Voxtur Analytics Corp. (CVE:VXTR) Stock Catapults 100% Though Its Price And Business Still Lag The Industry

Voxtur Analytics Corp. (CVE:VXTR) shareholders have had their patience rewarded with a 100% share price jump in the last month. Looking further back, the 16% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

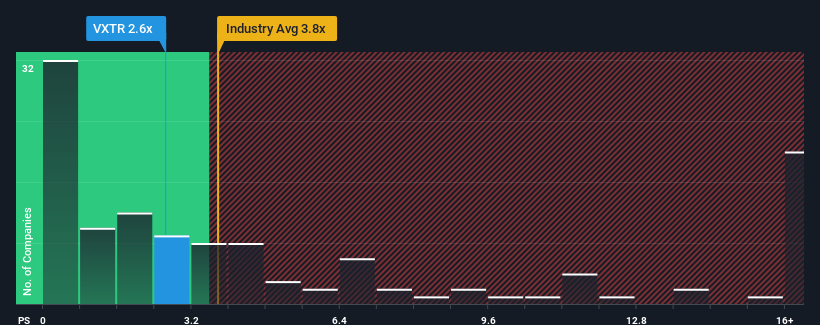

In spite of the firm bounce in price, Voxtur Analytics' price-to-sales (or "P/S") ratio of 2.6x might still make it look like a buy right now compared to the Software industry in Canada, where around half of the companies have P/S ratios above 3.8x and even P/S above 9x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Voxtur Analytics

What Does Voxtur Analytics' P/S Mean For Shareholders?

Recent times have been advantageous for Voxtur Analytics as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Voxtur Analytics' future stacks up against the industry? In that case, our free report is a great place to start.How Is Voxtur Analytics' Revenue Growth Trending?

In order to justify its P/S ratio, Voxtur Analytics would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 55%. The latest three year period has also seen an excellent 66% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 12% as estimated by the only analyst watching the company. That's shaping up to be materially lower than the 20% growth forecast for the broader industry.

With this in consideration, its clear as to why Voxtur Analytics' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Despite Voxtur Analytics' share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As expected, our analysis of Voxtur Analytics' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 5 warning signs for Voxtur Analytics (1 is a bit unpleasant) you should be aware of.

If these risks are making you reconsider your opinion on Voxtur Analytics, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:VXTR

Voxtur Analytics

Operates as a real estate technology company in the United States and Canada.

Slight risk and slightly overvalued.

Market Insights

Community Narratives