The Market Doesn't Like What It Sees From Wishpond Technologies Ltd.'s (CVE:WISH) Revenues Yet As Shares Tumble 28%

Unfortunately for some shareholders, the Wishpond Technologies Ltd. (CVE:WISH) share price has dived 28% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 65% share price decline.

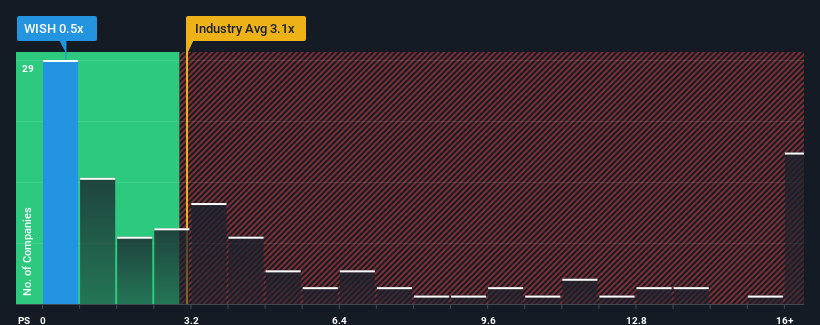

After such a large drop in price, Wishpond Technologies may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.5x, considering almost half of all companies in the Software industry in Canada have P/S ratios greater than 3x and even P/S higher than 8x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Wishpond Technologies

What Does Wishpond Technologies' Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Wishpond Technologies has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Wishpond Technologies will help you uncover what's on the horizon.How Is Wishpond Technologies' Revenue Growth Trending?

In order to justify its P/S ratio, Wishpond Technologies would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. However, a few strong years before that means that it was still able to grow revenue by an impressive 86% in total over the last three years. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

Shifting to the future, estimates from the three analysts covering the company suggest revenue growth is heading into negative territory, declining 5.6% over the next year. With the industry predicted to deliver 20% growth, that's a disappointing outcome.

With this information, we are not surprised that Wishpond Technologies is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

Shares in Wishpond Technologies have plummeted and its P/S has followed suit. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's clear to see that Wishpond Technologies maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, Wishpond Technologies' poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You always need to take note of risks, for example - Wishpond Technologies has 1 warning sign we think you should be aware of.

If you're unsure about the strength of Wishpond Technologies' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Wishpond Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:WISH

Wishpond Technologies

Provides marketing focused online business solutions in the United States, Canada, and internationally.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives