TSX Penny Stock Spotlight: Neptune Digital Assets And 2 Other Promising Picks

Reviewed by Simply Wall St

The Canadian market is currently benefiting from improved labour productivity and healthy wage growth, which are helping to support consumer spending and the broader economy. In such a landscape, identifying stocks with strong fundamentals becomes crucial for investors aiming to capitalize on potential opportunities. Penny stocks, though an older term, remain relevant as they often represent smaller or newer companies that can offer growth potential at lower price points.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.62 | CA$62.71M | ✅ 3 ⚠️ 3 View Analysis > |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.80 | CA$248.52M | ✅ 4 ⚠️ 1 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.32 | CA$48.06M | ✅ 2 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.03 | CA$2.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.45 | CA$12.89M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.79 | CA$525.59M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.90 | CA$17.84M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$4.13 | CA$209.62M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.93 | CA$184.26M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.69 | CA$9.65M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 432 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Neptune Digital Assets (TSXV:NDA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Neptune Digital Assets Corp. builds, owns, and operates infrastructure supporting the digital currency ecosystem in Canada with a market cap of CA$155.05 million.

Operations: The company generates revenue primarily from data processing, amounting to CA$1.84 million.

Market Cap: CA$155.05M

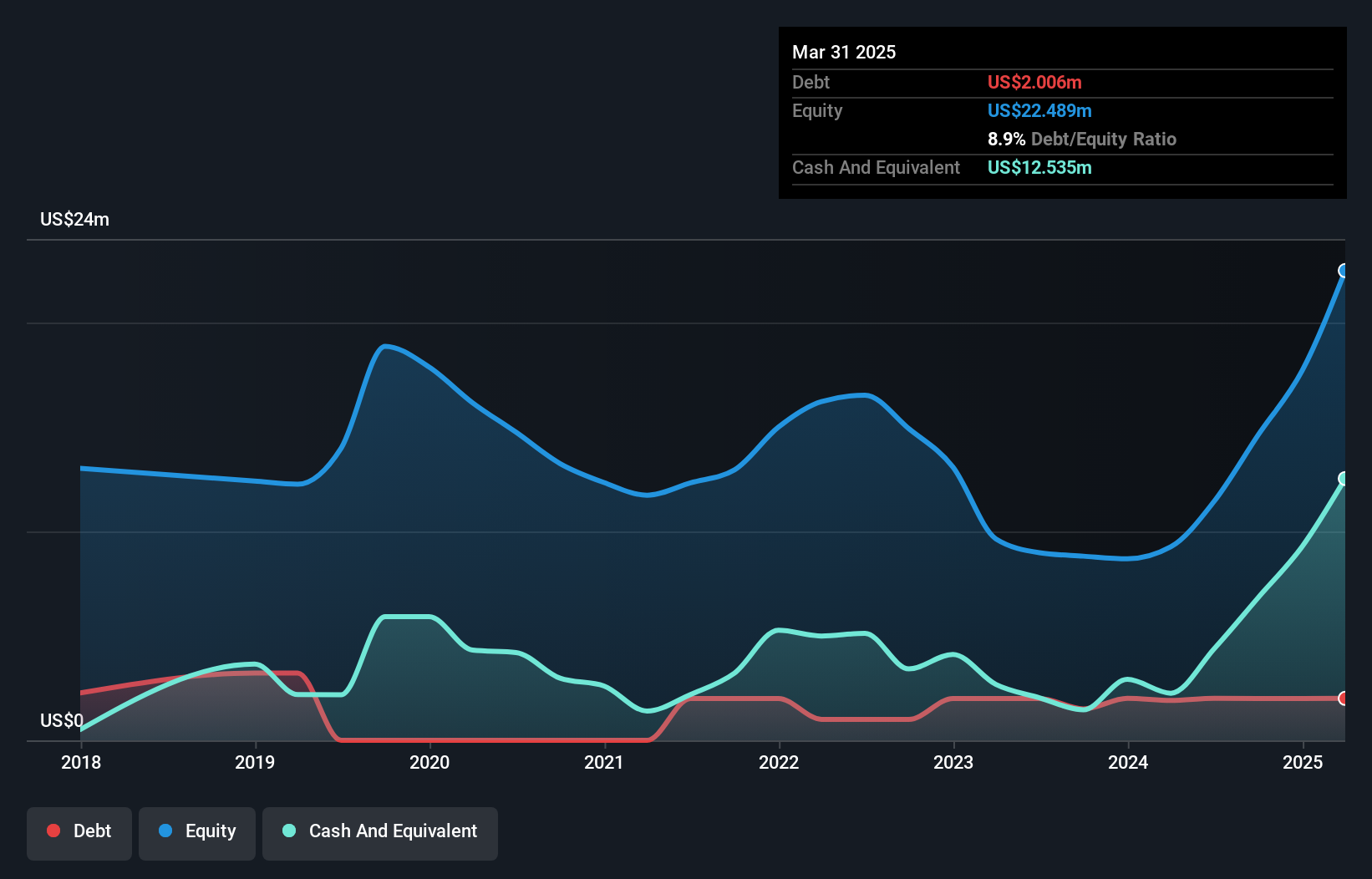

Neptune Digital Assets Corp. is navigating the volatile penny stock landscape with a strategic focus on digital asset growth, despite being pre-revenue with CA$1.39 million in sales for the first nine months of 2025. The company has no long-term liabilities and a seasoned management team, providing some stability amidst its unprofitability and increasing losses over five years. Neptune's strategy includes expanding Solana staking and leveraging a US$25 million credit facility to enhance Bitcoin holdings, aiming to mitigate timing risks through automated dollar cost averaging. Recent activities include filing for a CA$350 million shelf registration to support future operations and investments.

- Unlock comprehensive insights into our analysis of Neptune Digital Assets stock in this financial health report.

- Review our growth performance report to gain insights into Neptune Digital Assets' future.

OverActive Media (TSXV:OAM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: OverActive Media Corp. is an esports and entertainment company operating in Canada, the United States, and Europe with a market cap of CA$41.73 million.

Operations: The company's revenue is derived from Team Operations, generating CA$9.67 million, and Business Operations, contributing CA$18.69 million.

Market Cap: CA$41.73M

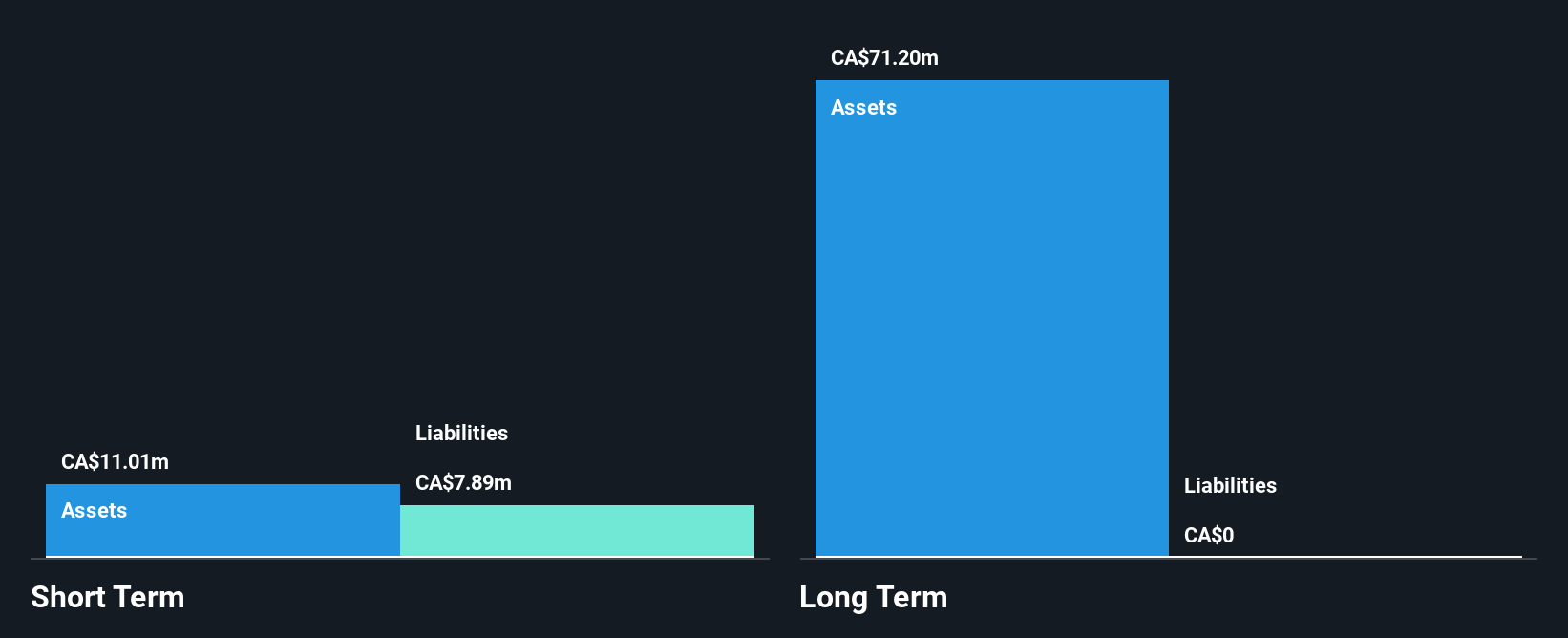

OverActive Media Corp., operating in the esports and entertainment sector, is leveraging its market presence to introduce ActiveVoices, an AI-powered platform aimed at expanding global reach for content creators. Despite a net loss of CA$3.68 million in Q1 2025, the company has shown revenue growth with sales reaching CA$5 million. OverActive's financial stability is supported by short-term assets exceeding both short and long-term liabilities, alongside reduced debt levels over five years. However, negative operating cash flow indicates challenges in covering debt through cash generation. The management team remains relatively inexperienced with an average tenure of 1.4 years.

- Take a closer look at OverActive Media's potential here in our financial health report.

- Gain insights into OverActive Media's historical outcomes by reviewing our past performance report.

Zoomd Technologies (TSXV:ZOMD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zoomd Technologies Ltd. operates as a global marketing technology platform focused on user acquisition and engagement, with a market cap of CA$134.79 million.

Operations: The company generates revenue of $63.92 million from its Internet Software & Services segment.

Market Cap: CA$134.79M

Zoomd Technologies Ltd. has demonstrated significant financial improvement, becoming profitable in the past year with a net income of US$4.76 million for Q1 2025, up from US$0.539 million the previous year. Its robust cash position and strategic focus on mergers and acquisitions signal potential growth avenues, supported by its inclusion in the S&P/TSX Venture Composite Index. The company's return on equity is outstanding at 58.4%, reflecting efficient capital utilization, while its debt is well-covered by operating cash flow and short-term assets exceed liabilities, showcasing financial stability amidst a volatile market environment for penny stocks.

- Navigate through the intricacies of Zoomd Technologies with our comprehensive balance sheet health report here.

- Learn about Zoomd Technologies' historical performance here.

Seize The Opportunity

- Explore the 432 names from our TSX Penny Stocks screener here.

- Curious About Other Options? The end of cancer? These 26 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Neptune Digital Assets might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NDA

Neptune Digital Assets

Neptune Digital Assets Corp. builds, owns, and operates infrastructure supporting the digital currency ecosystem in Canada.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives