- Canada

- /

- Oil and Gas

- /

- TSXV:HME

Top TSX Dividend Stocks To Watch In June 2025

Reviewed by Simply Wall St

As the Canadian market navigates through a landscape marked by trade developments and central bank meetings, investors are keeping a close eye on potential volatility while maintaining confidence in the underlying economic fundamentals. In this environment, dividend stocks can offer a stable income stream and act as a buffer against market fluctuations, making them an attractive option for those seeking to balance growth with security.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Sun Life Financial (TSX:SLF) | 3.98% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.01% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.51% | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | 9.34% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.79% | ★★★★★☆ |

| Olympia Financial Group (TSX:OLY) | 6.27% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 5.15% | ★★★★★☆ |

| Canadian Imperial Bank of Commerce (TSX:CM) | 4.14% | ★★★★★☆ |

| Atrium Mortgage Investment (TSX:AI) | 9.68% | ★★★★★☆ |

| Acadian Timber (TSX:ADN) | 6.38% | ★★★★★☆ |

Click here to see the full list of 26 stocks from our Top TSX Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Evertz Technologies (TSX:ET)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Evertz Technologies Limited designs, manufactures, and distributes video and audio infrastructure solutions for production, post-production, broadcast, and telecommunications markets globally with a market cap of CA$913.08 million.

Operations: Evertz Technologies Limited generates revenue primarily from the Television Broadcast Equipment Market, amounting to CA$496.59 million.

Dividend Yield: 6.4%

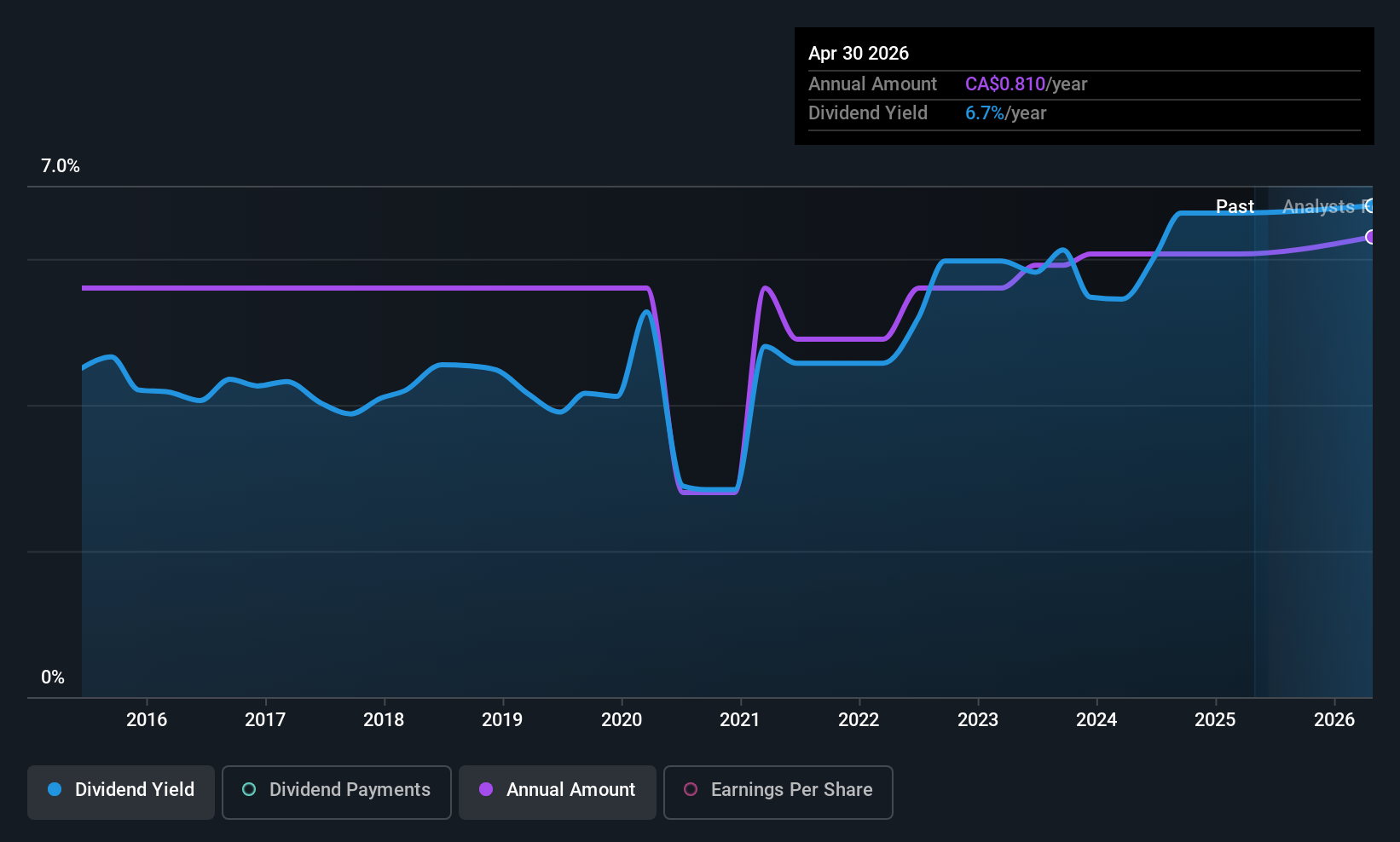

Evertz Technologies offers an attractive dividend yield of 6.41%, placing it in the top 25% of Canadian dividend payers. Its dividends are well-covered by earnings, with a payout ratio of 24.7%, and supported by cash flows at a cash payout ratio of 64.6%. However, its dividend payments have been volatile over the past decade, lacking reliability and stability despite some growth during this period. The stock is also valued attractively with a price-to-earnings ratio below the industry average.

- Take a closer look at Evertz Technologies' potential here in our dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Evertz Technologies shares in the market.

National Bank of Canada (TSX:NA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: National Bank of Canada offers financial services to individuals, businesses, institutional clients, and governments both domestically and internationally, with a market cap of CA$52.81 billion.

Operations: National Bank of Canada's revenue is primarily derived from its Personal and Commercial segment at CA$4.25 billion, Wealth Management at CA$3.01 billion, Financial Markets (Excluding USSF&I) at CA$3.58 billion, and U.S. Specialty Finance and International (USSF&I) at CA$1.32 billion.

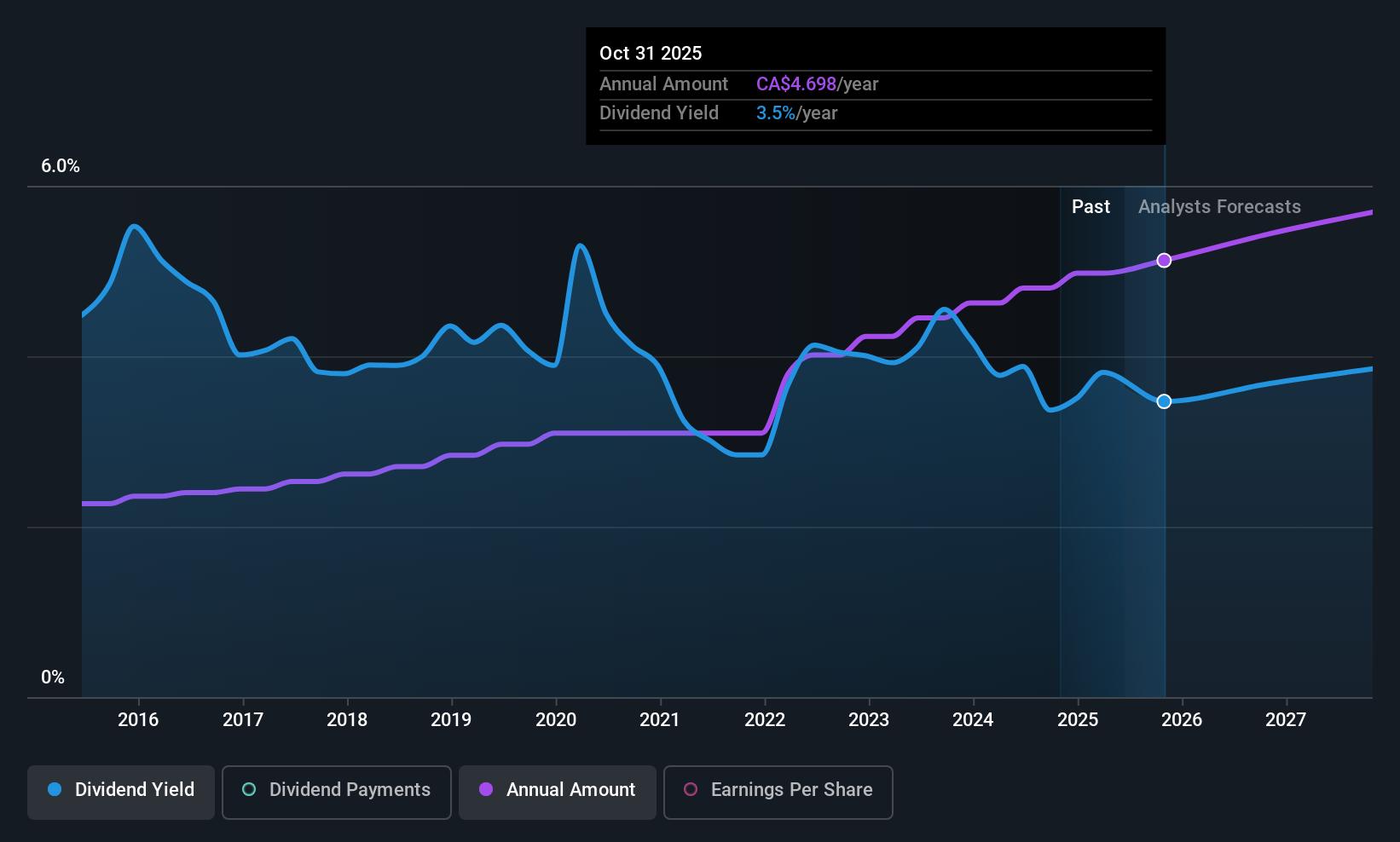

Dividend Yield: 3.5%

National Bank of Canada's dividend is well-covered with a payout ratio of 42.5%, and it has shown stability and growth over the past decade. Despite a lower yield of 3.51% compared to top Canadian payers, its recent increase to $1.18 per share highlights ongoing commitment to dividends. Earnings have been stable, though slightly down in recent quarters, reflecting sound financial management amidst strategic initiatives like debt redemption and operational expansion in Western Canada.

- Navigate through the intricacies of National Bank of Canada with our comprehensive dividend report here.

- The valuation report we've compiled suggests that National Bank of Canada's current price could be inflated.

Hemisphere Energy (TSXV:HME)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hemisphere Energy Corporation is involved in the acquisition, exploration, development, and production of petroleum and natural gas interests in Canada with a market cap of CA$178.86 million.

Operations: Hemisphere Energy Corporation generates revenue from its petroleum and natural gas interests, amounting to CA$84.99 million.

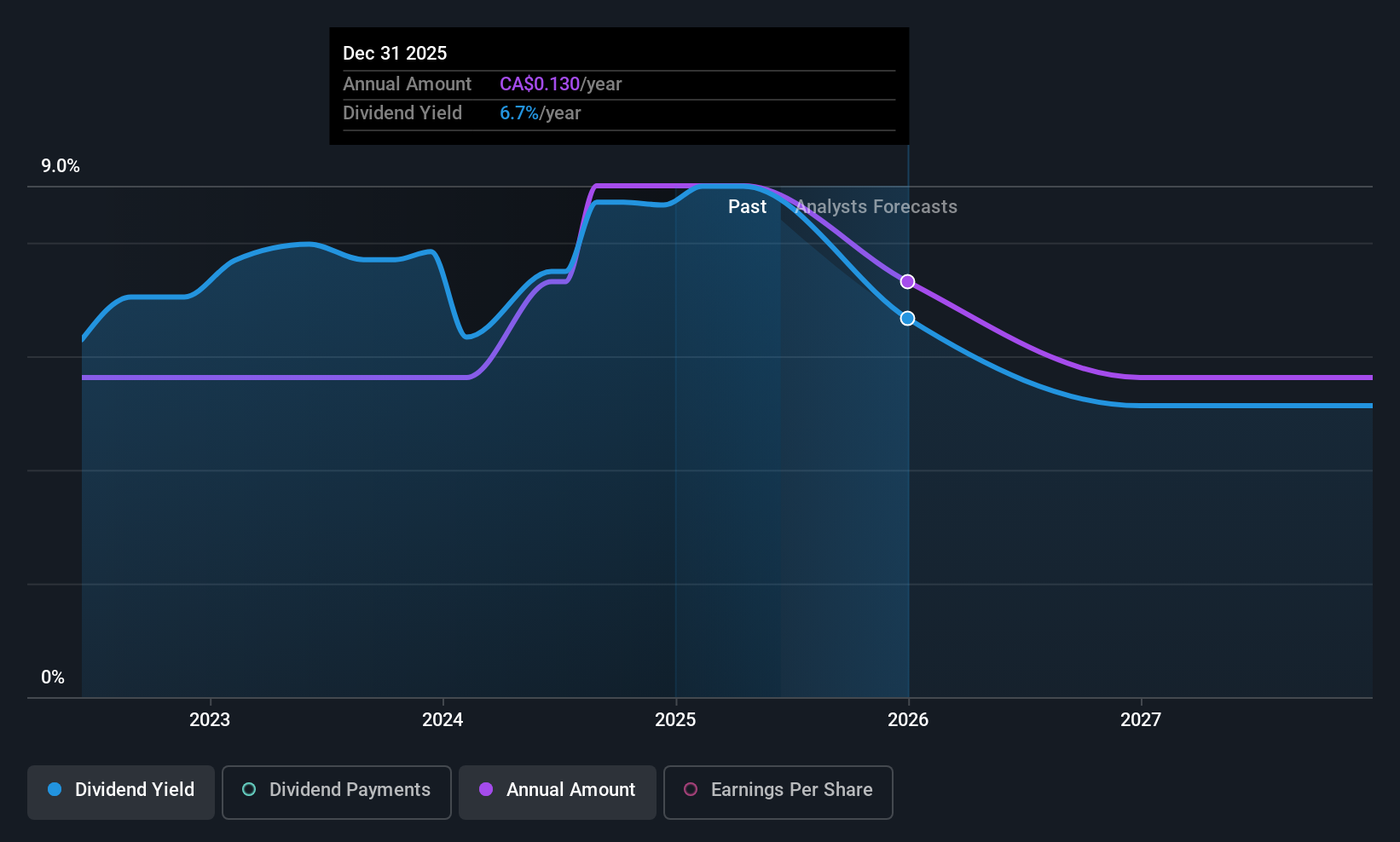

Dividend Yield: 8.6%

Hemisphere Energy's dividend yield of 8.65% ranks in the top 25% of Canadian payers, with a payout ratio of 27.7%, indicating strong earnings coverage. Despite only three years of dividend history, payments have been stable and growing. Recent earnings growth supports this stability, as Q1 2025 revenue increased to C$21.3 million from C$16.56 million year-over-year. The company also declared a special dividend and continues share buybacks, reflecting robust financial health and shareholder returns strategy.

- Click here to discover the nuances of Hemisphere Energy with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Hemisphere Energy is priced lower than what may be justified by its financials.

Seize The Opportunity

- Delve into our full catalog of 26 Top TSX Dividend Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hemisphere Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:HME

Hemisphere Energy

Acquires, explores, develops, and produces petroleum and natural gas interests in Canada.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives