As global markets reach new highs, driven by easing geopolitical tensions and favorable trade developments, investors are closely watching the tech sector's potential for high growth amidst a backdrop of modest inflation upticks and fluctuating consumer confidence. In such an environment, identifying promising tech stocks involves looking for companies that can leverage innovation and adaptability to thrive despite economic uncertainties.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 30.80% | 45.66% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| KebNi | 20.56% | 94.46% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Pharma Mar | 29.61% | 44.92% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.05% | 87.21% | ★★★★★★ |

| JNTC | 54.24% | 87.93% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

Truecaller (OM:TRUE B)

Simply Wall St Growth Rating: ★★★★★☆

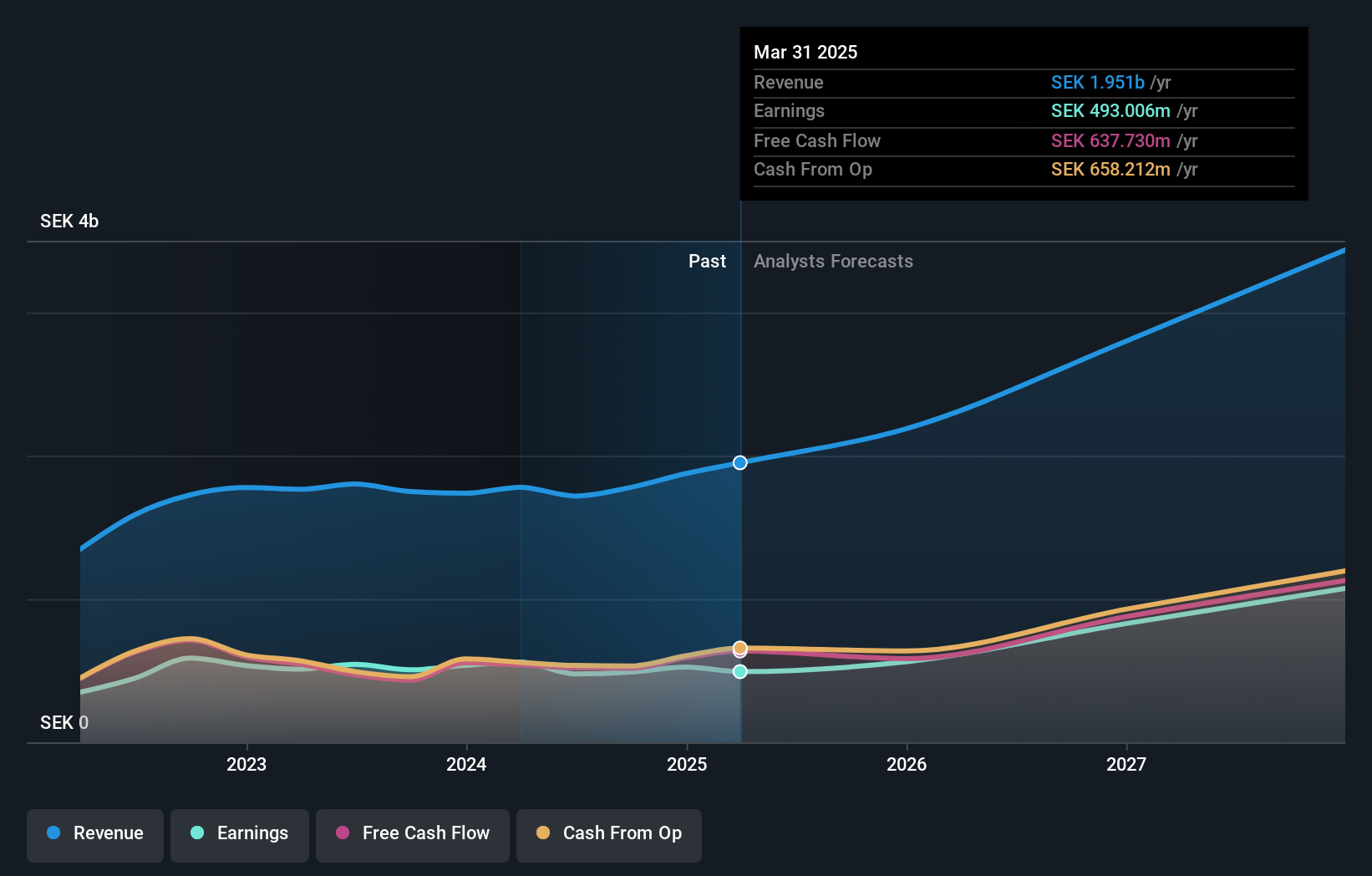

Overview: Truecaller AB (publ) is a company that develops and publishes mobile caller ID applications for individuals and businesses across India, the Middle East, Africa, and other international markets, with a market cap of approximately SEK23.12 billion.

Operations: The company primarily generates revenue from its communications software segment, which amounts to SEK1.95 billion.

Truecaller, a leader in communication software, has been innovating with features like Secure Calls to enhance trust and reduce fraud in business communications. This development not only strengthens Truecaller's market position but also addresses the critical issue of call spoofing by verifying each business call's authenticity. Financially, the company is on a robust growth trajectory with an annual revenue increase of 19.4% and earnings expected to surge by 26.2% yearly. Moreover, Truecaller's commitment to reinvesting in its technology is evident from its R&D expenses which are strategically aligned to foster continuous innovation and maintain competitive advantage in the fast-evolving tech landscape.

- Take a closer look at Truecaller's potential here in our health report.

Gain insights into Truecaller's historical performance by reviewing our past performance report.

Topicus.com (TSXV:TOI)

Simply Wall St Growth Rating: ★★★★☆☆

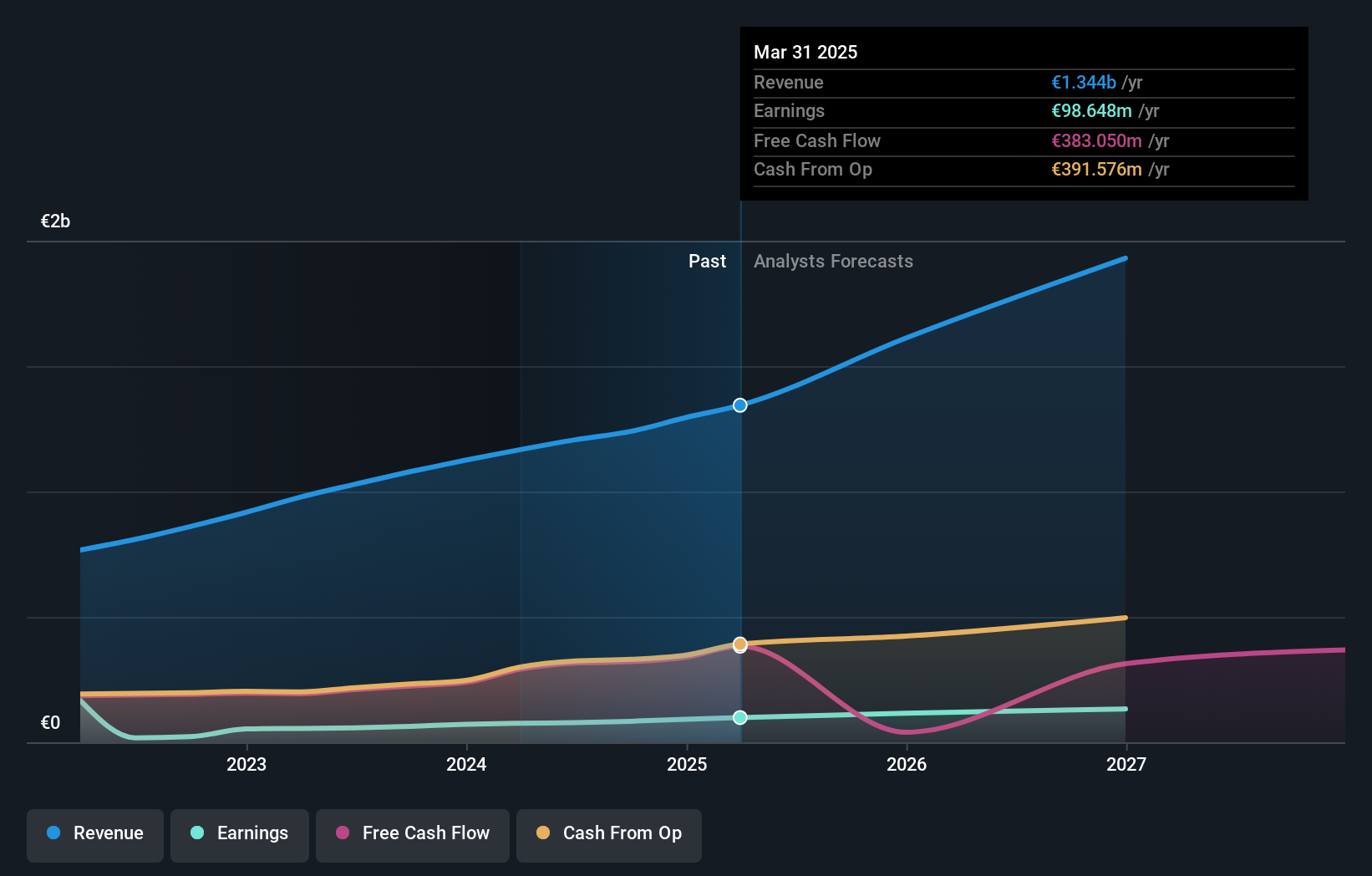

Overview: Topicus.com Inc. is a company that offers vertical market software and platforms both in the Netherlands and internationally, with a market cap of CA$14.08 billion.

Operations: The company generates revenue primarily from its software and programming segment, totaling €1.34 billion.

Topicus.com Inc. showcases a robust growth trajectory with its first-quarter revenue soaring to EUR 355.6 million, up from EUR 306.57 million the previous year, complemented by a net income increase to EUR 24.74 million from EUR 18.09 million. This performance underscores a significant annualized revenue growth rate of 20.5% and earnings expansion at an impressive rate of 29.9% over the past year, outpacing the software industry's average of 28.6%. The company's strategic focus on innovation is evident in its R&D investments, aligning with industry trends towards enhanced software solutions and services that promise sustained growth in a competitive tech landscape.

- Navigate through the intricacies of Topicus.com with our comprehensive health report here.

Understand Topicus.com's track record by examining our Past report.

Ströer SE KGaA (XTRA:SAX)

Simply Wall St Growth Rating: ★★★★☆☆

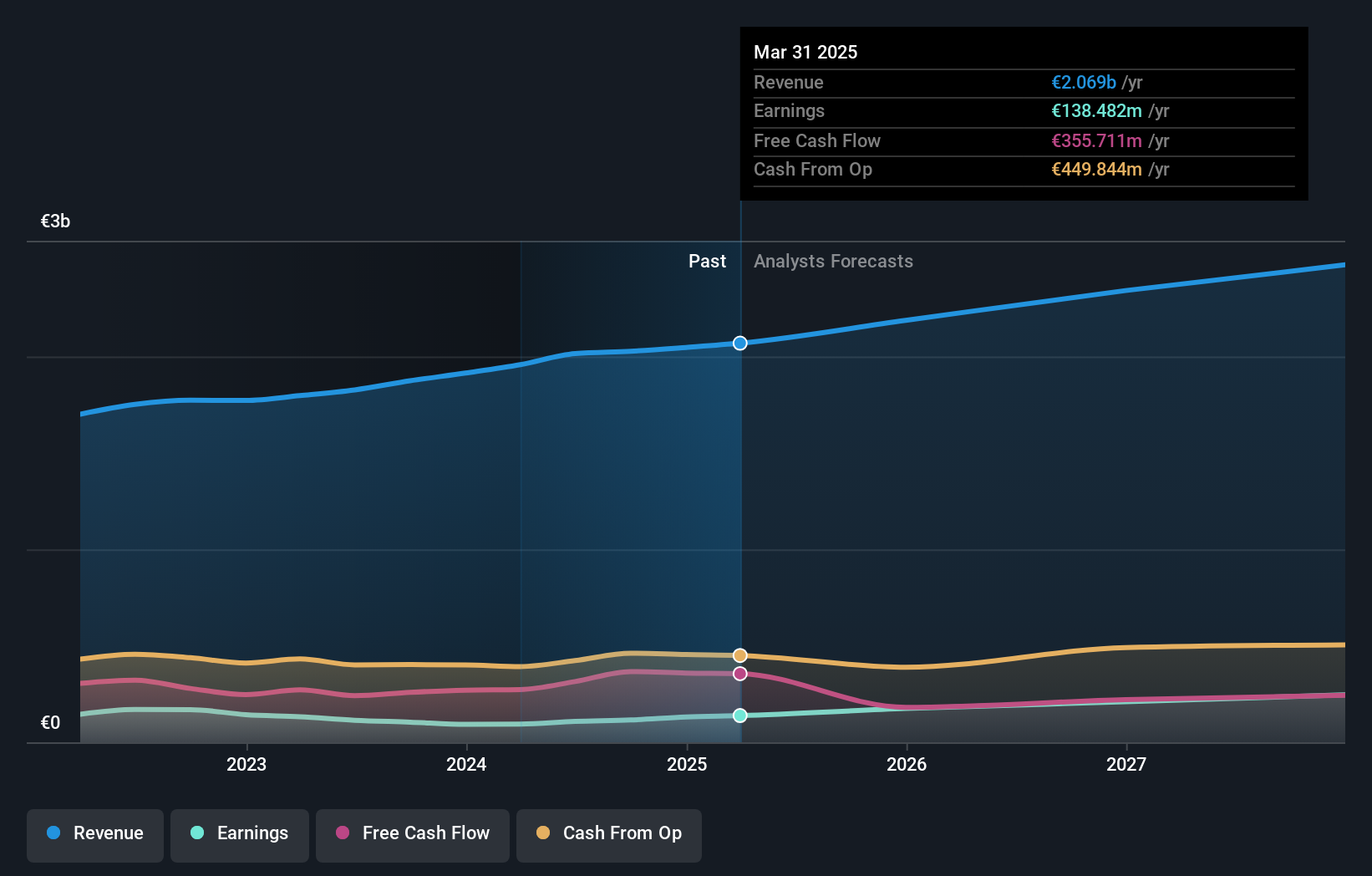

Overview: Ströer SE & Co. KGaA is a company that offers out-of-home and digital advertising services both in Germany and internationally, with a market capitalization of approximately €2.84 billion.

Operations: The company generates revenue primarily from three segments: Out-Of-Home Media (€981.11 million), Digital & Dialog Media (€881.05 million), and Daas & E-Commerce (€356.69 million).

Ströer SE & Co. KGaA, amidst a dynamic media landscape, is outpacing its German market with a projected annual revenue growth of 6.3% and earnings expected to surge by 20% per year. The company's recent quarterly results underscore this trajectory, with sales climbing to EUR 475.47 million from EUR 453.44 million year-over-year and net income increasing significantly to EUR 8.54 million from EUR 0.85 million in the same period last year. This financial uplift is supported by Ströer's commitment to innovation as reflected in their R&D spending trends which resonate well with ongoing industry shifts towards digital and targeted advertising solutions, ensuring they remain at the forefront of market demands and technological advancements.

- Click here and access our complete health analysis report to understand the dynamics of Ströer SE KGaA.

Explore historical data to track Ströer SE KGaA's performance over time in our Past section.

Taking Advantage

- Investigate our full lineup of 754 Global High Growth Tech and AI Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SAX

Ströer SE KGaA

Provides out-of-home (OOH) media and digital out-of-home advertising services in Germany and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion