Canadian markets have shown resilience, closing October near record highs despite a more hawkish stance from central banks and ongoing geopolitical tensions. In this context, penny stocks—often representing smaller or newer companies—remain an intriguing investment area, offering potential growth opportunities for those willing to explore beyond the larger market players. While the term "penny stock" may seem outdated, these investments can still provide substantial returns when backed by strong financial health and strategic positioning.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.33 | CA$63.96M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$22.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$2.35 | CA$226.69M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.425 | CA$3.38M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.01 | CA$671.95M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.04 | CA$21.21M | ✅ 2 ⚠️ 3 View Analysis > |

| Rio2 (TSX:RIO) | CA$2.19 | CA$919.77M | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.92 | CA$149.73M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.07 | CA$196.98M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.73 | CA$9.33M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 416 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

CEMATRIX (TSX:CEMX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CEMATRIX Corporation, with a market cap of CA$56.33 million, specializes in the onsite production of cellular concrete for infrastructure, industrial, and commercial construction markets across North America.

Operations: The company's revenue is derived from the supply and placement of cellular concrete, amounting to CA$37.75 million.

Market Cap: CA$56.33M

CEMATRIX Corporation, with a market cap of CA$56.33 million, has shown significant revenue growth, reporting CA$15.31 million in sales for Q3 2025 compared to CA$10.14 million the previous year. The company has achieved profitability over the past five years and maintains a strong balance sheet, with short-term assets exceeding both short- and long-term liabilities. Despite its relatively inexperienced management team, CEMATRIX's board is seasoned with an average tenure of 15.7 years. Recent contract awards totaling $11.9 million further bolster its position in the infrastructure sector across North America.

- Dive into the specifics of CEMATRIX here with our thorough balance sheet health report.

- Assess CEMATRIX's future earnings estimates with our detailed growth reports.

EV Nickel (TSXV:EVNI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: EV Nickel Inc. is a nickel exploration company focused on acquiring, evaluating, and exploring mineral properties in Canada with a market cap of CA$25.58 million.

Operations: EV Nickel Inc. does not report any revenue segments.

Market Cap: CA$25.58M

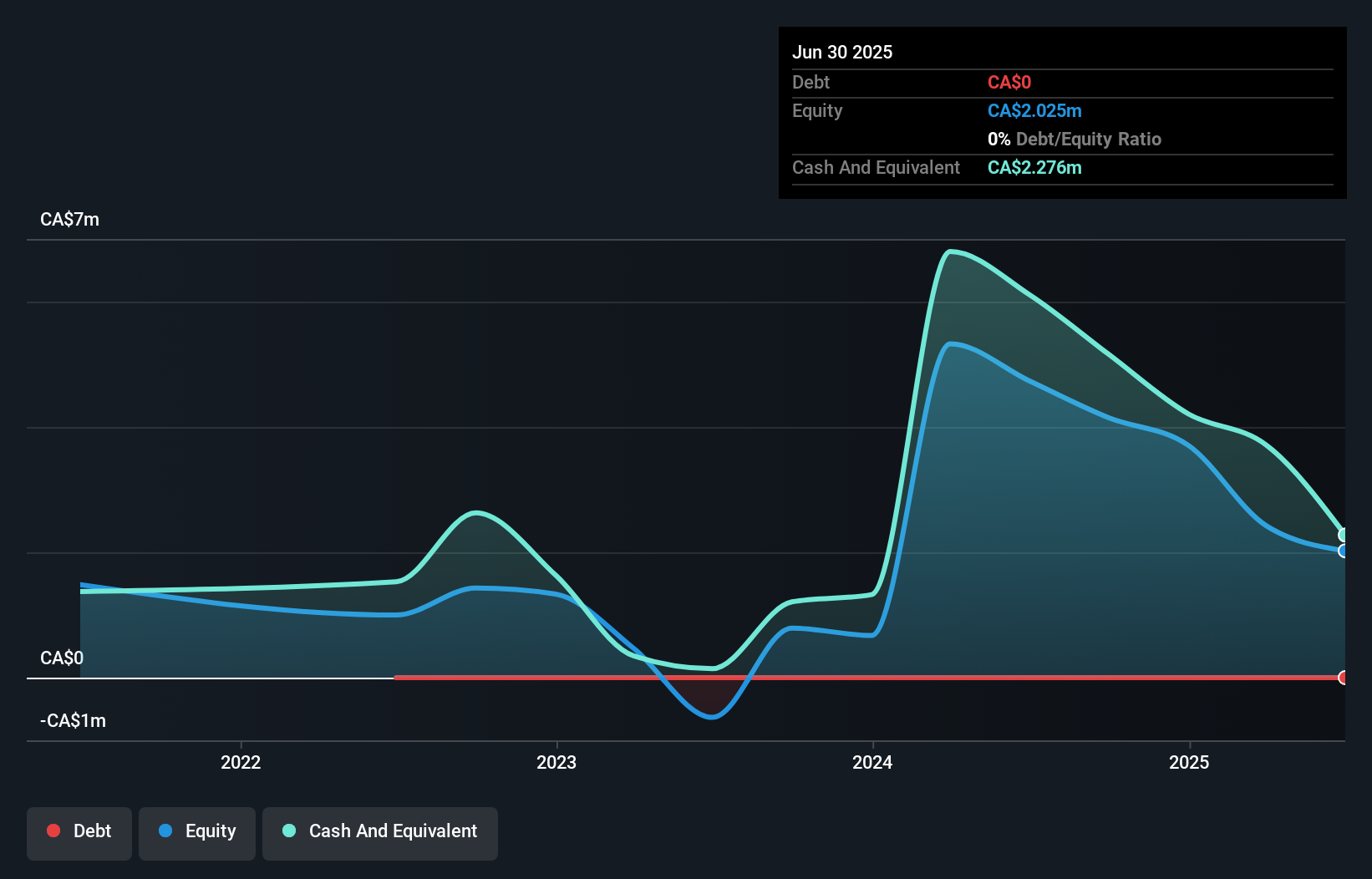

EV Nickel Inc., with a market cap of CA$25.58 million, is a pre-revenue company focused on nickel exploration. Despite being debt-free and having no long-term liabilities, the company faces challenges such as increased volatility and a highly volatile share price over recent months. The company's auditor has expressed doubts about its ability to continue as a going concern, highlighted by its net loss of CA$3.15 million for the year ending June 30, 2025. However, EV Nickel's cash runway exceeds one year based on current free cash flow levels, providing some financial stability amidst these concerns.

- Unlock comprehensive insights into our analysis of EV Nickel stock in this financial health report.

- Examine EV Nickel's past performance report to understand how it has performed in prior years.

Visionstate (TSXV:VIS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Visionstate Corp. focuses on developing technology related to the Internet of Things, big data and analytics, and sustainability in Canada and the United States, with a market cap of CA$3.87 million.

Operations: The company's revenue is primarily generated from its Computer Graphics segment, amounting to CA$0.54 million.

Market Cap: CA$3.87M

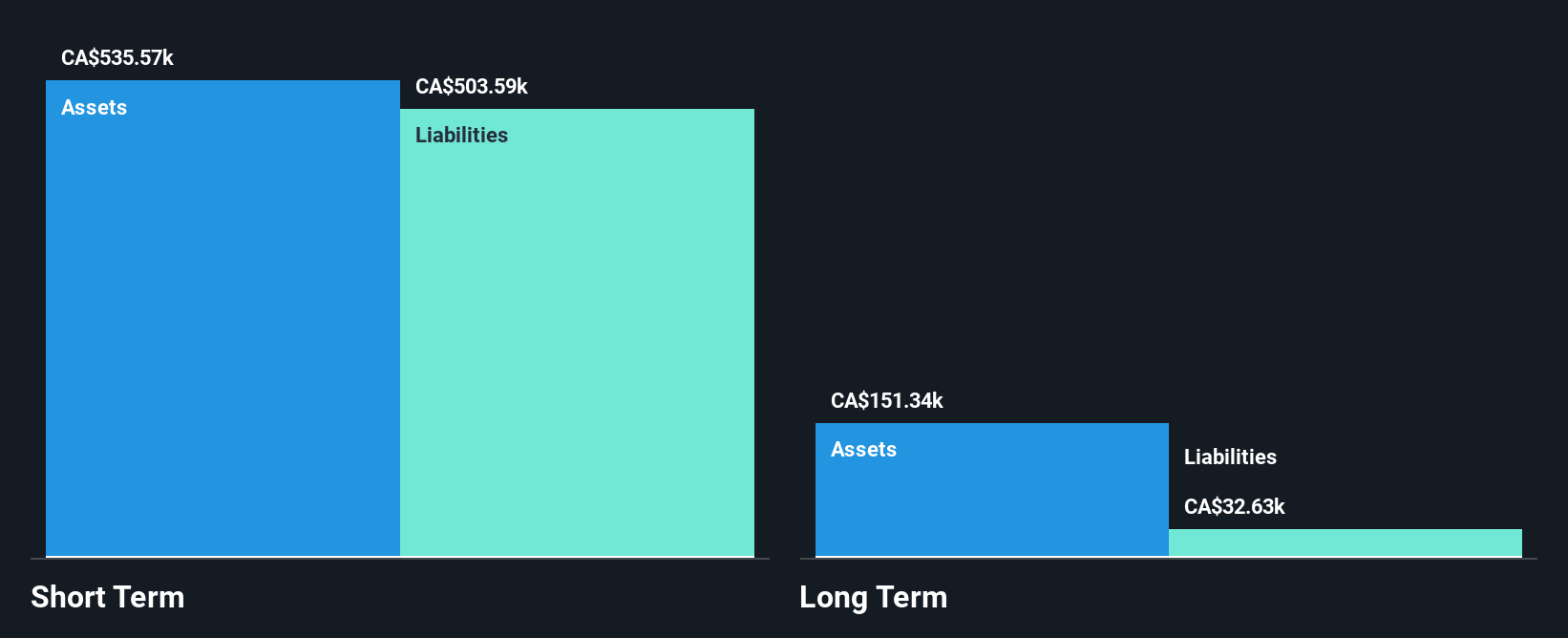

Visionstate Corp., with a market cap of CA$3.87 million, remains pre-revenue, generating CA$0.54 million primarily from its Computer Graphics segment. The company has improved its financial position over the past five years with positive shareholder equity but faces challenges such as high volatility and limited cash runway under one year. Recent developments include a private placement for convertible debentures worth $500,000 and the launch of TidyLogic, an AI-powered planning tool set to commercially launch in early 2026. Visionstate's strategic investment in Sol Spaces Inc., which focuses on sustainable infrastructure solutions, offers potential growth avenues.

- Jump into the full analysis health report here for a deeper understanding of Visionstate.

- Evaluate Visionstate's historical performance by accessing our past performance report.

Key Takeaways

- Reveal the 416 hidden gems among our TSX Penny Stocks screener with a single click here.

- Looking For Alternative Opportunities? These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:VIS

Visionstate

Through its subsidiaries, engages in the research and development of technology in the realm of the Internet of Things, big data and analytics, and sustainability in Canada and the United States.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion