Should Baylin Technologies (TSE:BYL) Be Disappointed With Their 93% Profit?

By buying an index fund, you can roughly match the market return with ease. But if you pick the right individual stocks, you could make more than that. Just take a look at Baylin Technologies Inc. (TSE:BYL), which is up 93%, over three years, soundly beating the market return of 15% (not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 9.6%.

View our latest analysis for Baylin Technologies

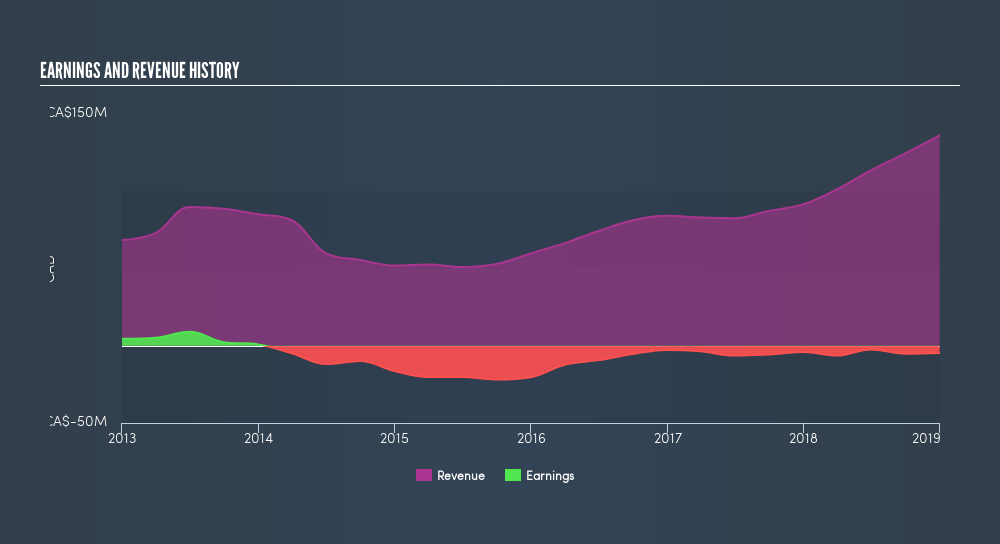

Because Baylin Technologies is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over the last three years Baylin Technologies has grown its revenue at 24% annually. That's much better than most loss-making companies. The share price rise of 24% per year throughout that time is nice to see, and given the revenue growth, that gain seems somewhat justified. If that's the case, now might be the time to take a close look at Baylin Technologies. A window of opportunity may reveal itself with time, if the business can trend to profitability.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This freereport showing analyst forecasts should help you form a view on Baylin Technologies

A Different Perspective

We're pleased to report that Baylin Technologies shareholders have received a total shareholder return of 9.6% over one year. Notably the five-year annualised TSR loss of 1.1% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

If you like to buy stocks alongside management, then you might just love this freelist of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:BYL

Baylin Technologies

Researches, designs, develops, manufactures, and sells passive and active radio frequency (RF) products, satellite communications products, and supporting services.

Undervalued with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion