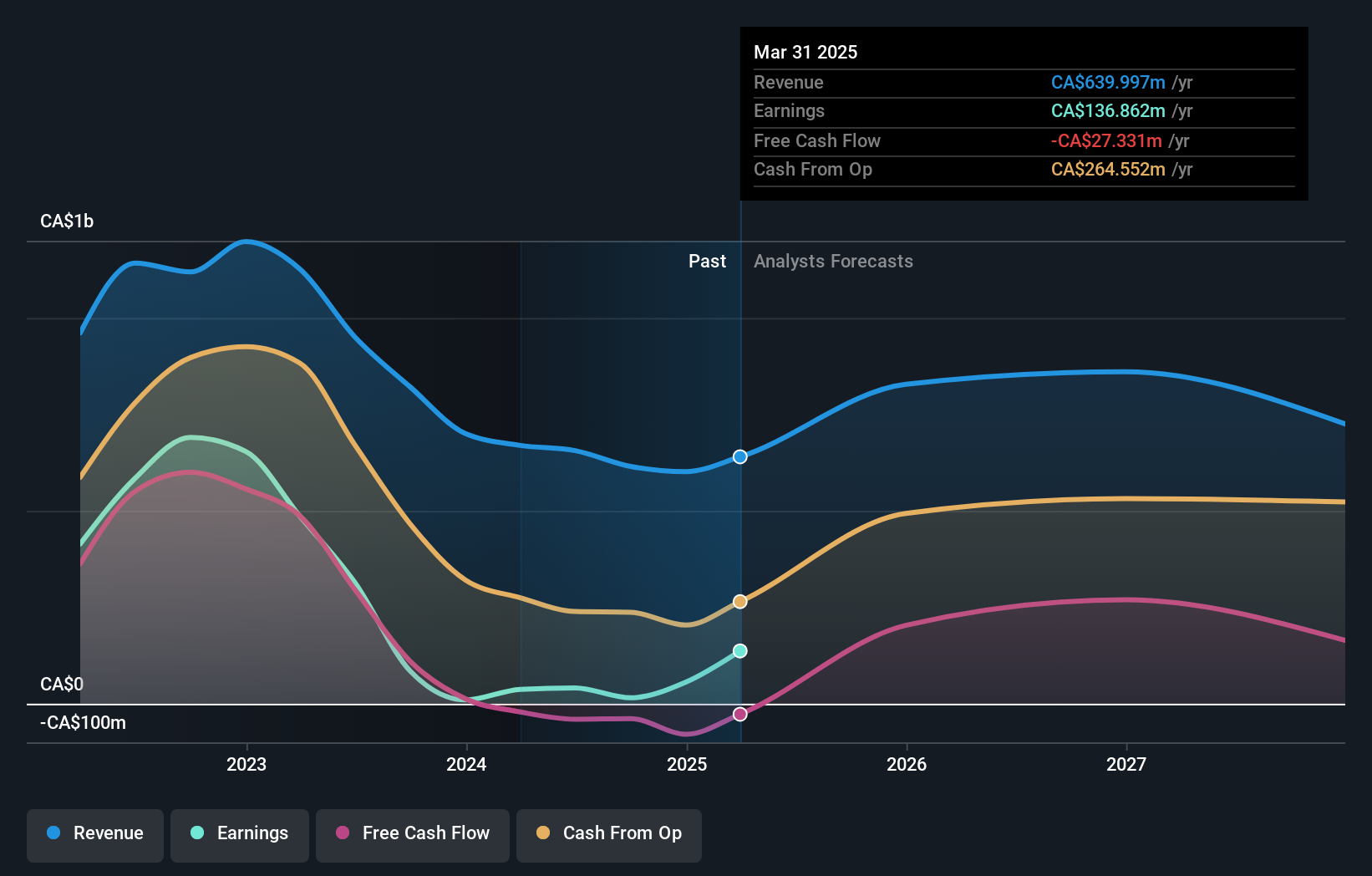

Birchcliff Energy, a promising player in Canada's energy sector, has been making waves with its impressive financial metrics. Over the past year, earnings surged by 87.2%, significantly outpacing the industry's 7.8% growth rate. The company boasts a satisfactory net debt to equity ratio of 23.6%, down from 50% over five years, indicating prudent financial management. Despite recent insider selling and a challenging quarter with a CAD 13.9 million net loss against last year's CAD 46.38 million profit, Birchcliff's high-quality earnings and well-covered interest payments reflect robust operational health amidst fluctuating market conditions.

Evertz Technologies (TSX:ET)

Simply Wall St Value Rating: ★★★★★★

Overview: Evertz Technologies Limited designs, manufactures, and distributes video and audio infrastructure solutions for production, post-production, broadcast, and telecommunications markets globally with a market cap of CA$913.49 million.

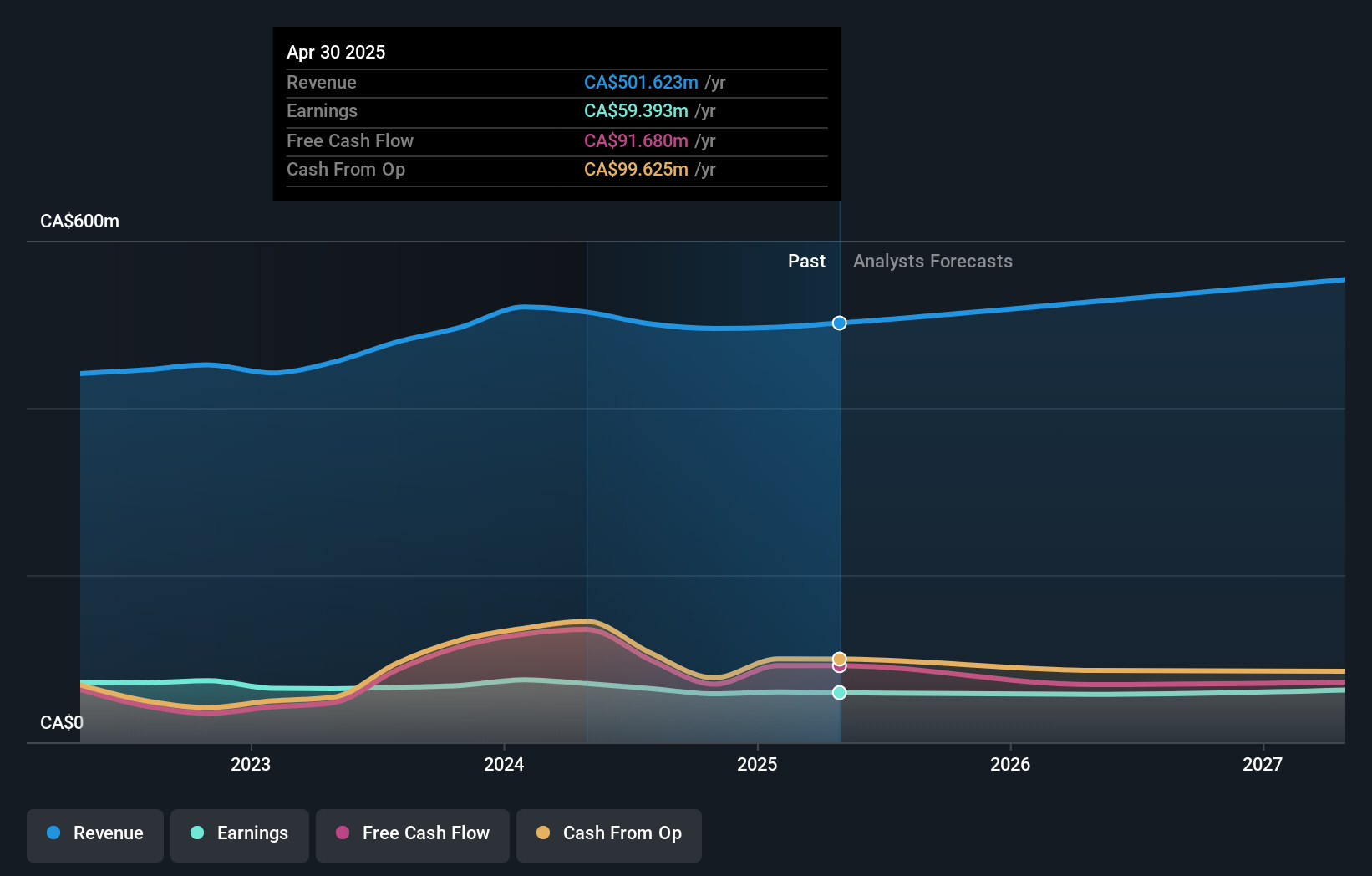

Operations: Evertz Technologies generates revenue primarily from the Television Broadcast Equipment Market, amounting to CA$501.62 million. The company's financial performance is influenced by its net profit margin trends, which reflect its profitability after accounting for all expenses.

Evertz Technologies, a nimble player in the tech sector, is leveraging its transition to software and cloud solutions to enhance profit margins and secure stable recurring revenue. Despite facing challenges like declining hardware sales and customer concentration, Evertz remains debt-free with a strong cash flow of CA$135.12 million as of April 2024. The company repurchased 190,772 shares for CA$2.02 million between February and April 2025, reflecting confidence in its valuation at CA$12 per share against a target of CA$13.92. However, net income fell to CA$59.39 million from last year's CA$70.17 million due to industry pressures.

North West (TSX:NWC)

Simply Wall St Value Rating: ★★★★★★

Overview: The North West Company Inc. operates as a retailer of food and everyday products and services in northern Canada, rural Alaska, the South Pacific, and the Caribbean with a market capitalization of approximately CA$2.41 billion.

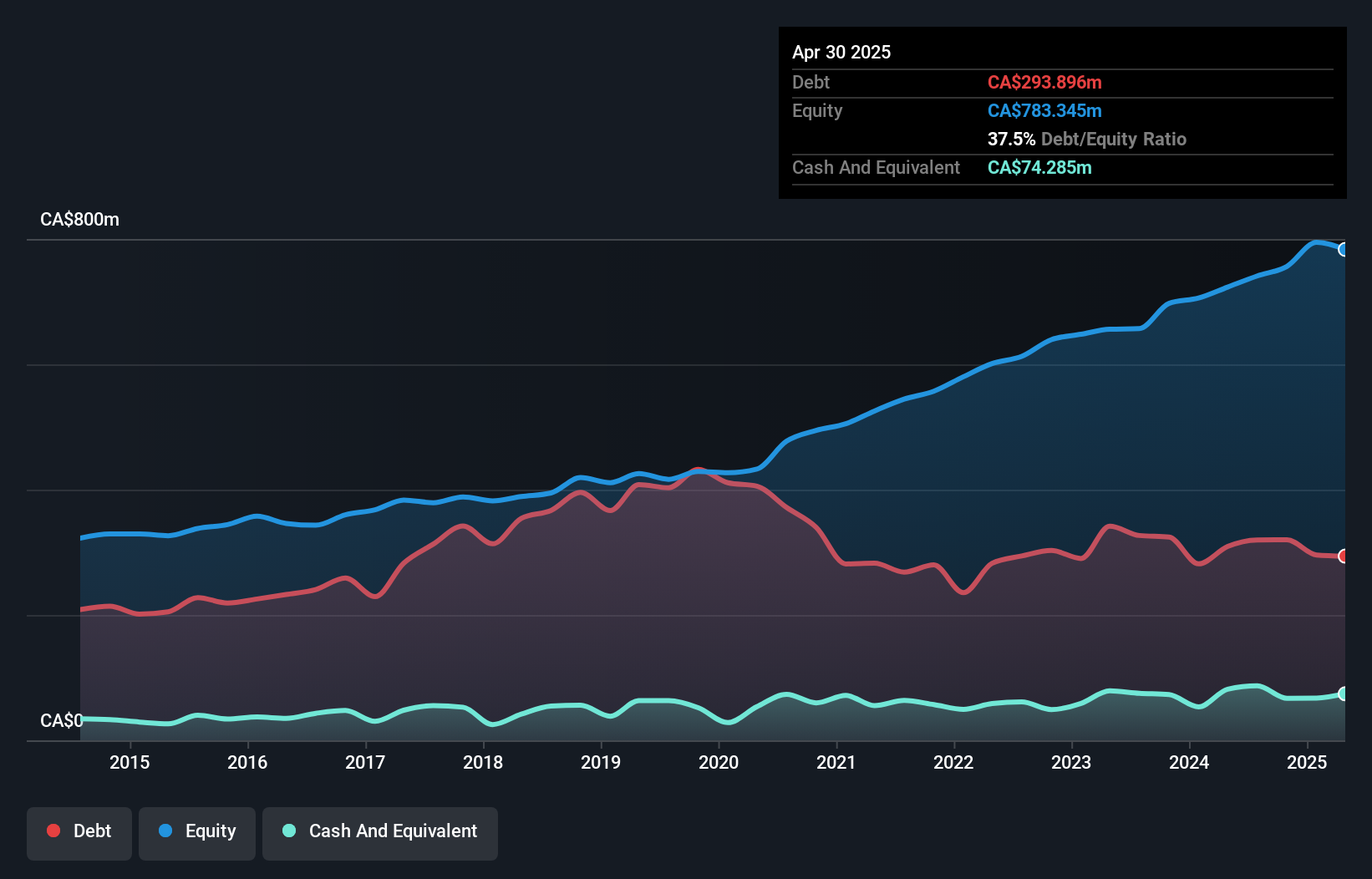

Operations: North West generates revenue primarily from retailing food and everyday products and services, with reported sales of approximately CA$2.60 billion.

North West shows promise with a net debt to equity ratio of 28%, which is satisfactory, and interest payments well-covered by EBIT at 11.9 times. Over the past year, earnings grew by 2.7%, outpacing the Consumer Retailing industry’s -0.3%. The company trades at a significant discount, valued at 66.6% below its estimated fair value, and boasts high-quality earnings alongside positive free cash flow. Recent developments include appointing Gregg Saretsky as director and reporting first-quarter sales of CAD 641 million with net income slightly up to CAD 25.84 million from last year’s CAD 25.53 million.

- Dive into the specifics of North West here with our thorough health report.

Evaluate North West's historical performance by accessing our past performance report.

Summing It All Up

- Gain an insight into the universe of 51 TSX Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if North West might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NWC

North West

Through its subsidiaries, engages in the retail of food and everyday products and services in northern Canada, rural Alaska, the South Pacific, and the Caribbean.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives