Evertz Technologies Limited (TSE:ET) has announced that it will pay a dividend of CA$0.195 per share on the 25th of September. Based on this payment, the dividend yield on the company's stock will be 6.6%, which is an attractive boost to shareholder returns.

See our latest analysis for Evertz Technologies

Evertz Technologies' Future Dividend Projections Appear Well Covered By Earnings

A big dividend yield for a few years doesn't mean much if it can't be sustained. Before this announcement, Evertz Technologies was paying out 91% of earnings, but a comparatively small 60% of free cash flows. In general, cash flows are more important than earnings, so we are comfortable that the dividend will be sustainable going forward, especially with so much cash left over for reinvestment.

EPS is set to grow by 2.3% over the next year. Assuming the dividend continues along recent trends, our estimates say the payout ratio could reach 91% - on the higher side, but we wouldn't necessarily say this is unsustainable.

Dividend Volatility

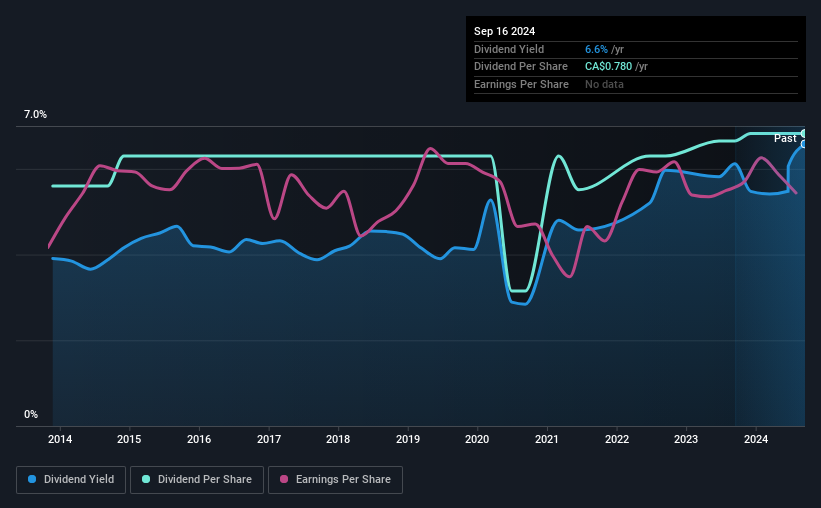

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. Since 2014, the annual payment back then was CA$0.64, compared to the most recent full-year payment of CA$0.78. This means that it has been growing its distributions at 2.0% per annum over that time. The dividend has seen some fluctuations in the past, so even though the dividend was raised this year, we should remember that it has been cut in the past.

Dividend Growth May Be Hard To Achieve

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. It's not great to see that Evertz Technologies' earnings per share has fallen at approximately 2.6% per year over the past five years. A modest decline in earnings isn't great, and it makes it quite unlikely that the dividend will grow in the future unless that trend can be reversed. Earnings are predicted to grow over the next year, but we would remain cautious until a track record of earnings growth is established.

Our Thoughts On Evertz Technologies' Dividend

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Evertz Technologies' payments, as there could be some issues with sustaining them into the future. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We would probably look elsewhere for an income investment.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. As an example, we've identified 1 warning sign for Evertz Technologies that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Evertz Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ET

Evertz Technologies

Engages in the design, manufacture, and distribution of video and audio infrastructure solutions for the production, post-production, broadcast, and telecommunications markets in Canada, the United States, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion