With EPS Growth And More, AirIQ (CVE:IQ) Makes An Interesting Case

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like AirIQ (CVE:IQ), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for AirIQ

AirIQ's Improving Profits

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. So a growing EPS generally brings attention to a company in the eyes of prospective investors. It's an outstanding feat for AirIQ to have grown EPS from CA$0.026 to CA$0.12 in just one year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. Could this be a sign that the business has reached an inflection point?

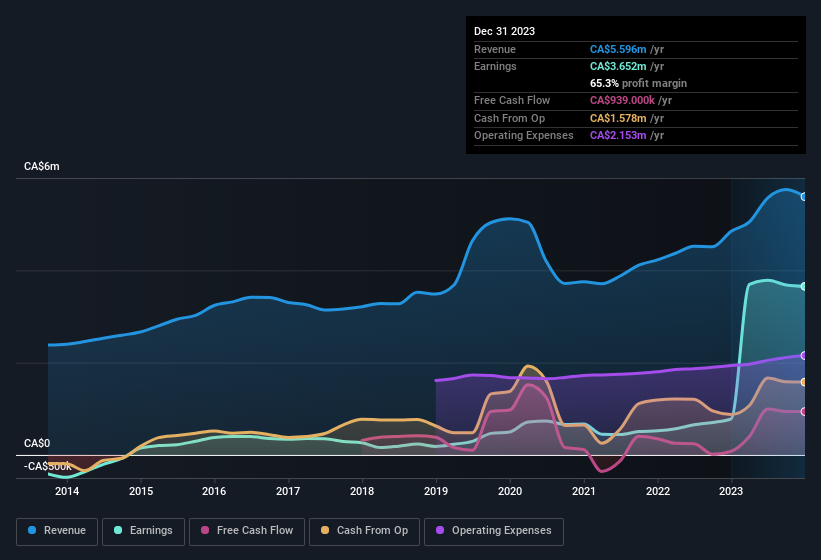

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. EBIT margins for AirIQ remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 15% to CA$5.6m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

AirIQ isn't a huge company, given its market capitalisation of CA$12m. That makes it extra important to check on its balance sheet strength.

Are AirIQ Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

One positive for AirIQ, is that company insiders spent CA$37k acquiring shares in the last year. While this investment may be modest, it is great considering the lack of insider selling. Zooming in, we can see that the biggest insider purchase was by Independent Director Gabriel Bouchard-Phillips for CA$16k worth of shares, at about CA$0.36 per share.

Does AirIQ Deserve A Spot On Your Watchlist?

AirIQ's earnings per share have been soaring, with growth rates sky high. Growth investors should find it difficult to look past that strong EPS move. And indeed, it could be a sign that the business is at an inflection point. If this is the case, then keeping a watch over AirIQ could be in your best interest. Don't forget that there may still be risks. For instance, we've identified 3 warning signs for AirIQ (2 are potentially serious) you should be aware of.

Keen growth investors love to see insider activity. Thankfully, AirIQ isn't the only one. You can see a a curated list of Canadian companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:IQ

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion