This Is Why 01 Communique Laboratory Inc.'s (CVE:ONE) CEO Compensation Looks Appropriate

CEO Andrew Cheung has done a decent job of delivering relatively good performance at 01 Communique Laboratory Inc. (CVE:ONE) recently. As shareholders go into the upcoming AGM on 21 April 2021, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. Here is our take on why we think the CEO compensation looks appropriate.

View our latest analysis for 01 Communique Laboratory

Comparing 01 Communique Laboratory Inc.'s CEO Compensation With the industry

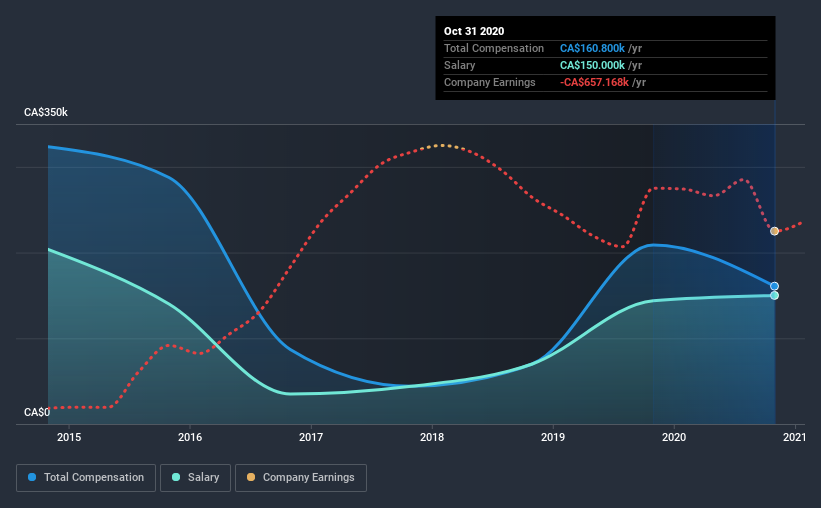

According to our data, 01 Communique Laboratory Inc. has a market capitalization of CA$24m, and paid its CEO total annual compensation worth CA$161k over the year to October 2020. That's a notable decrease of 23% on last year. In particular, the salary of CA$150.0k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the industry with market capitalizations below CA$251m, reported a median total CEO compensation of CA$227k. From this we gather that Andrew Cheung is paid around the median for CEOs in the industry. What's more, Andrew Cheung holds CA$556k worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$150k | CA$144k | 93% |

| Other | CA$11k | CA$65k | 7% |

| Total Compensation | CA$161k | CA$209k | 100% |

On an industry level, roughly 69% of total compensation represents salary and 31% is other remuneration. According to our research, 01 Communique Laboratory has allocated a higher percentage of pay to salary in comparison to the wider industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at 01 Communique Laboratory Inc.'s Growth Numbers

01 Communique Laboratory Inc. has reduced its earnings per share by 29% a year over the last three years. In the last year, its revenue is up 153%.

The decrease in EPS could be a concern for some investors. But on the other hand, revenue growth is strong, suggesting a brighter future. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has 01 Communique Laboratory Inc. Been A Good Investment?

Most shareholders would probably be pleased with 01 Communique Laboratory Inc. for providing a total return of 375% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Some shareholders will be pleased by the relatively good results, however, the results could still be improved. Despite robust revenue growth, until EPS growth improves, shareholders may be hesitant to increase CEO pay by too much.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. In our study, we found 4 warning signs for 01 Communique Laboratory you should be aware of, and 1 of them shouldn't be ignored.

Important note: 01 Communique Laboratory is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade 01 Communique Laboratory, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if 01 Quantum might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:ONE

01 Quantum

Provides cyber security and remote access solutions in the United States, Asia-Pacific, and Canada.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026