NTG Clarity Networks Inc.'s (CVE:NCI) Share Price Boosted 48% But Its Business Prospects Need A Lift Too

NTG Clarity Networks Inc. (CVE:NCI) shareholders would be excited to see that the share price has had a great month, posting a 48% gain and recovering from prior weakness. This latest share price bounce rounds out a remarkable 333% gain over the last twelve months.

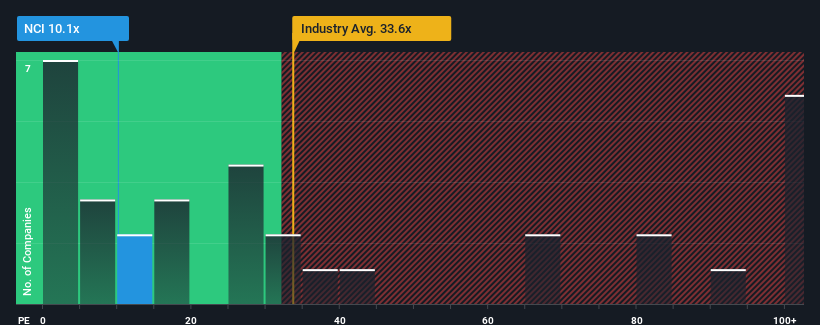

In spite of the firm bounce in price, given about half the companies in Canada have price-to-earnings ratios (or "P/E's") above 15x, you may still consider NTG Clarity Networks as an attractive investment with its 10.1x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Our free stock report includes 2 warning signs investors should be aware of before investing in NTG Clarity Networks. Read for free now.With earnings growth that's superior to most other companies of late, NTG Clarity Networks has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for NTG Clarity Networks

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like NTG Clarity Networks' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 404% gain to the company's bottom line. Pleasingly, EPS has also lifted 399% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the only analyst covering the company suggest earnings growth is heading into negative territory, declining 18% over the next year. Meanwhile, the broader market is forecast to expand by 20%, which paints a poor picture.

In light of this, it's understandable that NTG Clarity Networks' P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

The latest share price surge wasn't enough to lift NTG Clarity Networks' P/E close to the market median. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of NTG Clarity Networks' analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You need to take note of risks, for example - NTG Clarity Networks has 2 warning signs (and 1 which shouldn't be ignored) we think you should know about.

Of course, you might also be able to find a better stock than NTG Clarity Networks. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if NTG Clarity Networks might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:NCI

NTG Clarity Networks

Provides network, telecom, IT, and infrastructure solutions to medium and large network service providers in Canada, North America, Iraq, Saudi Arabia, Egypt, and Oman.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026