Baylin Technologies Inc.'s (TSE:BYL) Shares Leap 28% Yet They're Still Not Telling The Full Story

Those holding Baylin Technologies Inc. (TSE:BYL) shares would be relieved that the share price has rebounded 28% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 9.4% in the last twelve months.

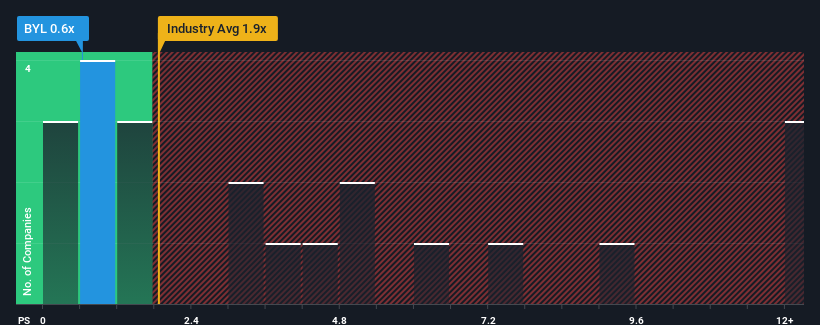

Even after such a large jump in price, Baylin Technologies may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.6x, since almost half of all companies in the Electronic industry in Canada have P/S ratios greater than 3.4x and even P/S higher than 7x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Baylin Technologies

What Does Baylin Technologies' P/S Mean For Shareholders?

Baylin Technologies certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Baylin Technologies' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Baylin Technologies?

In order to justify its P/S ratio, Baylin Technologies would need to produce anemic growth that's substantially trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 31%. Still, revenue has fallen 30% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 12% over the next year. With the industry predicted to deliver 14% growth , the company is positioned for a comparable revenue result.

With this information, we find it odd that Baylin Technologies is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What We Can Learn From Baylin Technologies' P/S?

Baylin Technologies' recent share price jump still sees fails to bring its P/S alongside the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've seen that Baylin Technologies currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Baylin Technologies (3 are a bit unpleasant) you should be aware of.

If these risks are making you reconsider your opinion on Baylin Technologies, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Baylin Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:BYL

Baylin Technologies

Researches, designs, develops, manufactures, and sells passive and active radio frequency (RF) products, satellite communications products, and supporting services.

Undervalued with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026