- Canada

- /

- Metals and Mining

- /

- TSX:TECK.B

3 TSX Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As we head into the second half of 2025, the Canadian market is navigating through significant trade negotiations and tariff adjustments, which could influence inflation and economic growth. In this environment, identifying stocks that may be trading below their estimated value can offer potential opportunities for investors seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Timbercreek Financial (TSX:TF) | CA$7.51 | CA$10.96 | 31.5% |

| TerraVest Industries (TSX:TVK) | CA$172.63 | CA$299.11 | 42.3% |

| Teck Resources (TSX:TECK.B) | CA$52.11 | CA$73.40 | 29.0% |

| OceanaGold (TSX:OGC) | CA$6.82 | CA$12.34 | 44.8% |

| Magna Mining (TSXV:NICU) | CA$1.80 | CA$3.09 | 41.8% |

| Lithium Royalty (TSX:LIRC) | CA$5.27 | CA$8.68 | 39.3% |

| Kolibri Global Energy (TSX:KEI) | CA$9.85 | CA$17.88 | 44.9% |

| High Tide (TSXV:HITI) | CA$2.99 | CA$4.36 | 31.4% |

| Aris Mining (TSX:ARIS) | CA$9.23 | CA$13.25 | 30.3% |

| Alphamin Resources (TSXV:AFM) | CA$0.86 | CA$1.35 | 36.1% |

Let's uncover some gems from our specialized screener.

Aya Gold & Silver (TSX:AYA)

Overview: Aya Gold & Silver Inc. operates in the exploration, evaluation, and development of precious metals projects in Morocco, with a market capitalization of CA$1.95 billion.

Operations: Aya Gold & Silver Inc. generates revenue primarily from the production at the Zgounder Silver Mine in Morocco, amounting to $67.87 million.

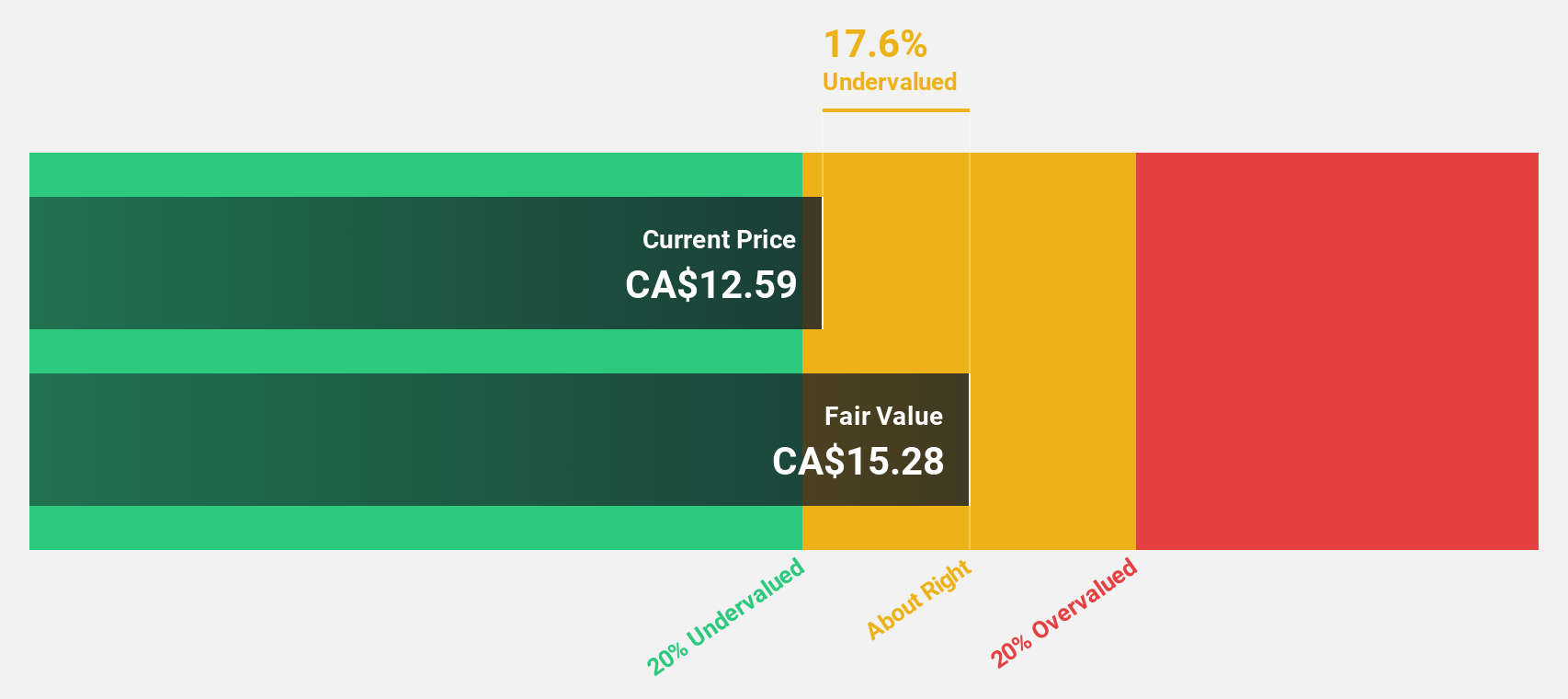

Estimated Discount To Fair Value: 15.5%

Aya Gold & Silver, trading at CA$12.86, is 15.5% below its fair value estimate of CA$15.21 and analysts agree the stock price could rise by 52.4%. The company is expected to become profitable within three years, with revenue growing at an impressive 29.1% annually, outpacing the Canadian market's growth rate of 3.9%. Recent high-grade drill results from Morocco bolster Aya's resource potential and support its growth trajectory despite recent equity offerings diluting shares slightly.

- The growth report we've compiled suggests that Aya Gold & Silver's future prospects could be on the up.

- Get an in-depth perspective on Aya Gold & Silver's balance sheet by reading our health report here.

Teck Resources (TSX:TECK.B)

Overview: Teck Resources Limited is involved in the research, exploration, development, processing, smelting, refining, and reclamation of mineral properties across Asia, the Americas, and Europe with a market cap of CA$26.11 billion.

Operations: Teck Resources generates revenue primarily from its Zinc and Copper segments, with CA$3.76 billion from Zinc and CA$5.97 billion from Copper.

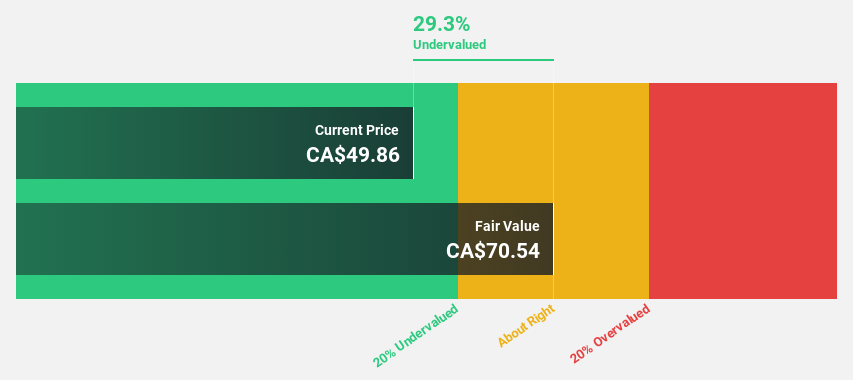

Estimated Discount To Fair Value: 29.0%

Teck Resources, trading at CA$52.11, is significantly undervalued with a fair value estimate of CA$73.4 and analysts foresee a 24% stock price increase. Despite recent operational hiccups in Chile, Teck's strategic projects like the Highland Valley Copper extension enhance long-term prospects. Expected earnings growth of 32.57% per year further strengthens its position as an attractive investment based on cash flows, though revenue growth remains moderate at 5.2% annually compared to market averages.

- Insights from our recent growth report point to a promising forecast for Teck Resources' business outlook.

- Navigate through the intricacies of Teck Resources with our comprehensive financial health report here.

Topicus.com (TSXV:TOI)

Overview: Topicus.com Inc. operates by providing vertical market software and platforms in the Netherlands and internationally, with a market cap of CA$13.71 billion.

Operations: Revenue for Topicus.com Inc. is primarily derived from its Software & Programming segment, which generated €1.34 billion.

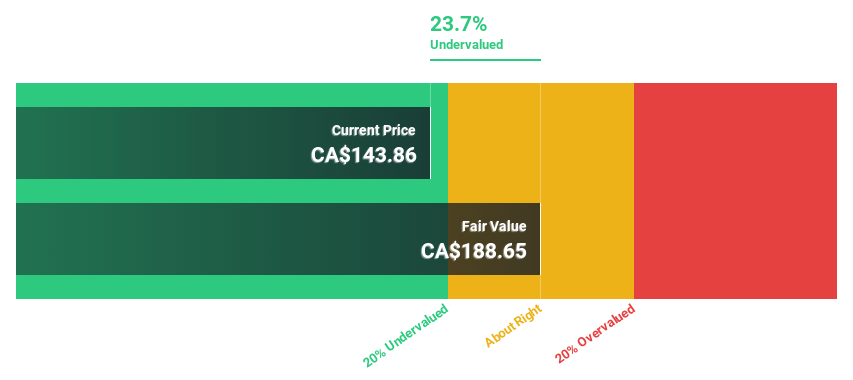

Estimated Discount To Fair Value: 11.5%

Topicus.com, trading at CA$165.03, is undervalued by 11.5% relative to its fair value of CA$186.42. Recent earnings showed strong performance with revenue rising to EUR 355.6 million and net income increasing to EUR 24.74 million year-over-year, despite significant insider selling in the past quarter. Forecasted annual earnings growth of 16.8% and revenue growth of 20.5% outpace the Canadian market, highlighting potential for investors focused on cash flow valuations amidst board changes.

- Our earnings growth report unveils the potential for significant increases in Topicus.com's future results.

- Delve into the full analysis health report here for a deeper understanding of Topicus.com.

Turning Ideas Into Actions

- Unlock more gems! Our Undervalued TSX Stocks Based On Cash Flows screener has unearthed 19 more companies for you to explore.Click here to unveil our expertly curated list of 22 Undervalued TSX Stocks Based On Cash Flows.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teck Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TECK.B

Teck Resources

Engages in research, exploration, development, processing, smelting, refining, and reclamation of mineral properties in Asia, the Americas, and Europe.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives