As global markets grapple with economic uncertainty, inflation fears, and trade policy concerns, U.S. stock indexes have notably declined, especially within the information technology sector. In such a volatile environment, identifying high-growth tech stocks requires a keen focus on companies that demonstrate resilience through innovative solutions and robust business models capable of navigating these challenges.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Fositek | 31.39% | 36.95% | ★★★★★★ |

| Shanghai Baosight SoftwareLtd | 22.81% | 27.89% | ★★★★★★ |

| Inspur Digital Enterprise Technology | 29.82% | 29.69% | ★★★★★★ |

| eWeLLLtd | 24.65% | 25.30% | ★★★★★★ |

| Pharma Mar | 24.24% | 40.82% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| CD Projekt | 33.68% | 36.76% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Medy-Tox (KOSDAQ:A086900)

Simply Wall St Growth Rating: ★★★★☆☆

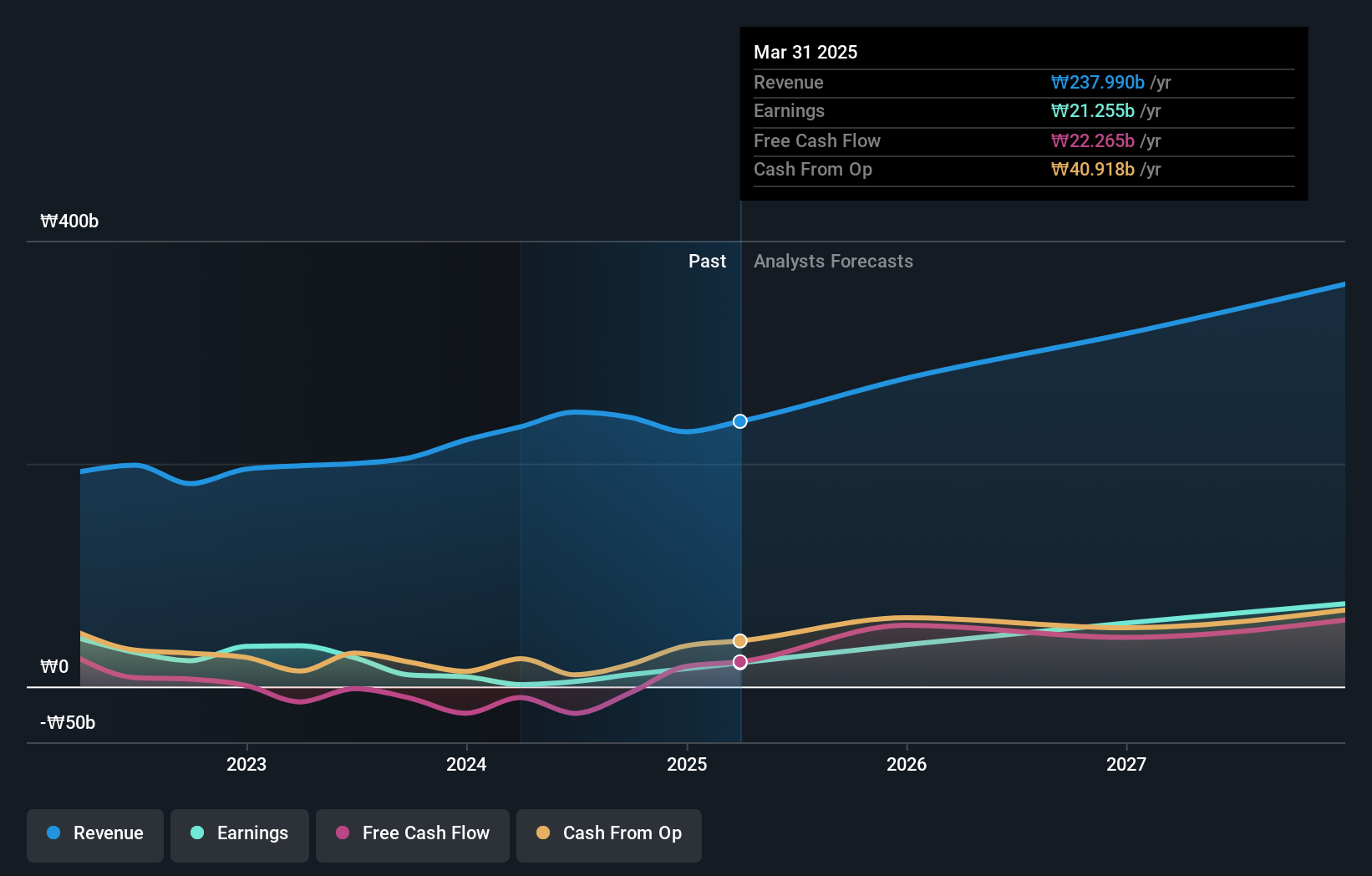

Overview: Medy-Tox Inc. is a biopharmaceutical company based in South Korea, with a market capitalization of approximately ₩938.31 billion.

Operations: Medy-Tox Inc. focuses on the development and commercialization of biopharmaceutical products, primarily generating revenue through its botulinum toxin and dermal filler segments. The company has experienced fluctuations in its net profit margin, reflecting variations in operational efficiency and market conditions over time.

Medy-Tox has demonstrated robust financial performance with a notable 73.8% earnings growth over the past year, outpacing the Biotechs industry average of 33.1%. This growth trajectory is underpinned by substantial R&D investments, aligning with its strategic focus on innovation in biotechnology. Recent share repurchases, totaling KRW 10,143.63 million for 80,677 shares since January 2025, reflect confidence in sustaining value creation. Moreover, Medy-Tox's projected annual revenue and earnings growth rates of 14.7% and 54.8%, respectively, suggest a strong forward momentum compared to broader market expectations.

Hengdian EntertainmentLTD (SHSE:603103)

Simply Wall St Growth Rating: ★★★★☆☆

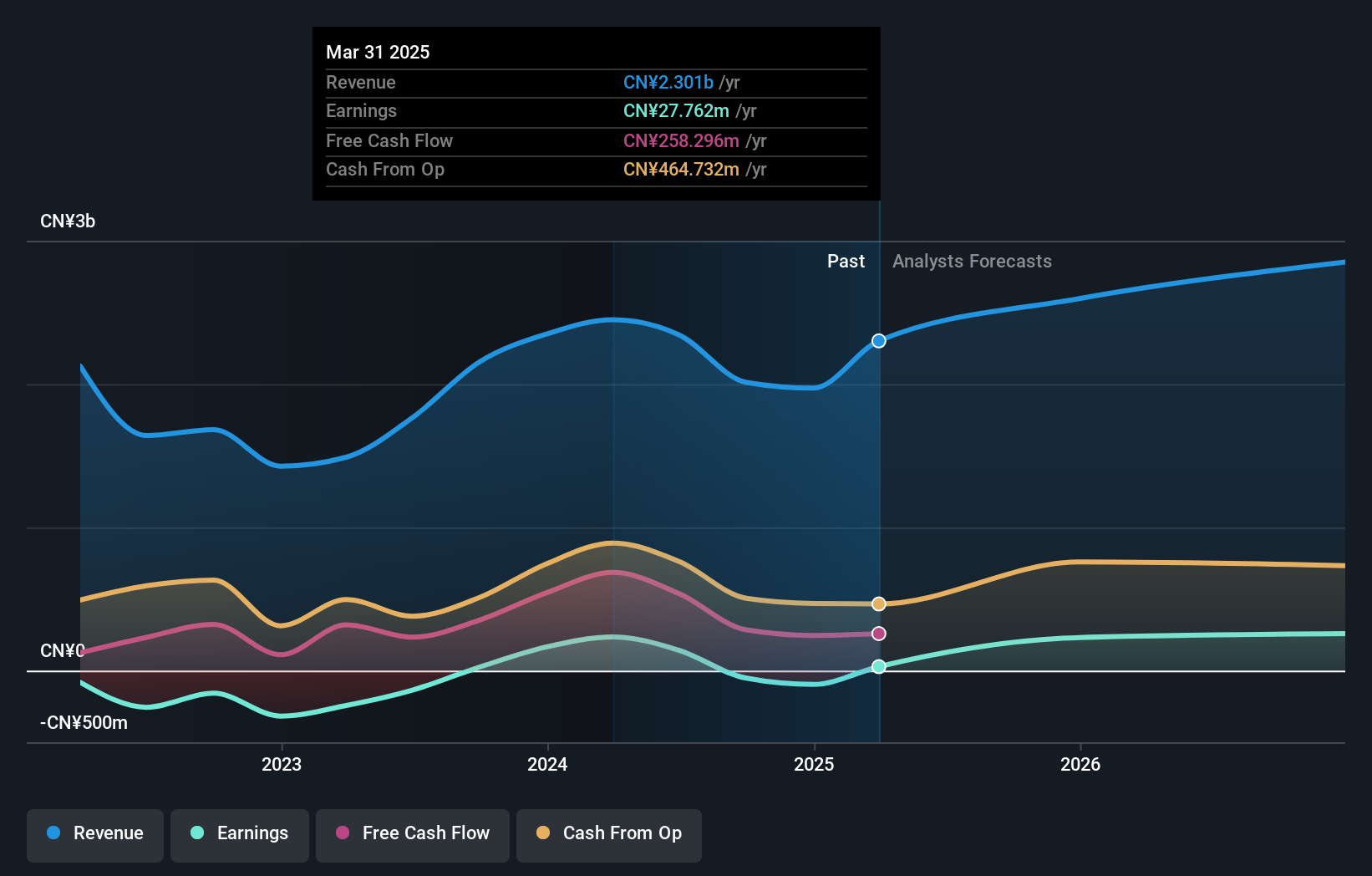

Overview: Hengdian Entertainment Co., LTD operates theaters in China and has a market capitalization of CN¥8.68 billion.

Operations: The company generates revenue primarily from its Cinema Branch, contributing CN¥1.77 billion, and its Film and Television Production and Distribution Division, which adds CN¥202.73 million.

Hengdian EntertainmentLTD, amidst a challenging landscape, reported a revenue decline to CNY 1.97 billion from CNY 2.35 billion year-over-year and swung to a net loss of CNY 96.38 million from a previous net income of CNY 165.85 million. Despite these setbacks, the company is projected to see its earnings soar by an impressive 108.65% annually over the next three years, significantly outpacing its industry's growth rate. This potential turnaround is underlined by its commitment to innovation as evidenced by substantial R&D investments aimed at revamping its entertainment offerings in response to evolving consumer preferences.

- Unlock comprehensive insights into our analysis of Hengdian EntertainmentLTD stock in this health report.

Understand Hengdian EntertainmentLTD's track record by examining our Past report.

Topicus.com (TSXV:TOI)

Simply Wall St Growth Rating: ★★★★☆☆

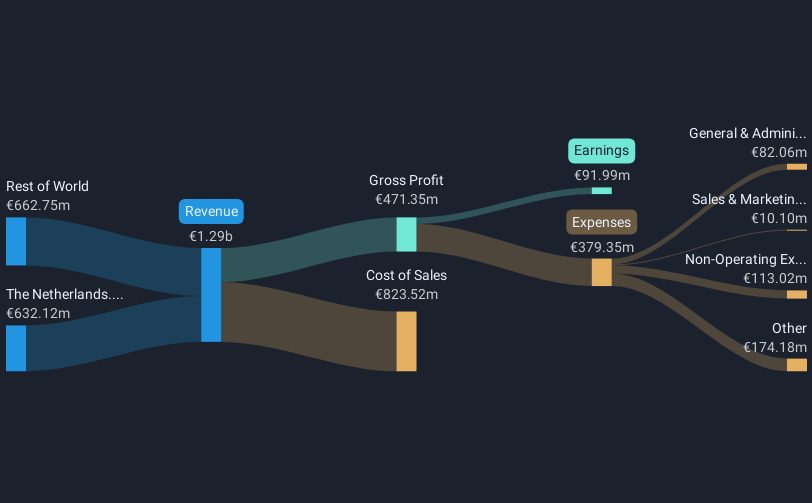

Overview: Topicus.com Inc. specializes in delivering vertical market software and platforms across various industries both in the Netherlands and internationally, with a market capitalization of CA$11.88 billion.

Operations: The company generates revenue primarily through its software and programming segment, which accounts for €1.29 billion. The focus is on providing specialized software solutions tailored to specific industry needs both domestically in the Netherlands and abroad.

Amidst a dynamic tech landscape, Topicus.com Inc. showcased robust growth in its latest annual report, with revenue climbing to EUR 1.29 billion, up from EUR 1.12 billion the previous year—an impressive increase of about 15%. This surge is paralleled by a notable rise in net income, which ascended from EUR 71.75 million to EUR 91.99 million. The firm's commitment to innovation is evident from its strategic R&D investments, which are crucial as it navigates through the competitive software sector where staying ahead technologically can significantly impact market position and future growth prospects.

- Navigate through the intricacies of Topicus.com with our comprehensive health report here.

Gain insights into Topicus.com's past trends and performance with our Past report.

Taking Advantage

- Delve into our full catalog of 780 Global High Growth Tech and AI Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Topicus.com might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:TOI

Topicus.com

Provides vertical market software and vertical market platforms in the Netherlands and internationally.

Good value with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion