- Canada

- /

- Communications

- /

- TSX:ET

Have Evertz Technologies Limited (TSE:ET) Insiders Been Selling Their Stock?

We'd be surprised if Evertz Technologies Limited (TSE:ET) shareholders haven't noticed that the CTO & Director, Rakesh Patel, recently sold CA$324k worth of stock at CA$12.95 per share. However, the silver lining is that the sale only reduced their total holding by 2.0%, so we're hesitant to read anything much into it, on its own.

Check out our latest analysis for Evertz Technologies

Evertz Technologies Insider Transactions Over The Last Year

Notably, that recent sale by Rakesh Patel is the biggest insider sale of Evertz Technologies shares that we've seen in the last year. So what is clear is that an insider saw fit to sell at around the current price of CA$13.00. While insider selling is a negative, to us, it is more negative if the shares are sold at a lower price. In this case, the big sale took place at around the current price, so it's not too bad (but it's still not a positive).

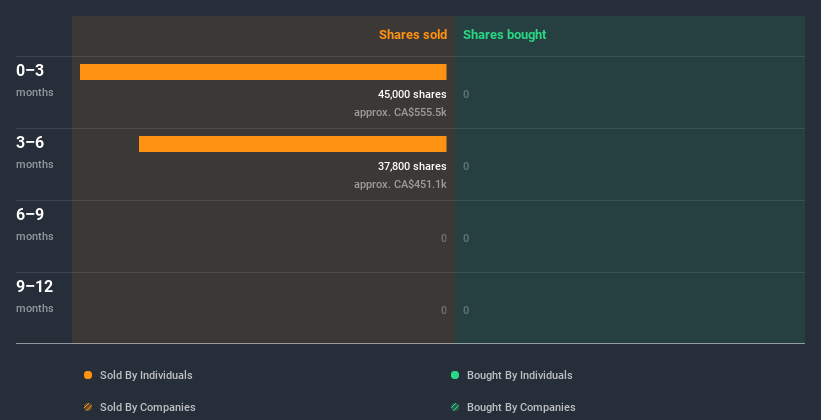

Rakesh Patel ditched 82.80k shares over the year. The average price per share was CA$12.20. The chart below shows insider transactions (by companies and individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

I will like Evertz Technologies better if I see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Insider Ownership of Evertz Technologies

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Evertz Technologies insiders own about CA$646m worth of shares (which is 65% of the company). I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

So What Do The Evertz Technologies Insider Transactions Indicate?

An insider sold stock recently, but they haven't been buying. And there weren't any purchases to give us comfort, over the last year. It is good to see high insider ownership, but the insider selling leaves us cautious. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Evertz Technologies. Every company has risks, and we've spotted 2 warning signs for Evertz Technologies you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you decide to trade Evertz Technologies, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Evertz Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:ET

Evertz Technologies

Engages in the design, manufacture, and distribution of video and audio infrastructure solutions for the production, post-production, broadcast, and telecommunications markets in Canada, the United States, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion