Celestica (TSX:CLS) Is Up 24.6% After Raising Guidance on Surging AI Data Center Demand

Reviewed by Sasha Jovanovic

- Celestica Inc. recently reported third-quarter earnings that surpassed analyst expectations, citing robust demand for AI data center infrastructure, and raised its full-year revenue and earnings outlook above consensus estimates. The company also announced the return of Laurette T. Koellner to its Board of Directors, the launch of a new 12-month share repurchase program pending TSX approval, and strong revenue guidance for 2026.

- These developments highlight the growing impact of AI-driven hyperscaler demand on Celestica’s performance and reinforce its commitment to leadership stability and shareholder returns.

- With management raising guidance following a very strong quarter, we will examine how these results could reshape Celestica's investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Celestica Investment Narrative Recap

To be a shareholder in Celestica today, you have to believe that the global shift toward AI-driven data center infrastructure and digital transformation across hyperscalers will continue to underpin robust growth in the company's core CCS segment. The latest results and raised guidance underscore this trend, but the firm's heavy exposure to a few key customers remains the main sensitivity, strong quarters like this can temporarily reduce risk perceptions, though customer concentration still tops short-term concerns. Among several recent announcements, the reappointment of Laurette T. Koellner to the Board stands out for its potential impact on leadership continuity, as Celestica's rapid expansion and capital allocation decisions require proven oversight to manage both growth and risk around its large, concentrated customer relationships. Yet, in contrast to the bullish headlines, investors should remain aware that if even one hyperscaler shifts strategy or spending plans...

Read the full narrative on Celestica (it's free!)

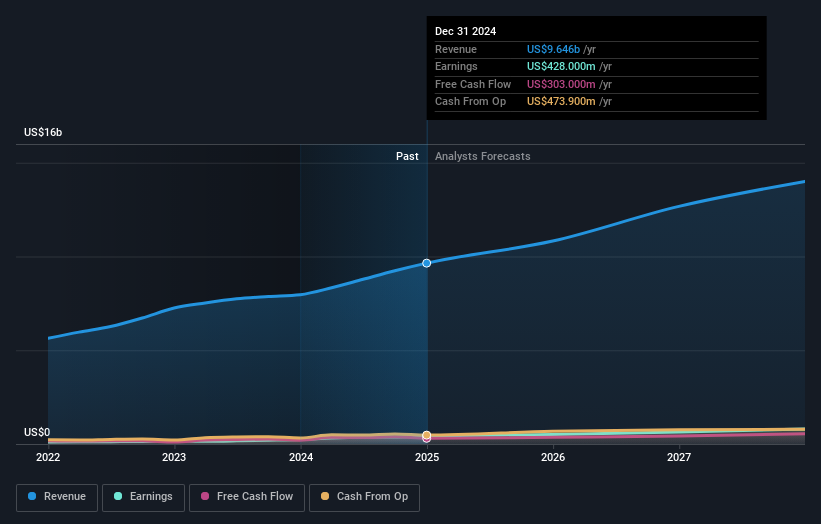

Celestica's outlook anticipates $17.4 billion in revenue and $992.0 million in earnings by 2028. This scenario is based on analysts forecasting 17.9% annual revenue growth and a $453.6 million increase in earnings from the current $538.4 million level.

Uncover how Celestica's forecasts yield a CA$402.69 fair value, a 15% downside to its current price.

Exploring Other Perspectives

Sixteen fair value estimates from the Simply Wall St Community cluster between CA$145 and CA$403 per share, reflecting broad differences in outlook. With Celestica’s reliance on a few major hyperscaler customers, it’s clear that investor perspectives on risk and reward can be wide ranging, explore various viewpoints to challenge your own assumptions.

Explore 16 other fair value estimates on Celestica - why the stock might be worth as much as CA$402.69!

Build Your Own Celestica Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Celestica research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Celestica research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Celestica's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CLS

Celestica

Provides supply chain solutions in Asia, North America, and internationally.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Community Narratives