Should You Be Adding Alphinat (CVE:NPA) To Your Watchlist Today?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Alphinat (CVE:NPA). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Alphinat

Alphinat's Improving Profits

In the last three years Alphinat's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Alphinat boosted its trailing twelve month EPS from CA$0.0015 to CA$0.0018, in the last year. That's a 24% gain; respectable growth in the broader scheme of things.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Alphinat's EBIT margins have actually improved by 3.3 percentage points in the last year, to reach 16%, but, on the flip side, revenue was down 13%. That's not ideal.

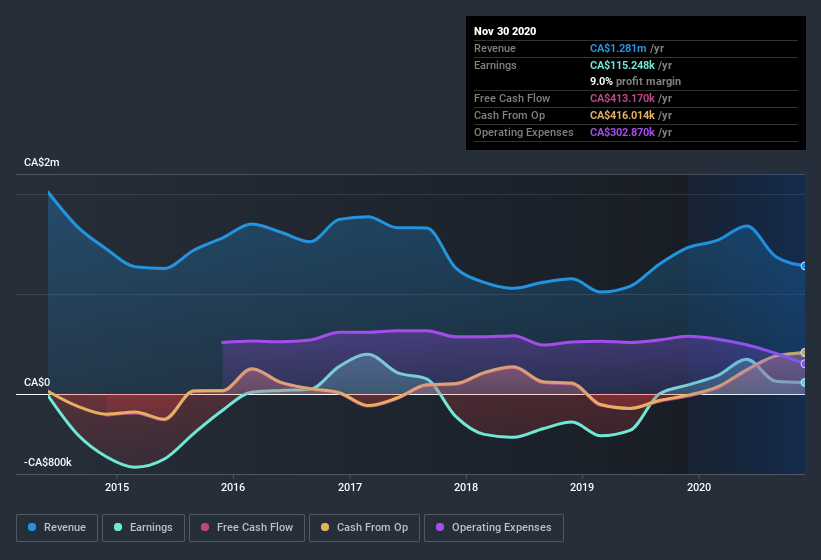

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Alphinat isn't a huge company, given its market capitalization of CA$6.3m. That makes it extra important to check on its balance sheet strength.

Are Alphinat Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So as you can imagine, the fact that Alphinat insiders own a significant number of shares certainly appeals to me. Actually, with 44% of the company to their names, insiders are profoundly invested in the business. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. Valued at only CA$6.3m Alphinat is really small for a listed company. So despite a large proportional holding, insiders only have CA$2.8m worth of stock. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Should You Add Alphinat To Your Watchlist?

One positive for Alphinat is that it is growing EPS. That's nice to see. If that's not enough on its own, there is also the rather notable levels of insider ownership. That combination appeals to me, for one. So yes, I do think the stock is worth keeping an eye on. It is worth noting though that we have found 5 warning signs for Alphinat (3 are potentially serious!) that you need to take into consideration.

Although Alphinat certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Alphinat, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:NPA.H

Alphinat

Develops and markets software products that allow the implementation of self-service solutions and Web-based workspace.

Medium-low and slightly overvalued.

Market Insights

Community Narratives