Celestica (TSX:CLS) Valuation in Focus After Launch of Advanced AI Data Center Switches

Reviewed by Kshitija Bhandaru

Celestica (TSX:CLS) has just launched the DS6000 and DS6001, two new high-bandwidth data center switches built with AI and machine learning applications in mind. This move places Celestica firmly in the spotlight as infrastructure spending on AI increases.

See our latest analysis for Celestica.

This launch adds to an already eventful stretch for Celestica, which recently earned attention for its growing partnerships with major AI players like Google and OpenAI. The market’s excitement is reflecting in the numbers, as the 1-year total shareholder return stands at a remarkable 387%. Momentum is still strong with a 14% share price return over the last month alone. Clearly, Celestica’s AI-driven positioning is boosting both its short-term and long-term investor confidence.

If these moves have you watching the tech sector more closely, this is the perfect time to discover See the full list for free.

But with shares up nearly 400% over the past year and investor optimism at a high, the key question is whether Celestica is actually undervalued or if recent gains have already incorporated years of expected AI growth.

Most Popular Narrative: 3.4% Undervalued

With Celestica's fair value recently raised to CA$402.69, now about 3.4% above the last close of CA$389.08, the market appears just a step behind bullish consensus. Intrigue builds around what is fueling this valuation premium among analysts and investors.

Accelerated demand for advanced networking and AI infrastructure by hyperscaler customers is driving rapid growth in Celestica's CCS segment, with multiple new 800G and upcoming 1.6T program ramps. This is supporting robust revenue expansion and greater operating leverage over the next 12, 24 months.

Want to know what is really driving this aggressive price target? The narrative is laser-focused on a few bold financial bets and a potentially game-changing shift in margins. Which underlying assumptions could make or break this call? Find out what is hidden inside the numbers and see the real engine behind Celestica’s bullish valuation.

Result: Fair Value of $402.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including heavy reliance on just a few hyperscaler customers as well as the potential for sudden slowdowns in AI and cloud spending.

Find out about the key risks to this Celestica narrative.

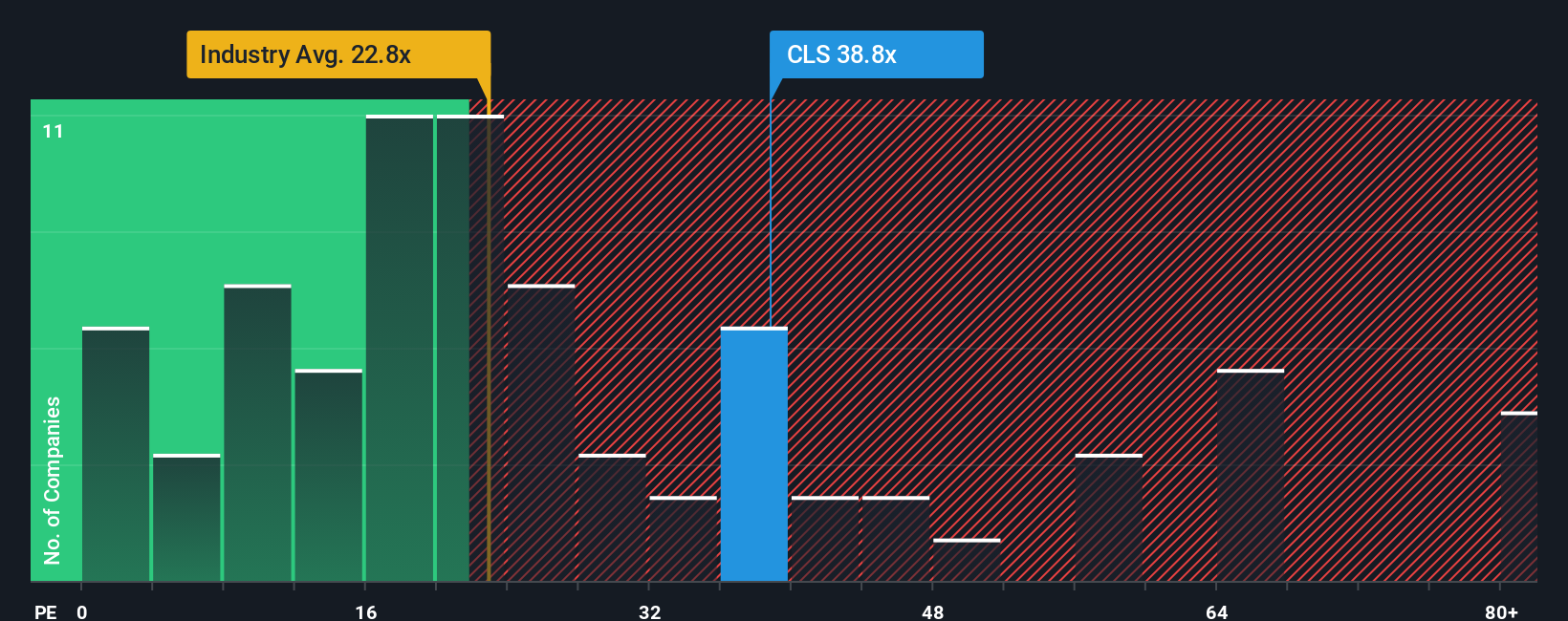

Another View: Multiples Tell a Cautionary Tale

Looking at Celestica through the lens of its price-to-earnings ratio paints a starkly different picture. Shares trade at 59.3 times earnings, nearly double the peer average of 30.7 and well above the North American industry average of 25.8. Even compared to a fair ratio of 53.3, Celestica appears pricey. With valuation stretched so far beyond typical benchmarks, could market enthusiasm risk outpacing fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Celestica Narrative

If you are curious to dig into the data and craft your own story, it takes less than three minutes to build a unique view. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Celestica.

Looking for More Investment Ideas?

Smart investors always keep their radar up for the next winning trend. Don’t wait to expand your horizons with stock ideas that could transform your portfolio.

- Tap into the potential for outsized returns by scanning these 3596 penny stocks with strong financials that combine strong financials with explosive growth prospects.

- Unlock opportunities in the AI revolution by focusing on these 24 AI penny stocks poised to shape tomorrow’s tech landscape.

- Secure steady income and long-term stability with these 18 dividend stocks with yields > 3% offering impressive yields well above the market average.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CLS

Celestica

Provides supply chain solutions in Asia, North America, and internationally.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Community Narratives