A Look at Celestica (TSX:CLS) Valuation After Recent Share Price Surge

Reviewed by Simply Wall St

See our latest analysis for Celestica.

Celestica’s latest share price swings are catching attention, especially after a strong surge over the past quarter. While this week’s dip stands out, momentum is still evident with a 196% share price return year-to-date and an impressive 211% total shareholder return over the last year. This suggests that investors remain eager about its growth story even as volatility creeps in.

If Celestica’s resilience makes you wonder what else is gaining traction, now’s the perfect time to broaden your view and discover fast growing stocks with high insider ownership

With shares still trading well below analyst price targets despite huge gains, investors may be wondering if Celestica is still undervalued or if the market has already accounted for the company’s impressive growth potential.

Most Popular Narrative: 29.7% Undervalued

Celestica’s latest closing price sits well below the widely tracked narrative’s fair value estimate, highlighting a major gap between recent price moves and the implied long-term upside. This backdrop adds urgency to dig deeper into what’s feeding such bullish expectations from market watchers.

Accelerated demand for advanced networking and AI infrastructure by hyperscaler customers is driving rapid growth in Celestica's CCS segment, with multiple new 800G and upcoming 1.6T program ramps. This is supporting robust revenue expansion and greater operating leverage over the next 12 to 24 months.

Want to see what’s behind this big valuation call? The secret is in audacious growth forecasts, margin upgrades, and future earnings power that rivals the sector’s leaders. The exact assumptions fueling that optimism might surprise you. Dive in to uncover the bold numbers and roadblocks that shape the fair value calculation.

Result: Fair Value of $565.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on a few hyperscaler customers and rapid technological shifts could quickly reverse momentum if demand falters or if program ramps face delays.

Find out about the key risks to this Celestica narrative.

Another View: Multiples Tell a Different Story

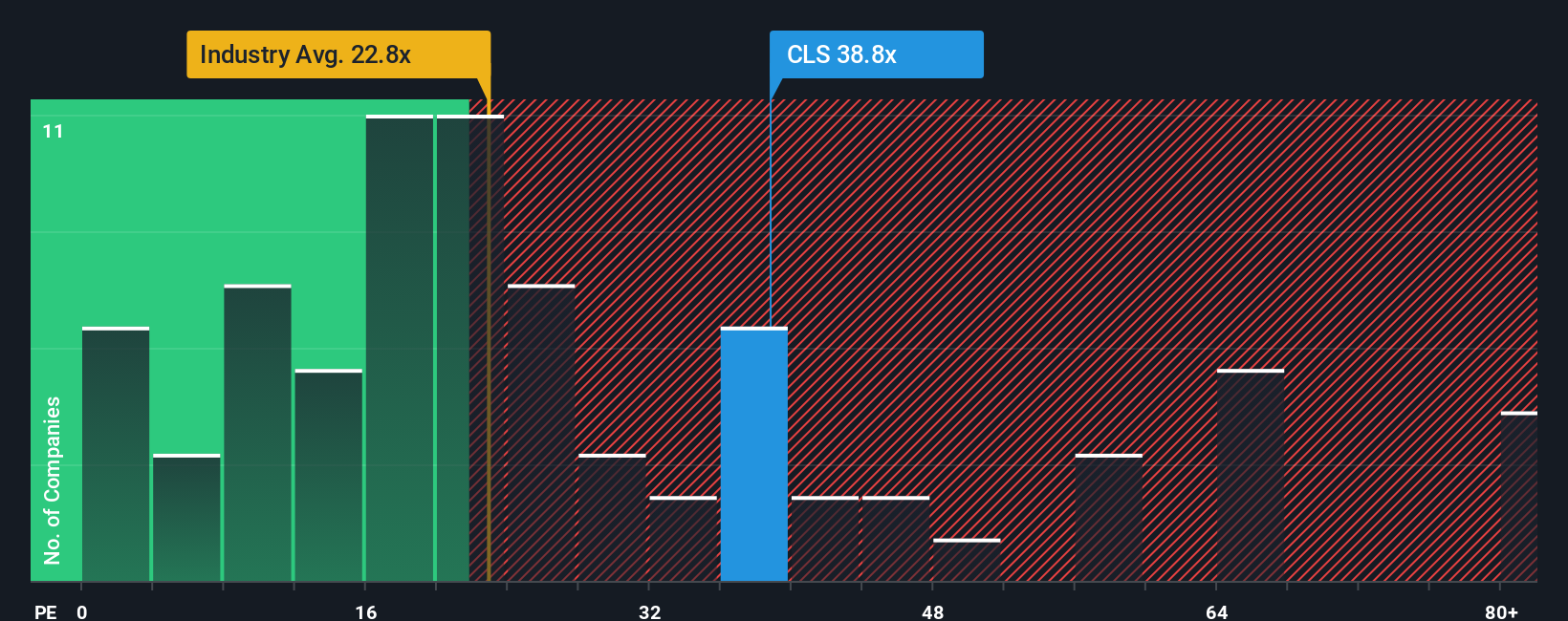

While analysts see substantial upside, the current price-to-earnings ratio of 45.3x is much higher than industry peers, which average just 23.3x, and also above the peer group at 28x. Even our fair ratio estimate stands at 51.8x, not far off. This lofty valuation suggests there is limited margin for error, so today's price could be running ahead of fundamentals.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Celestica Narrative

If you’re not convinced by the market’s story or want to test your own assumptions, you can dig into the numbers and shape your own Celestica outlook in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Celestica.

Looking for More Investing Opportunities?

Smart investors never stop searching for their next big winner. Use these powerful strategies to stay ahead because opportunities like these do not wait around for long.

- Tap into remarkable yield potential and track companies with consistent payouts through these 16 dividend stocks with yields > 3% offering above-average returns and income stability.

- Kickstart your search for game-changing technology by targeting early-stage innovators with these 26 AI penny stocks that are shaping the next wave of artificial intelligence breakthroughs.

- Uncover hidden bargains firsthand by hunting for companies trading below their intrinsic worth in these 917 undervalued stocks based on cash flows, giving your portfolio a true value edge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CLS

Celestica

Provides supply chain solutions in Asia, North America, and internationally.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Community Narratives