How Surging First-Half Net Income at Topicus.com (TSXV:TOI) Has Changed Its Investment Story

Reviewed by Simply Wall St

- Topicus.com Inc. announced its second quarter 2025 results, reporting revenue of €372.03 million and net income of €25.86 million, both higher than the same period last year.

- The company's net income for the first half of 2025 more than doubled compared to the prior year, suggesting a substantial improvement in profitability.

- We'll explore how Topicus.com's sharp increase in first-half net income shapes its investment narrative going forward.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is Topicus.com's Investment Narrative?

If you’re looking at Topicus.com today, the big picture is about believing in its ability to translate robust revenue growth into consistent, high-quality earnings over time. The recent Q2 earnings release, showing not just higher revenue but a doubling in first-half net income, offers real evidence that profitability is strengthening, which may shift short-term catalysts more toward execution and operational efficiency than pure top-line momentum. Yet despite the tangible improvement in financials, the share price moved down slightly after results, suggesting that expectations were already high and that market participants are paying closer attention to future growth rates and valuation. Risks from high price-to-earnings multiples remain relevant, especially if growth rates were to slow, and there is also ongoing board turnover which could influence future direction. These factors could influence both sentiment and short-term momentum for the stock more than the results alone might suggest.

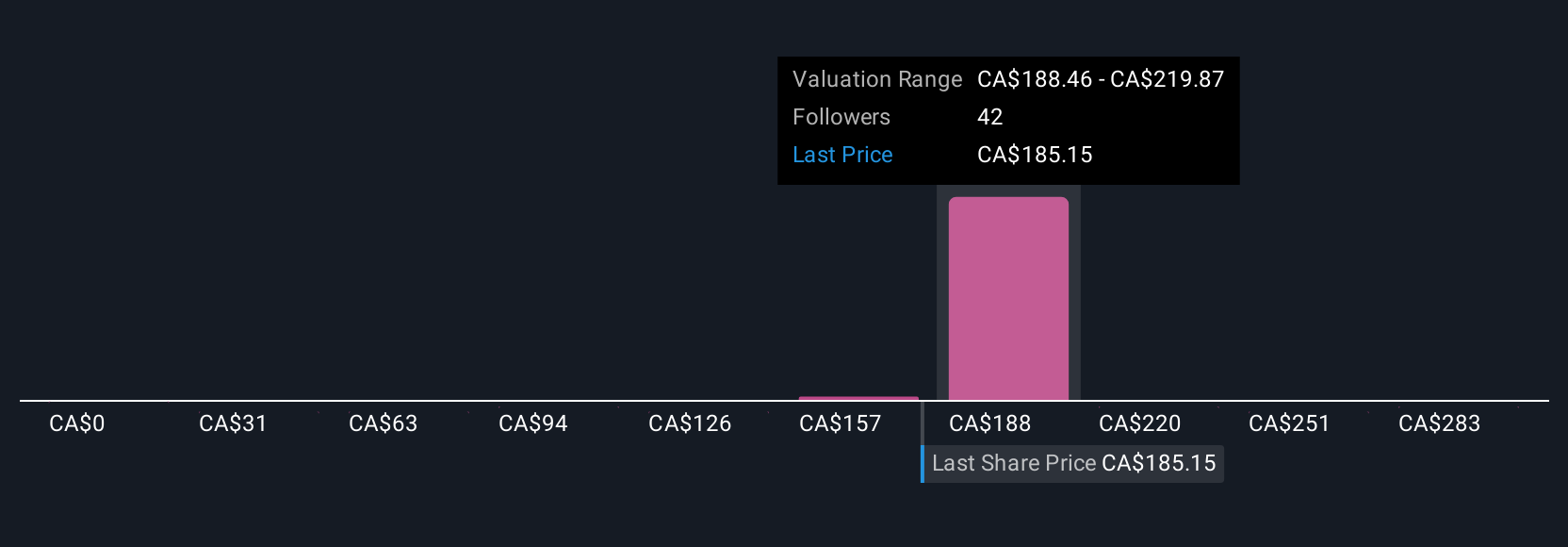

But investors can't ignore how Topicus.com's premium valuation increases sensitivity to shifts in growth expectations. Despite retreating, Topicus.com's shares might still be trading 9% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 13 other fair value estimates on Topicus.com - why the stock might be worth as much as 70% more than the current price!

Build Your Own Topicus.com Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Topicus.com research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Topicus.com research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Topicus.com's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Topicus.com might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:TOI

Topicus.com

Provides vertical market software and vertical market platforms in the Netherlands and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives