- Canada

- /

- Communications

- /

- TSX:ET

Undiscovered Gems In Canada Featuring 3 Promising Small Caps

Reviewed by Simply Wall St

As Canadian and U.S. stocks continue to reach new highs, buoyed by trade optimism and strong corporate earnings, investors are enjoying a period of low volatility and steady gains across the TSX. In this environment of cautious optimism, identifying promising small-cap stocks can be particularly rewarding, especially those with solid fundamentals that can thrive amid evolving trade dynamics and economic indicators.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pulse Seismic | NA | 13.84% | 33.31% | ★★★★★★ |

| Mako Mining | 6.32% | 19.64% | 64.11% | ★★★★★★ |

| TWC Enterprises | 4.02% | 13.46% | 16.81% | ★★★★★★ |

| Majestic Gold | 9.90% | 11.70% | 9.35% | ★★★★★★ |

| Pinetree Capital | 0.21% | 62.25% | 64.39% | ★★★★★★ |

| Heliostar Metals | NA | 106.15% | 25.35% | ★★★★★★ |

| Itafos | 25.35% | 11.11% | 49.69% | ★★★★★★ |

| BMTC Group | NA | -4.13% | -8.71% | ★★★★★☆ |

| Corby Spirit and Wine | 57.06% | 9.84% | -5.44% | ★★★★☆☆ |

| Dundee | 2.02% | -35.84% | 57.23% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Birchcliff Energy (TSX:BIR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Birchcliff Energy Ltd. is an intermediate oil and natural gas company focused on the exploration, development, and production of natural gas, light oil, condensate, and other natural gas liquids in Western Canada with a market cap of approximately CA$1.88 billion.

Operations: Revenue primarily comes from the exploration and production of oil and gas, totaling CA$640 million.

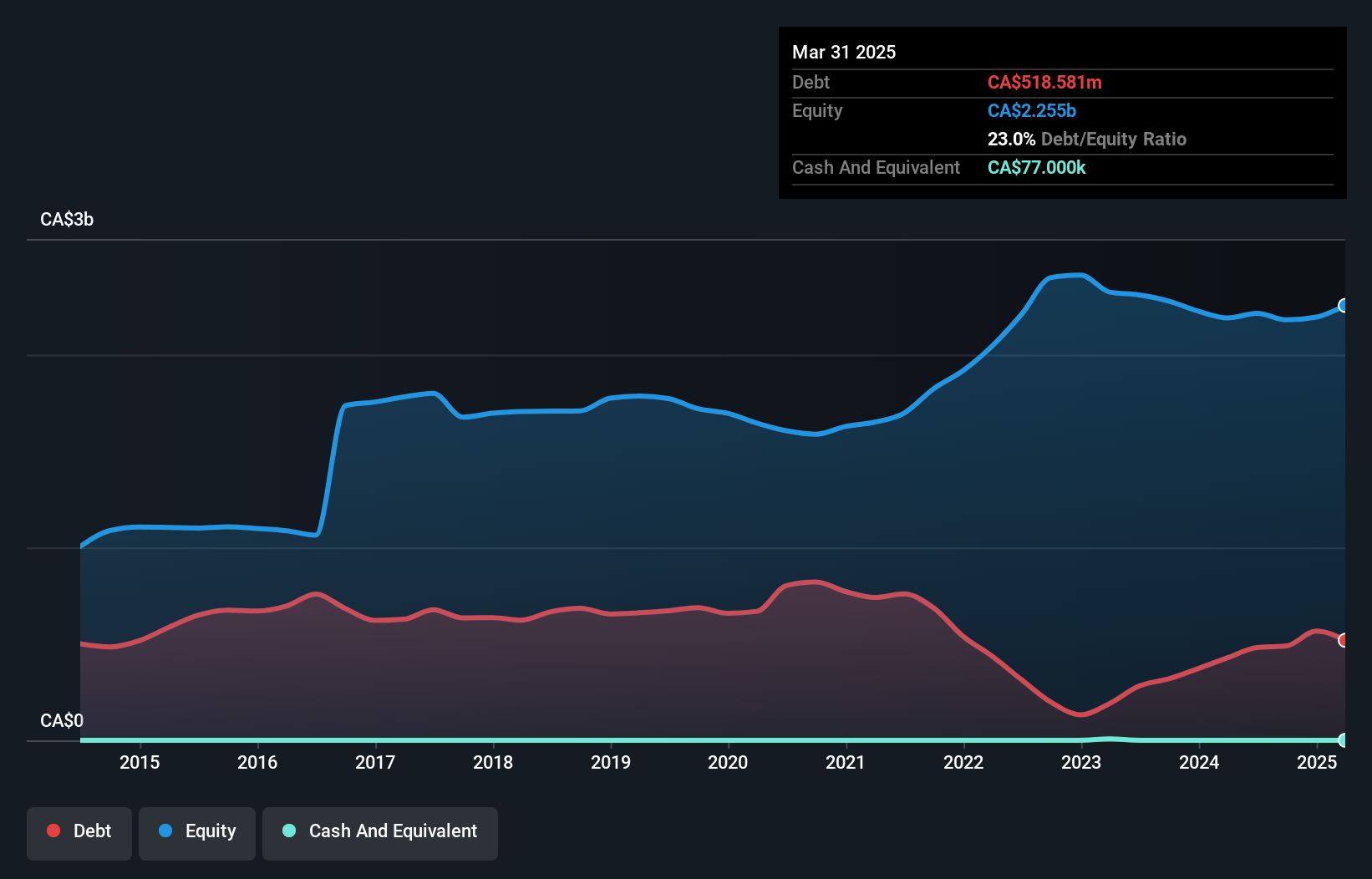

With a debt to equity ratio dropping from 40.7% to 23% over five years, Birchcliff Energy seems to have tightened its financial ship. The company reported a robust earnings growth of 267%, outpacing the industry average of just 3%. Its price-to-earnings ratio at 13.4x is attractive compared to the Canadian market's 16.1x, suggesting good value for investors eyeing energy stocks. Despite not being free cash flow positive, Birchcliff's profitability ensures no immediate cash runway concerns. Recent results showed revenue climbing to CAD 243 million and net income reaching CAD 65 million in Q1 2025, indicating solid operational performance.

- Take a closer look at Birchcliff Energy's potential here in our health report.

Gain insights into Birchcliff Energy's past trends and performance with our Past report.

Evertz Technologies (TSX:ET)

Simply Wall St Value Rating: ★★★★★★

Overview: Evertz Technologies Limited designs, manufactures, and distributes video and audio infrastructure solutions for production, post-production, broadcast, and telecommunications markets globally with a market cap of CA$916.93 million.

Operations: The primary revenue stream for Evertz Technologies comes from the Television Broadcast Equipment Market, generating CA$501.62 million.

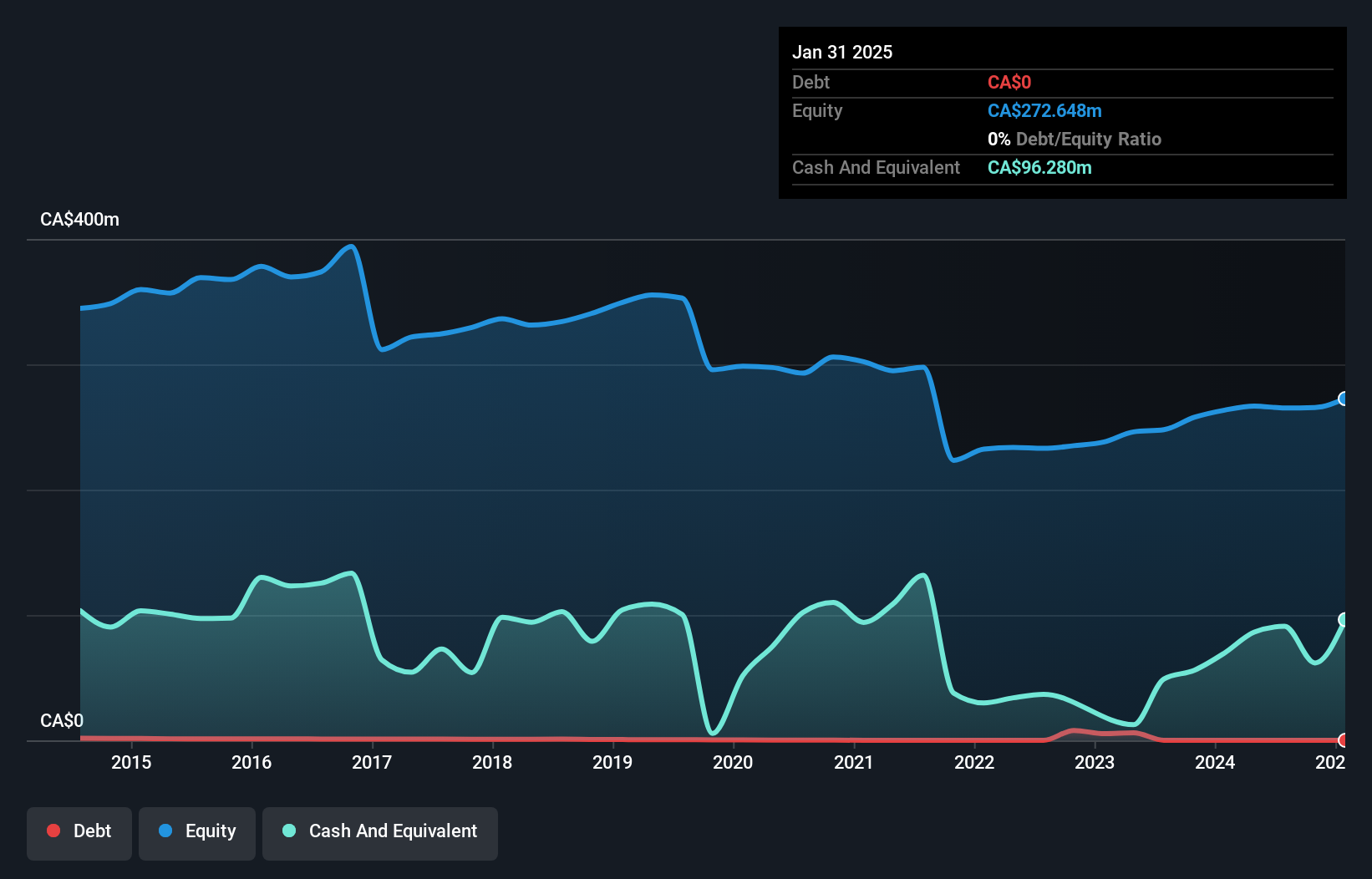

Evertz Technologies, a Canadian tech player, is navigating an evolving landscape with its focus on software and cloud solutions. Despite a drop in annual sales from CA$514.62 million to CA$501.62 million and net income decreasing to CA$59.39 million from CA$70.17 million, the company remains debt-free with high-quality earnings and forecasts of 2.7% growth per year in earnings. The recent share buyback of 190,772 shares for CAD 2.02 million indicates confidence in its valuation, trading at 6% below fair value estimates despite challenges like declining hardware revenue and market volatility risks impacting future performance prospects.

Kiwetinohk Energy (TSX:KEC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Kiwetinohk Energy Corp. is a Canadian company engaged in the production of natural gas, natural gas liquids, oil, and condensate with a market cap of CA$976.31 million.

Operations: Kiwetinohk Energy generates revenue primarily through the production of natural gas, natural gas liquids, oil, and condensate. The company's financials reveal a focus on these energy products as key revenue streams.

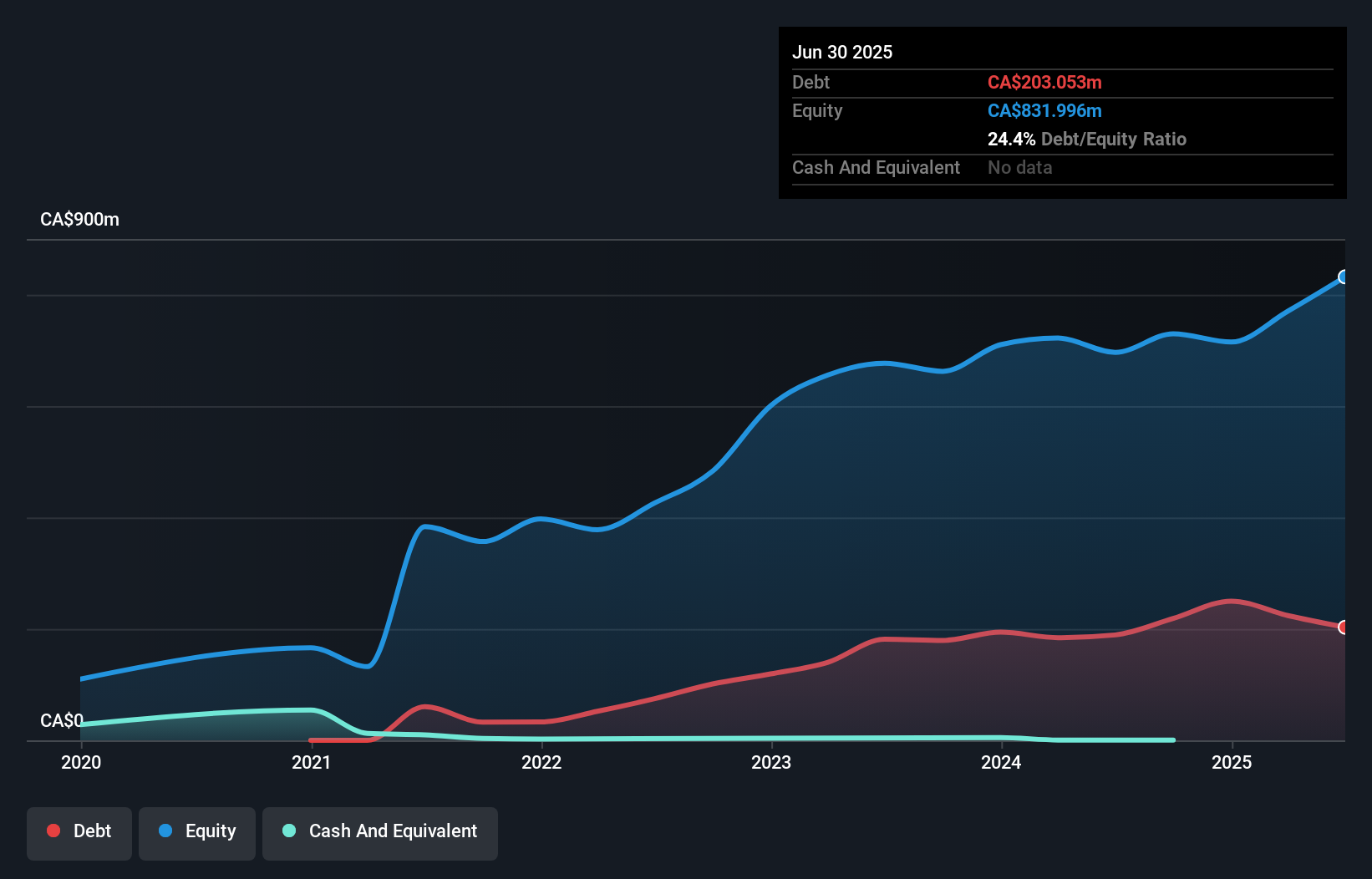

Kiwetinohk Energy, a promising player in Canada's energy sector, has showcased remarkable growth with earnings surging by 528.5% over the past year, outpacing the industry average of 3%. The company reported a net income of CAD 59.3 million for Q2 2025 compared to a loss of CAD 26.54 million last year, reflecting strong operational performance. Despite an increase in its debt to equity ratio from 0% to 24.4% over five years, this level remains satisfactory and well-managed with interest payments covered eight times by EBIT. Trading at a significant discount—89.1% below estimated fair value—Kiwetinohk appears undervalued given its high-quality earnings and robust production figures like oil output rising from 7,598 bbl/d to 10,462 bbl/d year-over-year in Q2.

- Unlock comprehensive insights into our analysis of Kiwetinohk Energy stock in this health report.

Evaluate Kiwetinohk Energy's historical performance by accessing our past performance report.

Seize The Opportunity

- Click here to access our complete index of 43 TSX Undiscovered Gems With Strong Fundamentals.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evertz Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ET

Evertz Technologies

Engages in the design, manufacture, and distribution of video and audio infrastructure solutions for the production, post-production, broadcast, and telecommunications markets in Canada, the United States, and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives