Improved Revenues Required Before NowVertical Group Inc. (CVE:NOW) Stock's 111% Jump Looks Justified

NowVertical Group Inc. (CVE:NOW) shareholders would be excited to see that the share price has had a great month, posting a 111% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 15% in the last twelve months.

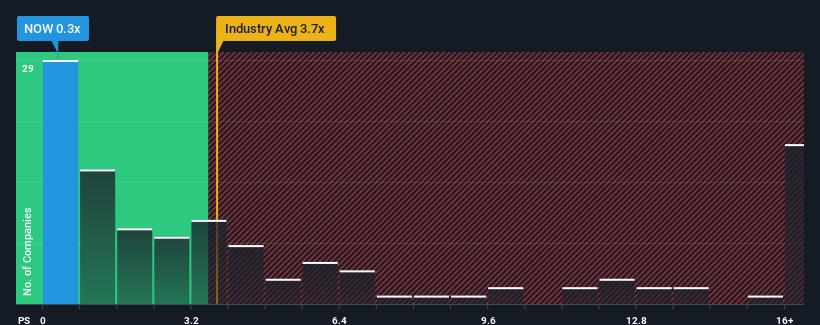

Even after such a large jump in price, NowVertical Group's price-to-sales (or "P/S") ratio of 0.3x might still make it look like a strong buy right now compared to the wider Software industry in Canada, where around half of the companies have P/S ratios above 3.7x and even P/S above 7x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for NowVertical Group

How Has NowVertical Group Performed Recently?

NowVertical Group could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on NowVertical Group.How Is NowVertical Group's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as NowVertical Group's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a frustrating 13% decrease to the company's top line. In spite of this, the company still managed to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it is now in decline.

Looking ahead now, revenue is anticipated to climb by 3.1% each year during the coming three years according to the two analysts following the company. That's shaping up to be materially lower than the 20% per year growth forecast for the broader industry.

With this in consideration, its clear as to why NowVertical Group's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From NowVertical Group's P/S?

Shares in NowVertical Group have risen appreciably however, its P/S is still subdued. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that NowVertical Group maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

Plus, you should also learn about these 3 warning signs we've spotted with NowVertical Group (including 1 which is potentially serious).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if NowVertical Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:NOW

NowVertical Group

Operates as a big data, analytics, and vertical intelligence company in the United States, Argentina, Brazil, Chile, the United Kingdom, and internationally.

Undervalued with imperfect balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026