Lumine Group (TSXV:LMN): Evaluating Valuation After Strong Third-Quarter Revenue and Income Growth

Reviewed by Simply Wall St

Lumine Group (TSXV:LMN) just released its third quarter results, showing higher revenue and net income for both the quarter and past nine months compared to last year. This signals a clear upswing in the company’s financial performance.

See our latest analysis for Lumine Group.

After announcing solid year-over-year revenue and income gains, Lumine Group’s share price has come under renewed pressure, dropping 27.68% in the past month. Its 12-month total shareholder return now sits at -22.5%. Despite the improved financials, it appears investor sentiment remains cautious. Momentum has been fading since the summer.

If you want to keep your investing options open, now is a great chance to discover fast growing stocks with high insider ownership.

With shares still well below analyst price targets despite strong earnings, the real question is whether Lumine Group is a bargain waiting to be seized or if the market has already accounted for all future growth.

Price-to-Earnings of 55.1x: Is it justified?

Lumine Group’s shares closed at CA$29.87, and the stock trades on a price-to-earnings (P/E) ratio of 55.1x. This is notably above the industry average and the ratio estimated to be a fair level for the company.

The price-to-earnings ratio measures how much investors are willing to pay for each dollar of earnings. It is valuable for software companies, as higher multiples often signal expectations of robust future profit growth or unique competitive advantages.

However, Lumine Group's P/E ratio is only marginally higher than the Canadian Software industry average of 54.3x, suggesting that the market is valuing Lumine near its direct competitors. It is almost double the estimated fair P/E ratio of 29.1x, meaning investors are currently paying a substantial premium relative to what analysts’ regressions suggest might be justified by fundamentals. If multiples trend toward the fair level, it could move the share price accordingly.

Explore the SWS fair ratio for Lumine Group

Result: Price-to-Earnings of 55.1x (OVERVALUED)

However, ongoing weak share momentum and the sizable premium to fair value could accelerate further declines if investor sentiment worsens.

Find out about the key risks to this Lumine Group narrative.

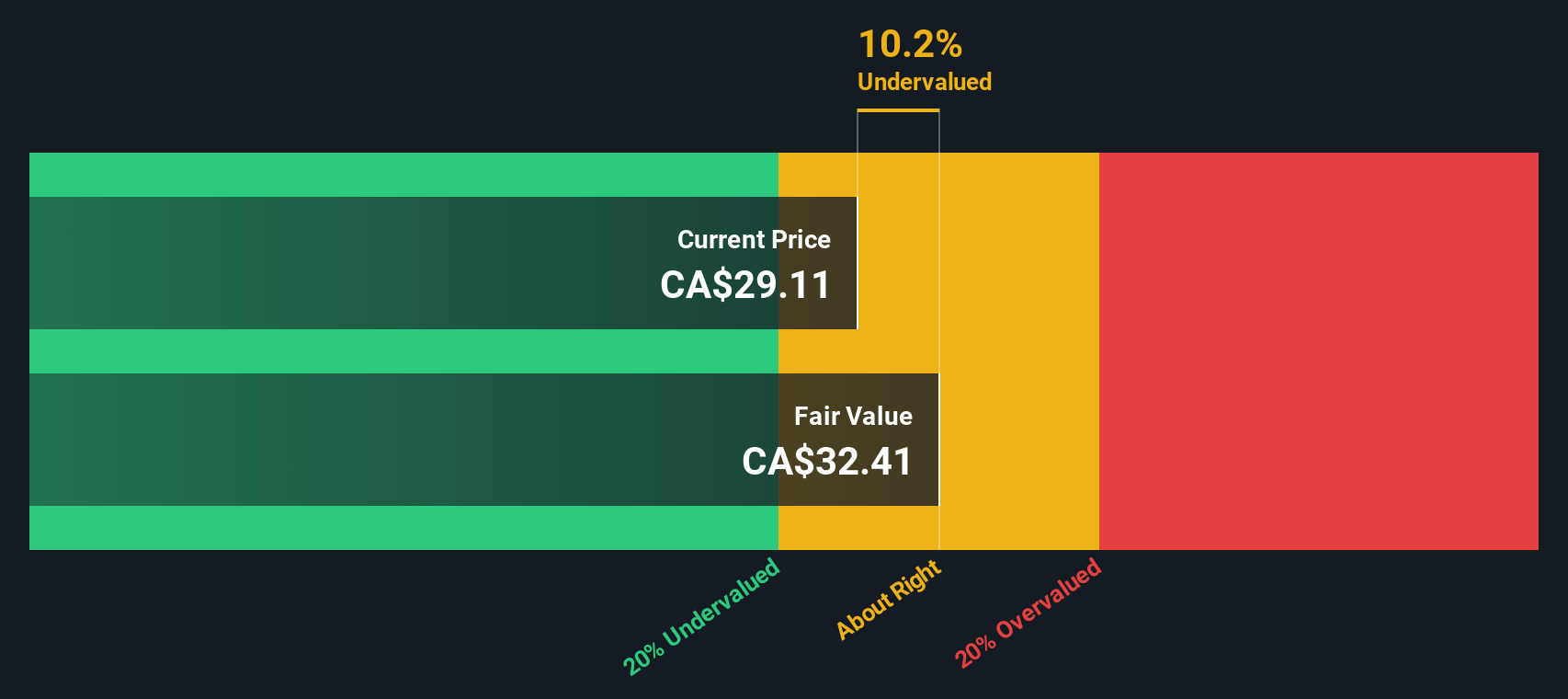

Another View: Discounted Cash Flow Model Suggests Undervaluation

While the price-to-earnings ratio presents Lumine Group as expensive compared to industry norms and the fair ratio, our DCF model offers a different perspective. The SWS DCF model values the company at CA$32.76 per share, which is 8.8% above its current price. Could the market be overlooking future value here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Lumine Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 836 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Lumine Group Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can craft your own narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Lumine Group.

Looking for your next winning investment idea?

Don't let great opportunities slip by. The market is full of standout stocks, and the right screener can help you spot your next smart move before the crowd catches on.

- Unlock game-changing innovation by reviewing these 26 AI penny stocks that are setting new standards in artificial intelligence and transforming tomorrow's industries.

- Tap into steady income opportunities by evaluating these 20 dividend stocks with yields > 3% with yields above 3% and robust financial track records.

- Stay ahead of the curve by tracking these 81 cryptocurrency and blockchain stocks to capitalize on blockchain breakthroughs and the growth of digital asset adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:LMN

Lumine Group

Offers develops, installs, and customizes of software worldwide.

Excellent balance sheet and fair value.

Market Insights

Community Narratives