There's Reason For Concern Over Martello Technologies Group Inc.'s (CVE:MTLO) Massive 33% Price Jump

The Martello Technologies Group Inc. (CVE:MTLO) share price has done very well over the last month, posting an excellent gain of 33%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 20% in the last twelve months.

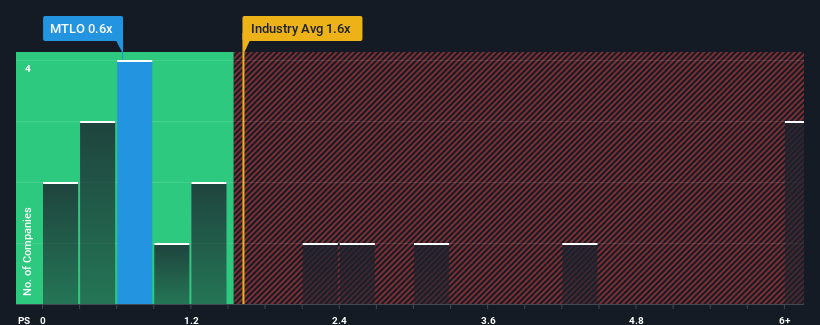

Although its price has surged higher, you could still be forgiven for feeling indifferent about Martello Technologies Group's P/S ratio of 0.6x, since the median price-to-sales (or "P/S") ratio for the IT industry in Canada is also close to 0.8x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Martello Technologies Group

What Does Martello Technologies Group's Recent Performance Look Like?

For instance, Martello Technologies Group's receding revenue in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Martello Technologies Group will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Martello Technologies Group's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 4.0%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 19% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 11% shows it's noticeably less attractive.

In light of this, it's curious that Martello Technologies Group's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What Does Martello Technologies Group's P/S Mean For Investors?

Martello Technologies Group's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Martello Technologies Group's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Martello Technologies Group (3 are potentially serious) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:MTLO

Martello Technologies Group

Develops and sells experience monitoring solutions in Canada, the United States, Europe, Asia, Latin America, Australia, and internationally.

Slight risk and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion